Want to Make Extra Money Now?

|

|

5.0

|

4.5

|

4.4

|

|

|

|

- Min credit score: Mid 600s

- Fixed APR: 4.43 -17.99%

- Variable APR: 5.59-17.99%

- Min credit score: 660

- Fixed APR: 4.39-11.11%

- Variable APR: 5.84-11.11%

- Min credit score: Varies

- Fixed APR: 4.13% - 15.46%

- Variable APR: 6.16% - 16.10%

Looking for the best private student loans?

Funding your education using student loans can be pretty useful. Here is an insightful guide on all you need to know about the best private student loans of 2024.

You have deftly tackled the nerve-wracking pressure of getting into the college or university of your dreams. You have the scores, a host of co-curricular activities to show your mettle, and the only thing left to do is secure a student loan to fund your education.

Quite a significant number of students are in your shoes right now. In fact, studies reveal that a whopping 71% students course through college with the help of student loans every year on an average. Not that startling, if you think about the high cost of education at the leading higher education institutions all across the world.

Since you are at the threshold of applying for one, it is best to proceed with all the knowledge that you can get your hands on regarding student loans. Presented here is a quick overview of the crucial facts and factors pertaining to student loans along with the 8 best private student loan options you can explore.

Remember: Always borrow federal student loans before private loans. Once you've exhausted federal options, compare offers from multiple private lenders to find the lowest interest rate.

The Difference Between Federal and Private Student Loans

Did you know the likes of Barack Obama and plenty of Hollywood actors (including Jane Lynch and Finesse Mitchell) all had to use student loans, whether federal or private? They couldn't even escape the high cost of college, which is usually over $30,000 in the United States for a 4-year public college.

Before we apply for student loans, here are the basics of federal and private student loans.

Federal and Private Student Loans – Know the Difference:

Federal Student Loans

A federal loan stands for a loan that you borrow from the government. You are basically using the taxpayers’ money to get your college or university degree, hence repaying federal loans come with a different level of responsibility altogether.

However, since interest rates are comparatively lower in federal loans and one does not require having a great credit score, most students take a lax approach when the time comes for repayment. You will also find options for paying as per your level of income or alternative repayment options if you apply for federal loans.

Private Student Loans

In case you opt for a private student loan, a credit union, bank or online lender provides you with the money that you need to pay your way through getting a higher education degree. They can have varying rates of interest (that is usually dependent on the loan provider and the type of interest you choose) and have comparatively rigid repayment options.

However, since the rules regarding what you do with the loan money are quite lax in case of private loans, you can come up with ingenious tricks to pay it off way before it starts accumulating interest.

Best Private Student Loan Options

Prior to approaching a lender for a private student loan, you must know that you will need to have to meet a number of criteria for your loan to be approved.

Carefully consider if you have an established credit score (or having a creditworthy co-signer will also do the trick) and read all terms and conditions before you apply.

Here are the best private student loans that will help you pay off the high tuition fees for college or university.

|

5.0

|

4.5

|

4.4

|

|

|

|

- Min credit score: Mid 600s

- Fixed APR: 4.43 -17.99%

- Variable APR: 5.59-17.99%

- Min credit score: 660

- Fixed APR: 4.39-11.11%

- Variable APR: 5.84-11.11%

- Min credit score: Varies

- Fixed APR: 4.13% - 15.46%

- Variable APR: 6.16% - 16.10%

1. College Ave Student Loans

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.5/5 | 4.43% – 17.99% with autopay | Cost of attendance, minus aid | Mid 600s |

Student loans are available at College Ave Student Loans — which was founded in 2014 and is located in Wilmington, Delaware, and provides undergraduate, graduate, and parent loans to borrowers from all 50 states.

With applications that take a few minutes to finish on any device and quick decisions, College Ave has an edge in terms of speed.

At College Ave Student loans you can apply in just 3 minutes and get an instant decision. College Ave offers 4 flexible repayment options to help you make paying your student loans off easier.

Special features include: Repayment Options, US Based Customer Service, Easy Mobile Application.

- Loan term length of 5, 8, 10, or 15 years1

- No application, origination or prepayment fees required

- 0.25% reduction in the interest rate2 when enrolled to make automatic payments

- Fixed APR: 4.43% – 17.99% APR [Rates include Auto-pay discount]

- Variable APR: 5.59%- 17.99% APR [Rates include the Auto-pay discount]

- Good or excellent credit score needed (get a co-signer if you have a bad or no credit score)

Click here to learn more about Private Student Loans with College Ave Student Loans.

College Ave offers private student loans with multiple repayment options. Apply online in 3 minutes and get an instant credit decision. No application, origination, or disbursement fees.

- Min credit score: Mid 600s

- Fixed APR: 4.43-16.99%

- Variable APR: 5.59-16.99%

2. LendKey

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.5/5 | 4.39% to 11.11% with autopay | Cost of attendance, minus aid | Not disclosed |

LendKey offers repayments terms ranging from five to 20 years. They have numerous excellent 5-star reviews on Trustpilot and the process is easy to complete.

Borrowers can include parents of students, parents of graduates and degree holders as well as current undergrad and graduate students. To be eligible, U.S. citizens and permanent residents must have proof of citizenship or residence permit as well as proof of income. Potential borrowers can check their eligibility online and then receive offers from LendKey’s networks of community lenders.

The minimum loan amount starts at $7,500 and goes up to $250,000, with rates as low as 4.39% or 5.84% depending on if you go with a variable or fixed APR.

Don’t meet the requirements or want to qualify for a lower interest rate?

LendKey allows borrowers to add a cosigner to the loan to help borrowers meet eligibility and get the interest rate that works best for them. This isn’t the only benefit to considering a LendKey loan, they also offer unemployment protection. If you lose your job or have just finished school, loan payments are placed on temporary hold.

LendKey connects borrowers with student loans from community banks and credit unions. You can see if you’ll qualify and what rate you’ll get without a hard credit check.

- Min credit score: 660

- Fixed APR: 4.39-11.11%

- Variable APR: 5.84-11.11%

Or, click here to learn more about Private Student Loans with LendKey.

3. Ascent Funding

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.5/5 | 4.13% to 15.46% (cosigned) | $200,000 | Not disclosed |

At more than 2,200 colleges and universities across the country, Ascent Funding is an online lender that provides undergraduate and graduate student loans.

Ascent loans are available to U.S. citizens and permanent residents who want to borrow money for their education, as well as those with Deferred Action for Childhood Arrivals status – also known as “Dreamers” – who wish to borrow money on their own.

Applicants must have a co-signer who is creditworthy and a U.S. citizen or permanent resident, among other requirements. Ascent Funding is located in San Diego.

It's a smart option for students because:

- When students meet specific criteria and conditions, they may be entitled to a 1% cash back graduation reward.

- Undergraduate juniors and seniors may be eligible for Ascent Funding's Non-Cosigned Outcomes-Based Loans based on their major, cost of attendance, graduation date, and other criteria. These loans are offered at a rate discount of one percentage point and must be paid automatically.

- There are no application, origination, or disbursement costs with Ascent Funding student loans.

Ascent gives you more opportunities to pay for college with or without a cosigner. Find your best option in 4 simple steps – with no application fees.

Click here to learn more about Private Student Loans with Ascent Funding.

Ascent is an online lender that offers three options for student loan borrowers: a traditional co-signed loan, a non-co-signed credit-based option and a non-co-signed future income-based option. Its co-signed loan is best for students who want to use a co-signer and pay off loans fast.

- Min credit score: 540

- Fixed APR: 4.13% - 15.46%

- Variable APR: 6.16% - 16.10%

Ascent's undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations; and terms and conditions may apply. For Ascent Terms and Conditions please visit: www.AscentFunding.com/Ts&Cs. Rates are effective as of 02/1/2024 and reflect an automatic payment discount of either 0.25% (for credit-based loans) OR 1.00% (for undergraduate outcomes-based loans). Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates. 1% Cash Back Graduation Reward subject to terms and conditions. Cosigned Credit-Based Loan student must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs require interest-only payments, the shortest loan term, and a cosigner, and are only available to our most creditworthy applicants and cosigners with the highest average credit scores.

4. SoFi

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.6/5 | 4.49% to 13.45% with autopay | Cost of attendance, minus aid | Not disclosed |

SoFi provides a variety of useful perks for members to assist them in managing their student loan repayment and getting out of debt faster.

SoFi's mission is to help its customers handle their money and repay their student loans as quickly as feasible. SoFi offers a 4.49%–13.45% fixed APR with terms of 5-20 years.

SoFi loans are available to all students with a credit score of less than perfect, and the entire application procedure can be completed online. There are no additional costs associated with any SoFi loans, and students have several payment alternatives that suit their budget.

With perks like $400 off SAT/ACT preparation courses, it's no surprise that most SoFi members would suggest the company to a friend.

SoFi's helping students pay for school with no-fee private student loans. No fees means no fees. That means no origination fees, no late fees, and no insufficient fund fees. Period.

5. Citizens Bank

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.3/5 | 4.99% to 13.47% | $50,000 | Not disclosed |

Looking to make financing your education easy and affordable? You can apply for a private student loan from Citizens Bank today if you have a good or excellent credit score.

Citizens Bank private student loans are ideal for international students who have a qualifying co-signer and those with existing banking relationships with the bank. Applicants that open a qualifying Citizens Bank account get 0.25 percentage point interest rate savings.

If you're going to a four-year institution to get your bachelor's degree, you'll be better off with another bank. If you want to take a certificate course at a local community college or attend a community college, Citizens Bank isn't the best option. To qualify, students must have an undergraduate degree or higher and be pursuing a bachelor's.

- Loan repayment terms of 5, 10 or 15 years

- 25% reduction in interest rates if you go for auto-repaying options while still in college or university

- 25% reduction in interest rates for existing Citizens bank account holders

- Fixed APR starting at 4.99%

- Variable APR starting at 4.59%

- No application, prepayment, disbursement or origination fees required

- Good or excellent credit scores needed

6. Sallie Mae

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.3/5 | 4.50% to 14.83% with autopay | Cost of attendance, minus aid | Mid 600s |

Sallie Mae is one of the largest providers of private student loans in the United States. Sallie Mae is a well-established lender with a long history of providing student loans. They have a wide range of loan options and a reputation for providing good customer service.

They offer a variety of loan options, including undergraduate, graduate, and career training loans, as well as loan consolidation options. They also provide resources and tools to help students and families plan and pay for college.

Apply for the Sallie Mae private student loan that fits your needs today and you'll be in great hands.

- Covers up to 100% of education costs (including college-approved expenses)

- Offers interest rate reductions (subject to terms and conditions)

- 15-minute response time after applying

- No origination, prepayment or application fees

- Fixed APR of 5.00% – 15.33%

- Variable APR of 4.50% – 14.83%

- Good or excellent credit score required (you can opt for a co-signer in case you do not have a credit score)

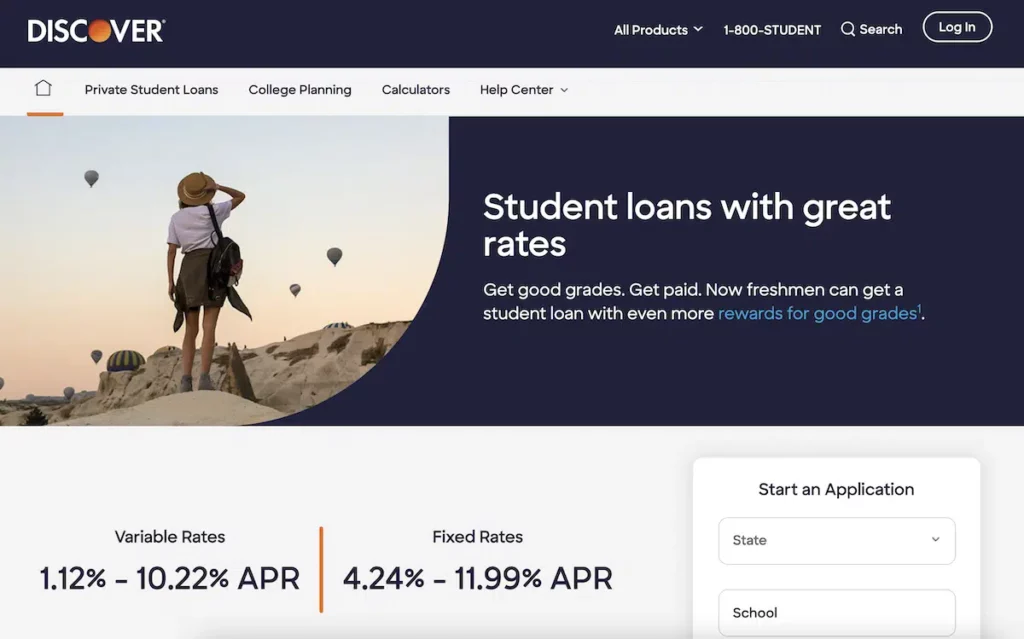

7. Discover

| Rating | Fixed APR | Max. Loan Amount | Min. Credit Score |

|---|---|---|---|

| 4.3/5 | 5.49% to 14.99% | No maximum | Not disclosed |

Discover's private student loans are a smart alternative for students who want to customize their payments in case they need more wiggle room in the future. In comparison with other student loan lenders, Discover provides more repayment assistance options, including the possibility of lowering payments temporarily.

Learn about student loans for college from #6 on our top picks for private student loan options. Discover Student Loans can help you find the best private student loan to fit your needs.

- Covers up to 100% of your education costs (including college-approved estimations of tuition and additional resources)

- Offers an interest-only repayment discount

- Includes 1% cash reward as an acknowledgment for good grades

- A simplified application process that provides the promptest feedback

- Fixed APR of 5.49% – 14.99%

- Variable APR of 5.87% – 15.12%

- No origination or prepayment fees needed

- A good or excellent credit score is needed (you can get a creditworthy co-signer in case you have a bad or no credit score to show)

Are There More Private Student Loan Options?

This list is not a comprehensive one by any means. There are definitely many more student loan options available to you — both private and federal — that we encourage you to research and consider as well.

The loans listed here are some of the best in regards to benefits and future opportunities, such as the interest rate reduction for meeting various requirements.

How Do Private Student Loans Work?

Private student loans can help students gain access to funding that they cannot get from the federal government. Students who have been denied federal aid due to bad or non-existent credit history may still be able to qualify for private education loans. There are different types of loan types:

Loan Types

Depending on the degree you're pursuing, private lenders may provide different sorts of loans. The loan type may have an impact on your funding, interest rate, and repayment terms.

- Community college or technical training. Students who are pursuing two-year degrees, attend nontraditional institutions, or participate in career training programs can get loans from lenders.

- Undergraduate school loans. To finance education expenses while studying for a bachelor's degree, you may apply for undergraduate loans. In comparison to community college loans, undergraduate loans have lower interest rates and increased loan limits.

- Graduate or professional school loans. Graduate school loans are more typically associated with larger loan installments, owing to the higher cost of receiving a master's or doctorate degree. Some lenders provide special loan programs for businesses, law degrees, or medical education.

- Parent loans. Parents may get Parent Loans to help pay for their children's education. Parents who have an informal understanding that the kid will make loan repayments after graduation typically do not have legal responsibility to pay back the loan.

Loan Terms

The length of time it will take you to pay off your student loan is determined by the term of the loan. Private student loans have terms ranging from five to 20 years, which means you may repay them for a shorter or longer period of time. Shorter loans typically have higher monthly payments, lower interest rates, and lower total costs. Larger loans generally have lower monthly installments, higher interest rates, and increased total costs.

Loan Limits

Loan minimums: There are many different financial institutions that provide private student loans. The amount you can borrow is determined by your state's lending rules. Because the minimal sum may be as little as $1,000, a private student loan might not be the best choice if you need only a few hundred dollars for books, for example.

Loan maximums: Lenders have numerous restrictions that influence how much you may borrow. There might be a maximum yearly amount you can borrow. Alternatively, there may be a maximum combined private and federal student loan amount you must fulfill to qualify for aid.

You may be restricted to borrowing up to the certified cost of attendance for your school. If you're going to graduate, professional, or medical school, your maximum loan limits might be greater than those shown in this table; reflecting potentially greater expenditures across all programs.

Interest Rate Types

Fixed or adjustable interest rates are offered on student loans. After taking out a loan, you may not be able to change the type of interest rate, so do your homework carefully before making a decision.

When comparing student loans from different providers, pay attention to the annual percentage rate (APR), rather than the interest rate. The APR is a more accurate predictor of your total costs over the life of your loan.

Fixed-rate loans. With a fixed-rate private student loan, your interest rate is set for the life of the loan. That means your payments will be predictable and you'll never have to worry about your rate increasing.

Variable-rate loans. A variable-rate student loan has an interest rate that can change over time. If the Federal Reserve raises its benchmark interest rate, your variable-rate loan's rate will probably go up, too. However, if the Fed lowers rates, your variable-rate loan could become more affordable.

A variable-rate loan would be ideal for individuals who can promptly pay back the loan, reducing your risk.

Should You Get Private Student Loans?

There’s no easy answer when it comes to private student loans. They can be a great way to get the extra money you need to pay for school, but they also come with a lot of risks.

Private student loans are offered by banks and other private student loan lenders, and they’re different from federal student loans in a few important ways. Private loans have higher interest rates, and they don’t come with the same protections as federal loans. For example, private lenders can terminate your loan if you go into default, while the government will work with you to get your loan back on track.

So, should you get a private student loan? The answer depends on many factors. If you have good credit, a steady income, and are absolutely sure you can pay off the loan in full, then it might be okay to get a private student loan. But if your finances are shaky, or if there’s even the slightest possibility that you won’t be able to repay the loan in full, then you should consider getting a federal student loan instead.

Related: Student Loan Forgiveness: How to Get Out of Student Loan Debt

How Can Students Maximize Federal and Free Financial Aid?

College is expensive. For many students, the only way they can afford to go is by taking out loans or maxing out their parents' credit cards. The good news is that there are ways to receive financial assistance with your education costs. These include state financial aid programs, need-based scholarships and campus-administered awards, but one of the best ways to get money for school is through federal financial aid.

To maximize your chances of receiving federal financial aid, you need to fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is used by the government to determine how much financial assistance you are eligible for. You can submit the FAFSA online here: https://studentaid.gov/h/apply-for-aid/fafsa

While you are completing the FAFSA, be sure to do two important things that could increase your eligibility for financial aid:

1. If you filed a tax return, use the IRS Data Retrieval Tool to complete the FAFSA. This will automatically import your tax information into the FAFSA.

2. Answer all questions accurately and completely. The government takes financial aid fraud seriously, and you could be penalized if you are found to have falsified any information on your FAFSA.

In addition to federal financial aid, there are also many private scholarships available. Scholarships are awards that don't have to be repaid. They are typically based on merit or financial need. You can search for scholarships on websites like www.fastweb.com and www.scholarships.com.

Another option for financing your education is to take out a student loan. Student loans are available from both the government and private lenders. They are loans that you have to pay back after you graduate, typically with interest. Many of the private student loans here are the best private student loans that take into account interest rates, loan types, terms, fees, unique features.

What Are the Drawbacks of Private Student Loans?

Private loans can help students fill gaps in funding. Yet private student loans have drawbacks compared with federal student loans. These include:

- Higher interest rates: Private student loans typically have higher interest rates than federal student loans. So, you may end up paying more for your education.

- Less flexible terms: Private lenders may be less flexible than the federal government in terms of repayment options. This could mean you’ll have to pay more money back over time or face penalties if you can’t make your payments.

- Fewer borrower protections: Private loans offer fewer borrower protections than federal loans. This means, for example, that you may not have the same options for deferring or canceling your loan if you encounter financial difficulties.

- Smaller loan limits: Private lenders typically offer smaller loan amounts than the federal government. So, if you need a large loan to cover your education costs, you may have to turn to private lenders.

- Less available funding: Private loans are not as widely available as federal loans. So, if you don’t have good credit or a strong cosigner, you may have trouble getting a private student loan.

- No grace period: Unlike federal loans, private student loans don’t have a grace period – the time after you graduate or leave school before you have to start repaying your loan. You typically must start making payments on a private student loan as soon as you receive the funds.

- Difficult to qualify: Private student loans are difficult to qualify for because of borrowers’ limited or damaged credit histories. You may need a co-signer to meet the credit requirements. If you can’t pay off the loan, your co-signer is responsible for doing so. To compare offers, shop around thoroughly and check annual percentage rates (APRs), loan terms, and fees.

As you can see, there are several drawbacks to private student loans. For one, these loans typically have higher interest rates than federal loans.

So, you may end up paying more for your education in the long run. Additionally, private lenders may be less flexible than the federal government when it comes to repayment options. This could mean you’ll have to pay more money back over time or face penalties if you can’t make your payments.

Student Lending Terms to Know

Anyone looking for lending offers should be aware of these terms before taking on private student loans:

- Principal: Principal is the money that you originally agreed to pay back. Interest is the cost of borrowing the principal.

- Variable rates: Variable rates are subject to change throughout the life of the loan. Student loan lenders typically set variable rates based on an economic indicator known as the London Interbank Offered Rate, or Libor. Lenders determine variable rates by adding the Libor rate to a base rate.

- Forbearance: Student loan forbearance is a way to suspend or lower your student loan payments temporarily, typically for 12 months or less, during times of financial stress.

- Interest payments: In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is calculated on the outstanding principal balance each month. This means the monthly interest amount declines over time as the outstanding principal declines

- Autopay discount: If the borrower chooses to make monthly payments automatically from a bank account, the interest rate will decrease by 0.25% and will increase back if the borrower stops making (or we stop accepting) monthly payments automatically from the borrower's bank account.

- Loan consolidation: A Direct Consolidation Loan allows you to consolidate (combine) multiple federal education loans into one loan.

- Prepayment penalty: A prepayment penalty is a fee that some lenders charge if you pay off all or part of your student loans early.

- Co-signers: A co-signer is a person who agrees to repay a loan along with the primary borrower. Qualifying for a private student loan sometimes requires borrowers to get a co-signer.

Your Best Option for Private Student Loans

You can benefit from using our top pick, College Ave Student Loans, to help you pick the best private student loan with the lowest rates:

College Ave offers private student loans with multiple repayment options. Apply online in 3 minutes and get an instant credit decision. No application, origination, or disbursement fees.

- Min credit score: Mid 600s

- Fixed APR: 4.43-16.99%

- Variable APR: 5.59-16.99%

When choosing a loan, remember to consider variable versus fixed rates and also the repayment plans offered. You might not have the resources to repay a loan immediately after you graduate and enter the workforce. In that case, deferment options and grace periods are highly beneficial.

Whether it is a public, non-profit private, or for-profit private higher education institution, you can ease a considerable portion of the financial burden if you choose to go for private student loans. It is a common case for almost every student aspiring for higher education. Consider all the factors carefully before you apply for one, read this student loans 101 guide, and make sure that you are wise with spending the money.

With oodles of confidence, a fiery passion for academics, and all-around know-how of the workings of the world, you will surely be able to repay your student debt once you start earning a living after graduation. Good luck in securing a suitable private student loan to give wings to your scholastic aspirations!

Any questions on any of these best private student loans for 2024? Sound off below!

|

5.0

|

4.5

|

4.4

|

|

|

|

- Min credit score: Mid 600s

- Fixed APR: 4.43 -17.99%

- Variable APR: 5.59-17.99%

- Min credit score: 660

- Fixed APR: 4.39-11.11%

- Variable APR: 5.84-11.11%

- Min credit score: Varies

- Fixed APR: 4.13% - 15.46%

- Variable APR: 6.16% - 16.10%

1This informational repayment example uses typical loan terms for a freshman borrower who selects the Deferred Repayment Option with a 10-year repayment term, has a $10,000 loan that is disbursed in one disbursement and a 8.35% fixed Annual Percentage Rate (“APR”): 120 monthly payments of $179.18 while in the repayment period, for a total amount of payments of $21,501.54. Loans will never have a full principal and interest monthly payment of less than $50. Your actual rates and repayment terms may vary.

2The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. Variable rates may increase after consummation.

College Ave Student Loans products are made available through Firstrust Bank, member FDIC, First Citizens Community Bank, member FDIC, or M.Y. Safra Bank, FSB, member FDIC. All loans are subject to individual approval and adherence to underwriting guidelines. Program restrictions, other terms, and conditions apply. (1) Rates shown include auto-pay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. If a payment is returned, you will lose this benefit. Variable rates may increase after consummation. Information advertised valid as of 02/01/2024. Variable interest rates may increase after consummation. Approved interest rate will depend on creditworthiness of the applicant(s), lowest advertised rates only available to the most creditworthy applicants and require selection of full principal and interest payments with the shortest available loan term.

- Dave is an app that provides an advance of up to $500 on your next paycheck

- Only required fee is a monthly $1 subscription fee

- An optional express fee from $1.99 to $13.99 to receive funds within an hour (instead of the standard two to three days)