Welcome to our Betterment review. If you're considering using Betterment as your investment platform, you've come to the right place. In this review, we'll take an in-depth look at what Betterment has to offer, including its investment options, fees, customer service, and more.

We'll also discuss the pros and cons of using Betterment, so you can make an informed decision about whether it's the right platform for you. So, let's dive in and see what Betterment has to offer.

Let's get started.

What is Betterment?

Betterment is an online investment platform that aims to make investing easy and accessible to everyone. It was founded in 2010 and is headquartered in New York City. Betterment is one of the leading robo advisors, currently having over 700,000 clients and managing over $33 billion in assets¹.

Betterment offers a range of investment options, including individual and joint taxable accounts, Traditional and Roth IRAs, SEP IRAs, and Trust accounts. It also offers goal-based investing, which allows you to set specific financial goals, such as saving for retirement or a down payment on a house, and provides personalized investment recommendations based on your goals and risk tolerance.

One of the main benefits of using Betterment is its low fees. It charges an annual fee of 0.25% of your account balance, which is significantly lower than the industry average for traditional financial advisors. It also offers a free financial planning tool called Betterment Planning, which can help you create a budget, track your spending, and set financial goals.

In terms of investment options, Betterment offers a range of low-cost index funds, as well as socially responsible investing options. It also has a feature called Smart Deposit, which automatically invests any excess cash in your account.

Overall, Betterment is a solid choice for investors who are looking for a user-friendly platform with low fees and a wide range of investment options. Its goal-based investing feature and financial planning tools make it particularly well-suited for those who are just starting out with investing or who want to take a more proactive approach to managing their finances.

Betterment is one of the pioneers of the robo-advisor approach to investing. After more than a decade in the business, we believe that no other platform offers as much value to its customers as Betterment.

How Much Does Betterment Cost?

Betterment has updated its pricing structure for its investing accounts:

Betterment costs $4/month for investing balances under $20K. 0.25% annual fee for balances over $20k

Keep in mind:

- Unlimited access to CFPs available for an incremental 0.15% annual fee

- Customers with $250 or more in monthly recurring deposits pay a 0.25% annual fee regardless of account balance

Betterment Digital has a 0.25% annual fee and does not have a minimum fee while Premium has a 0.40% annual fee and a minimum balance requirement of $100,000 to invest. This option also has unlimited phone access to human advisors while on the Digital option, access to advisors is through in-app messaging where advisors respond to messages within 24 hours.

Betterment relies on the modern portfolio theory to offer investment advice thus promoting diversity. The platform also screens companies to invest in according to their social responsibility and you can choose to invest in a company that supports a cause you believe in.

If you have more than $100,000 in your account, Betterment offers you the control and flexibility of choosing what percentage to invest in any particular ETF.

Betterment has various features on its platform and these include goal-based services, RetireGuide, automatic rebalancing, Smart Deposit, and tax harvesting.

Betterment Portfolios

Betterment offers a range of portfolios to suit different investment goals and risk tolerances. These portfolios are built using a combination of low-cost index funds, which track the performance of a particular market index such as the S&P 500.

One of the main portfolio options offered by Betterment is its goal-based portfolios. These portfolios are designed to help you achieve specific financial goals, such as saving for retirement or a down payment on a house. When you set up a goal-based portfolio, Betterment will ask you questions about your risk tolerance, time horizon, and financial goals, and use this information to recommend a portfolio that is tailored to your needs.

In addition to goal-based portfolios, Betterment also offers a range of more general investment portfolios, including:

- Conservative portfolios: These portfolios are designed for investors who are looking for a low-risk option, with a greater emphasis on fixed income investments such as bonds.

- Moderately conservative portfolios: These portfolios are a balance between the conservative and moderately aggressive options, with a mix of stocks and bonds.

- Moderately aggressive portfolios: These portfolios are designed for investors who are willing to take on a higher level of risk in exchange for the potential for higher returns. They have a higher proportion of stocks in the portfolio.

- Aggressive portfolios: These portfolios are designed for investors who are comfortable with a higher level of risk and are looking for the potential for higher returns. They have a higher proportion of stocks and may also include alternative investments such as real estate or commodities.

In addition to these portfolio options, Betterment also offers socially responsible investing (SRI) portfolios, which are built using index funds that focus on companies that meet certain environmental, social, and governance criteria. These portfolios are available in a range of risk levels, from conservative to aggressive.

Betterment Features

Betterment is a comprehensive online investment platform that offers a range of features to help you manage your investments and achieve your financial goals. Some of the key features offered by Betterment include:

- Goal-based investing: Betterment's goal-based investing feature allows you to set specific financial goals, such as saving for retirement or a down payment on a house, and provides personalized investment recommendations based on your goals and risk tolerance.

- Diversified portfolios: Betterment offers a range of diversified portfolios built using low-cost index funds, as well as socially responsible investing options. These portfolios are available in a range of risk levels, from conservative to aggressive, to suit different investment goals and risk tolerances.

- Automatic rebalancing: Betterment automatically rebalances your portfolio to ensure it stays well-diversified and aligned with your investment objectives. This can help you avoid taking on too much risk or missing out on potential investment opportunities.

- Tax-loss harvesting: Betterment's tax-loss harvesting feature automatically sells losing investments in your portfolio and replaces them with similar investments in order to generate tax losses that can offset capital gains and potentially lower your tax bill.

- Smart Deposit: Betterment's Smart Deposit feature automatically invests any excess cash in your account, helping you make the most of your money.

- Financial planning tools: Betterment offers a free financial planning tool called Betterment Planning, which can help you create a budget, track your spending, and set financial goals.

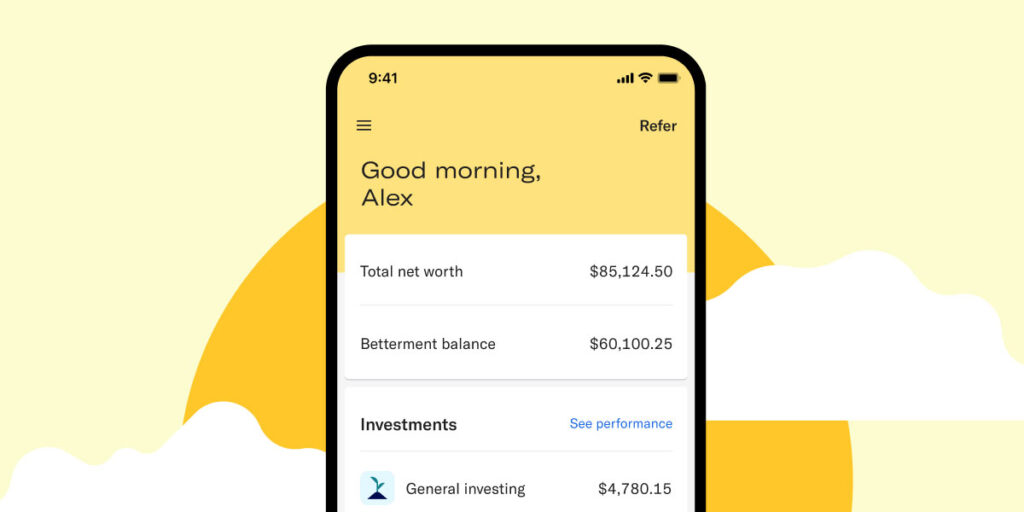

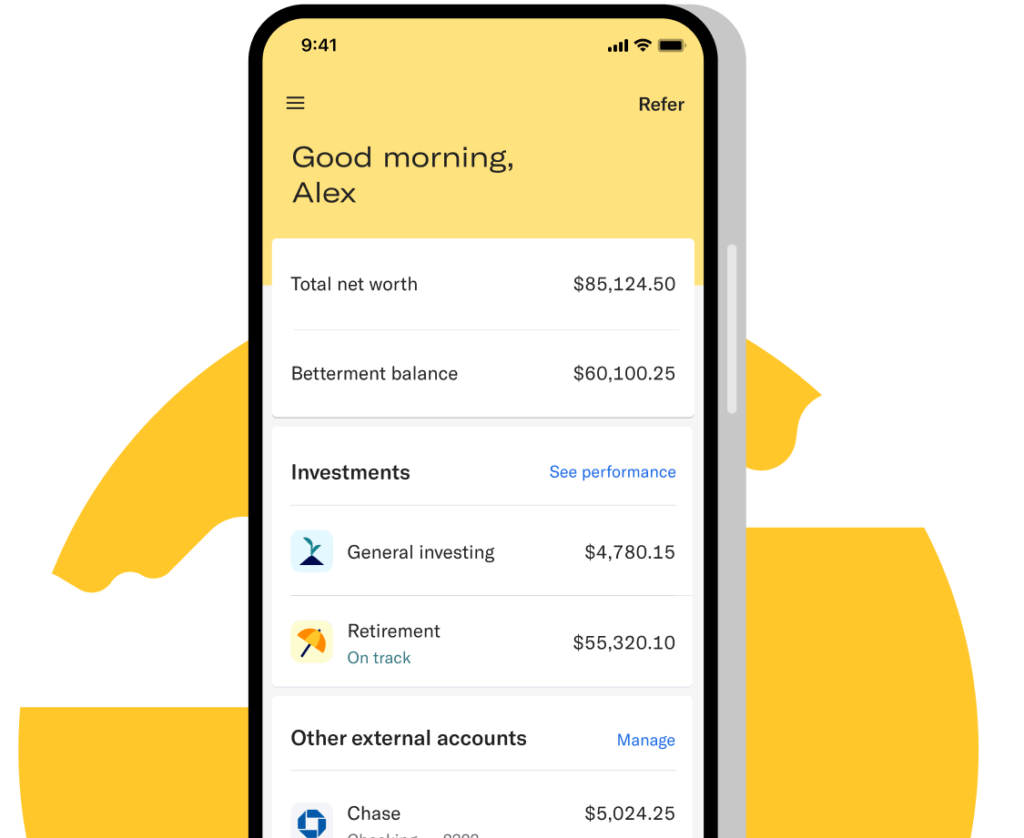

- Mobile app: Betterment has a mobile app that allows you to manage your investments on the go, track your portfolio performance, and access financial planning tools.

- Customer service: Betterment has a team of customer service representatives available to answer questions and provide support by phone, email, or chat.

Pros and Cons

Like any investment platform, Betterment has both pros and cons that you should consider before deciding whether it's the right fit for you.

Pros of Betterment

- Low fees: Betterment charges an annual fee of 0.25% of your account balance, which is significantly lower than the industry average for traditional financial advisors.

- Wide range of investment options: Betterment offers a range of investment options, including individual and joint taxable accounts, Traditional and Roth IRAs, SEP IRAs, and Trust accounts. It also offers goal-based investing, which allows you to set specific financial goals and receive personalized investment recommendations based on your goals and risk tolerance.

- Diversified portfolios: Betterment's portfolios are built using a combination of low-cost index funds, which are designed to track the performance of a particular market index. This can help reduce risk and provide a more balanced investment approach.

- Financial planning tools: Betterment offers a free financial planning tool called Betterment Planning, which can help you create a budget, track your spending, and set financial goals.

Cons of Betterment

- Limited investment options: Betterment only offers index funds and does not offer access to individual stocks or actively managed funds. This may not be suitable for investors who are looking for a more customized investment approach.

- No human financial advisors: Betterment is a robo-advisor, which means that it uses algorithms to make investment recommendations rather than human financial advisors. This may not be suitable for investors who prefer to work with a human advisor unless you are on the Premium Plan.

- Limited account minimums: Betterment has a minimum account balance of $10 for taxable accounts and $0 for IRAs. However, some investors may prefer a platform with a higher minimum account balance.

It's important to carefully consider the pros and cons of Betterment, as well as your own investment goals and risk tolerance, before deciding whether it's the right platform for you. It's always a good idea to consult with a financial advisor or conduct your own research before making any investment decisions.

Who is Betterment Best For?

Betterment is an online investment platform that is designed to make investing easy and accessible to everyone. It is particularly well-suited for the following types of investors:

Beginner investors: Betterment is user-friendly and offers a range of investment options, including goal-based investing, which can help beginner investors get started with investing and achieve their financial goals.

Investors who want a low-cost investment platform: Betterment charges an annual fee of 0.25% of your account balance, which is significantly lower than the industry average for traditional financial advisors. This can make it a cost-effective option for investors who are looking to minimize investment fees.

Investors who want a diversified portfolio: Betterment's portfolios are built using a combination of low-cost index funds, which are designed to track the performance of a particular market index. This can help reduce risk and provide a more balanced investment approach.

Investors who want financial planning tools: Betterment offers a free financial planning tool called Betterment Planning, which can help you create a budget, track your spending, and set financial goals.

That being said, Betterment may not be the best fit for all investors. For example, it only offers index funds and does not offer access to individual stocks or actively managed funds, which may not be suitable for investors who are looking for a more customized investment approach. It's always a good idea to carefully consider your own investment goals and risk tolerance before deciding whether Betterment is the right platform for you.

Other Betterment Accounts & Features

1. Cash Reserve Account

Betterment offers a Cash Reserve account, which is a high-yield savings account that is FDIC-insured up to $1 million. The account offers a competitive interest rate and has no minimum balance or monthly maintenance fees. It's a convenient place to keep your cash while you're waiting to invest it or as an emergency fund.

2. Checking Accounts

Betterment also offers a checking account, which is a convenient way to manage your day-to-day expenses and save money at the same time. The account has no monthly maintenance fees or minimum balance requirements, and it comes with a debit card that you can use to make purchases and withdraw cash. The account also offers cash back rewards on certain purchases, such as gas and groceries.

3. Cash Back Rewards

Betterment's checking account offers cash back rewards on certain purchases, such as gas and groceries. These rewards can help you save money on your everyday expenses and build your savings over time.

4. Easy Account Setup

Setting up an account with Betterment is quick and easy. You can open an account online in just a few minutes and start investing right away.

5. Smart Automation Tools and Goal Setting

Betterment offers a range of smart automation tools to help you manage your investments and achieve your financial goals. For example, its Smart Deposit feature automatically invests any excess cash in your account, and its tax-loss harvesting feature automatically sells losing investments in your portfolio and replaces them with similar investments in order to generate tax losses. Betterment also offers goal-based investing, which allows you to set specific financial goals, such as saving for retirement or a down payment on a house, and receive personalized investment recommendations based on your goals and risk tolerance.

6. Betterment Crypto Investing

Betterment recently introduced crypto investing in October 2022, which allows you to invest in 4 different diversified portfolio of cryptocurrencies such as Bitcoin and Ethereum. The portfolio is built using a combination of low-cost index funds and is available in a range of risk levels, from conservative to aggressive. Betterment's crypto investing feature has no minimum investment requirement, so it's ideal for beginners.

Betterment Customer Service

Betterment has a team of customer service representatives available to answer questions and provide support to its customers. You can contact Betterment's customer service team by phone, email, or chat.

In general, Betterment's customer service has received positive reviews from users. Many customers report that the company's customer service representatives are helpful, knowledgeable, and responsive. However, as with any company, there may be occasional instances where customer service is not up to par, and individual experiences with customer service may vary.

In addition to its customer service team, Betterment also offers a range of educational resources on its website, including articles, videos, and a FAQ section. These resources can help you learn more about investing and managing your finances.

It's always a good idea to consider a company's customer service when deciding whether to use its products or services. If you have specific concerns about Betterment's customer service, it may be helpful to read reviews from other users or reach out to the company directly to ask any questions you may have.

Betterment Security

Security is a top priority for Betterment, and the company takes a number of steps to protect the personal and financial information of its customers.

Some of the security measures implemented by Betterment include:

- Encryption: Betterment uses encryption to protect the personal and financial information of its customers. This means that the data is scrambled as it is transmitted between your computer and Betterment's servers, making it more difficult for unauthorized parties to access it.

- Two-factor authentication: Betterment offers two-factor authentication, which requires you to enter a code that is sent to your phone or email in addition to your password when logging in to your account. This can help prevent unauthorized access to your account.

- FDIC insurance: Betterment's Cash Reserve account is FDIC-insured up to $1 million, which means that your money is insured by the Federal Deposit Insurance Corporation in the event that Betterment were to fail.

- Regular security audits: Betterment regularly undergoes security audits to ensure that its systems and processes are secure.

Overall, Betterment takes a number of steps to ensure the security of its customers' personal and financial information. It's always a good idea to carefully consider the security measures in place when deciding whether to use a financial service, and to take steps to protect your own personal and financial information, such as using strong, unique passwords and enabling two-factor authentication.

Betterment Competitors

Betterment is a robo-advisor, which means that it is an online investment platform that uses algorithms to make investment recommendations rather than human financial advisors. Some of the other robo-advisors that are similar to Betterment and could be considered competitors include:

- Wealthfront: Wealthfront is another online investment platform that offers a range of investment options, including goal-based investing and socially responsible investing. It charges an annual fee of 0.25% of your account balance.

- Charles Schwab Intelligent Portfolios: Charles Schwab Intelligent Portfolios is a robo-advisor offering from the brokerage firm Charles Schwab. It offers a range of investment options, including goal-based investing and socially responsible investing, and charges a 0.30% annual fee.

- Vanguard Personal Advisor Services: Vanguard Personal Advisor Services is a robo-advisor offering from the mutual fund company Vanguard. It offers goal-based investing and charges an annual fee of 0.30% of your account balance.

- Ellevest: Ellevest is a robo-advisor that focuses on investing for women. It offers goal-based investing and charges an annual fee of 0.25% of your account balance.

It's important to note that there are many other robo-advisors on the market, and the specific features and fees of these platforms may vary. It's always a good idea to carefully compare the different options and consider your own investment goals and risk tolerance before deciding which platform is the best fit for you.

Bottom Line: Is Betterment Worth It?

While some investing apps offer free stocks for joining, sometimes having goal-oriented tools and helpful tax strategies should be more appealing to investors. These days you probably are seeing ads for a new robo advisor on the daily. The truth is, they keep on popping up left and right.

These robo advisors are helpful for consumers as they provide an automated and logarithm-based advising service and act as a financial advisor providing online financial advice online with little or no human consultation.

Sounds complicated. But they make it easy. Ultimately, the decision of whether to use Betterment (or any other investment platform) should be based on a thorough evaluation of your financial situation and goals, as well as a careful comparison of the costs and benefits of different investment options.

Betterment is an online financial advisor built for people who refuse to settle for average investing. People who demand better should look into signing up here.

Bottom line: Betterment has various features on their platform and these include goal-based services, RetireGuide, automatic rebalancing, Smart Deposit, and tax harvesting. It is one of the top robo advisors that we have reviewed and we do recommend it.

Article Sources

- Betterment. “Betterment Raises $160 Million in Growth Capital, https://www.betterment.com/resources/2021-fundraising”