Believe it or not, in today's digital age, a myriad of online stock trading brokerages are luring customers with enticing sign-up bonuses. These can range from free stocks to cash rewards. It's fascinating to see how these platforms are more than willing to reward you just for choosing them over their competitors.

Numerous investment apps offer opportunities to acquire complimentary stock shares. A highlight of my personal finance journey is ensuring my brokerage meets my expectations. The following investment platforms stand out, allowing you to curate a strong portfolio with mutual funds, stocks, and ETFs, all while earning free stock shares.

Next, we'll move on to ways anyone can get free stocks. Some of them don't require a deposit and you can still earn a free stock.

|

Primary Rating:

4.5

|

Primary Rating:

5.0

|

|

Get 16 free stocks valued up $2,000

|

Get $20 bonus investment after joining

|

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

- No fees to open or maintain an account

- No fees to transfer funds to an account

- Free Level II data

- No account minimum

- Advanced trading platform

- Free research tools

- No fractional shares

- No minimum deposit

- Low-cost, diversified funds

- Beginner-friendly

- Offers online checking account

- Easy-to-navigate interface

- $3 per month

Collect Free Stocks From These Companies

Yes, there is such a thing as free stocks. We know, we know. It sounds too good to be true, but you just have to know where to look.

- Moomoo: Get up to 16 free stocks worth between $2 and $2,000 (requires $100 min. deposit)

- Acorns: $20 bonus investment (requires $5 min. recurring investment)

- Robinhood: Get 1 stock worth between $5.00 and $200 (no deposit required)

- Webull: Deposit and claim 6-12 free stocks (requires $1 min. deposit)

- Public: Between $3 and $300 (requires $20 min. deposit)

- SoFi Invest: Get $25 worth of your favorite stock (requires $10 min. deposit)

- M1 Finance: Get up to $500 bonus (requires $10,000 min. deposit)

Here's the run down on each of these investing apps:

Free Stock Eligibility Requirements

There are some investing apps giving out free stocks with no deposit for signing up. Be sure to check the eligibility requirements below to see if a sign up is all that is required or if you have to deposit money to claim the free stock.

Here’s how to get free stocks:

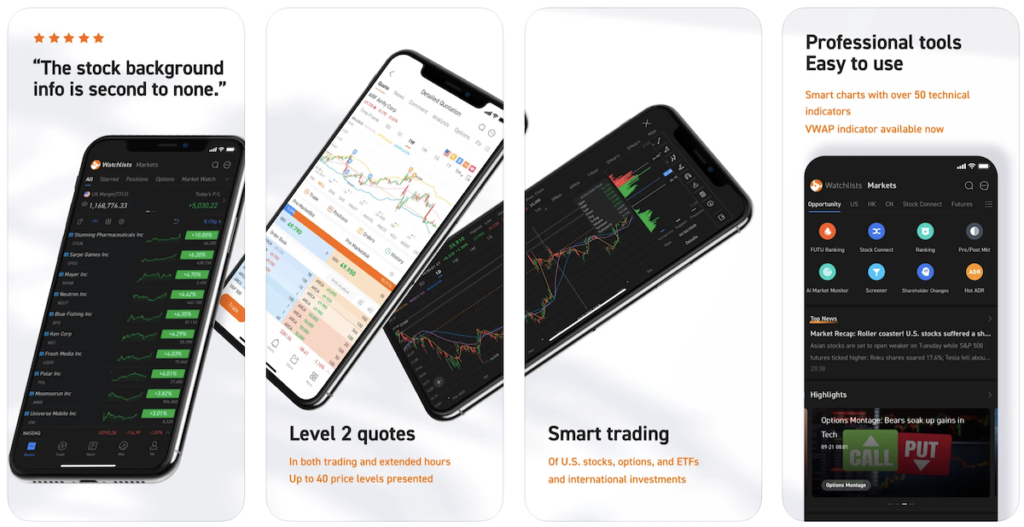

1. Moomoo: Get up to 16 free stocks worth up to $2,000

- Free stock value: $3-$2,000

- Available on: Apple iOS (4.7 rating – 629,216 reviews) and Google Android (4.5 rating – 124,337 votes)

Moomoo is a stock trading platform that offers commission-free trading of US stocks and ETFs. They also offer low-cost options trading. Moomoo is a FINRA-regulated platform that is insured by the FDIC and SIPC.

Moomoo offers a free stock promotion where you can receive up to 16 free stocks. You can also receive free stocks by completing specified tasks. The value of the stocks you receive can range from $3 to $2,000. You don't have to invest the money to earn the free stocks.

Download: iOS | Android | Desktop

Moomoo has an exclusive offer for new users where you can earn up to 16 free stocks! You must use our link to claim this promotion.

Here are the details:

- Sign up with Moomoo Financial Inc. for free, put in $100, and get up to 5 free stocks that could be worth as much as $2,000 each!

- Put in $1,000 and get up to 15 more chances to win a free stock! Just keep $1,000 in your account for two months to claim your free stocks.

- Add $5,000 and get a free share of Tesla or Google!

Once you have finished the promotional tasks, the app will send you an in-app notification. Then navigate to the “Me” tab – “Event Center” – “Welcome Gifts” in the Moomoo app.

Then you can tap the “DRAW” button on the promotional page.

You will get a free stock by clicking “DRAW”. If you have multiple lucky draw chances, you can repeat the lucky draw until all bonuses have been drawn.

Smart trading anytime, anywhere on Moomoo stock tradign app. It's a one-stop investment platform and you can join now and get free stocks!

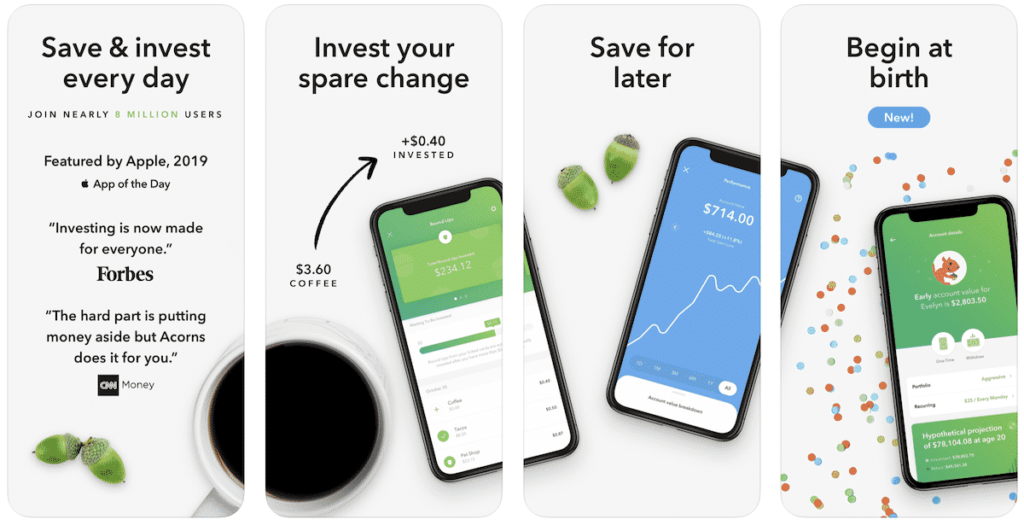

2. Acorns: $20 bonus after joining and setting up recurring investments

- Free stock value: $20

- Available on: Apple iOS (4.7 rating – 629,216 reviews) and Google Android (4.5 rating – 124,337 votes)

Acorns is an investing app for those who want to invest their spare change and have it grow into a large portfolio over time.

This investing app will round up your purchases and invest the difference on your behalf if you have automatic roundups enabled. This makes investing easy and effortless.

You'll be investing in professionally-created portfolios that match your financial goals and risk tolerance starting at only $3/mo and comes with Acorns Later which lets you set money aside in an IRA so you can save on taxes.

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

Download: iOS | Android | Desktop

Acorns is offering a $20 bonus when you sign up for a new account and set up recurring investments. After joining through this link, make your first successful Recurring Investment (min $5) – get your $20 bonus within 10 days of the following month.

How can I get my $20 Bonus at Acorns?

Here's how:

- Set up your Acorns account in under 3 minutes

- Set up Recurring Investments

- Make your first successful Recurring Investment (min $5) – get your $20 bonus within 10 days of following month

Join over 9.5 million people who have used Acorns to help their money grow!

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

3. Robinhood: Get 1 free stock worth between $5.00 and $200

- Free stock value: Up to $200

- Available on: Apple iOS (4.8 rating – 1,939,166 reviews) and Google Android (4.3 rating – 156,704 votes)

With apps like Robinhood, you can invest in stocks, options, cryptocurrencies and ETFs, all commission-free trades and start with as little as $1.

If you choose to open an account with Robinhood you can learn and understand financial markets so you can confidently invest in stocks, funds and options, all commission-free.

Robinhood has led the charge with commission-free trading and has left mostly all other brokerages scrambling to offer free trades in order to remain competitive — with the average trader benefiting immensely.

Robinhood's app and the beautiful interface make it simple to purchase stocks and options. Before buying a stock, coin, or any other investment, you can access real-time market data, read relevant stock news articles, and get notified about important events.

And of course, you can manage your portfolio on the go with the Robinhood app (iOS and Android).

Robinhood also allows you to set up customized news and notifications to stay on top of your stocks as casually or as relentlessly as you like. Controlling the flow of info is up to you.

Plus, Robinhood has a full range of products to help make your money work harder for you such as a Cash Management account, a savings account that comes with up to $1.25 million in FDIC coverage.

Download: iOS | Android | Desktop

To receive your Robinhood free stock, sign up with this link. Robinhood will add 1 share of free stock to your account when signing up for a new account.

You’ll be able to keep the stock or sell it after 2 trading days. You have a 1 in 150 chance of getting Microsoft ($220.8), Visa ($210.58), or Johnson & Johnson ($152.3).

The free stock is randomly chosen and individuals must sign up through this promotional page to be eligible.

How do I claim my free stock on Robinhood?

Once your stock is ready, Robinhood will send you a notification prompting you to claim your reward. If you forget to tap on the notification, you can claim your reward stock by navigating to Messages to check if you have new claimable stocks under Robinhood Rewards.

You can also navigate to the Rewards tab/icon on the home page and click on “Past” to see previously-granted rewards. If you don’t claim the reward stock within 60 days, it will expire.

Robinhood is a free-trading app that allows you to trade stocks, crypto, and more without paying commissions. Plus, they'll give you a free stock worth between $5 and $200 for joining.

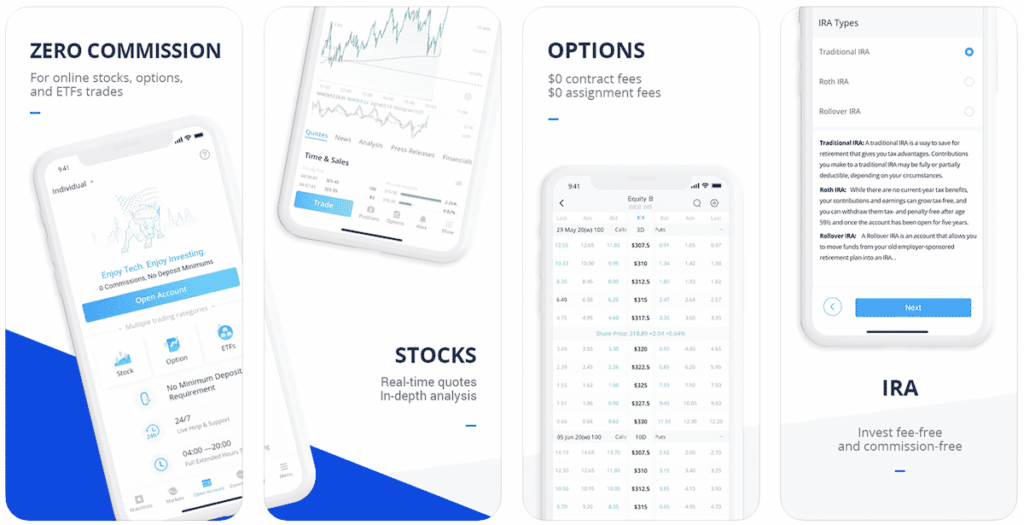

4. Webull: Deposit and claim 6-12 free stocks

- Free stock value: Account Opening and $5 Deposit: 6-12 free stocks worth between $3 – $3,000

- Available on: Apple iOS (4.7 rating – 53,326 reviews) and Google Android (4.4 rating – 63,908 votes)

Webull is the zero-commission brokerage app that's new to the scene, having only opened its doors in 2018. Just like Robinhood, you can trade stocks, ETFs and options all for free (but no cryptocurrency).

An added benefit from Webull, the investing app provides you all the US market data you can handle. This includes a vast depth of news, real-time market data, analysis tools, and trading commissions completely free.

Webull definitely prides itself on continually improving its investing platform and bringing exciting and useful tools to help its users make smarter financial decisions. They app offers a subscription to Nasdaq TotalView for $24.99 that allows you to see . Having access to Level II data is crucial for the active trader.

If you're just a regular investor though, you'll enjoy the investing app as it offers you the ability to trade stocks, ETFs and options for free and you can access extended trading hours. Plus, they even offer you the ability to open a Roth IRA or other individual retirement accounts (IRAs)

If all of those free options did not entice, perhaps their lucrative free stock promotion would.

Download: iOS | Android | Desktop

Webull offers a promotion where you can get up to 12 free stocks worth between $3 and $3,000 each. To qualify, you need to make an initial deposit of any amount.

The free stocks are randomly chosen from Webull's inventory of settled shares. They are from companies listed on NYSE or NASDAQ with a minimum market cap of $2.5 billion.

How to claim your free stocks on Webull?

You can claim your free stocks in the “My Free Stock” tab on the Menu page. Webull will also send push notifications if you have free stocks to claim.

There are no obligations to actually invest your money once you sign up – so it truly is free money.

Take action: Sign up for Webull and earn a free stock in minutes.

Webull offers a promotion where you can get up to 12 free stocks worth between $3 and $3,000 each. To qualify, you need to make an initial deposit of any amount. The free stocks are randomly chosen from Webull's inventory of settled shares. They are from companies listed on NYSE or NASDAQ with a minimum market cap of $2.5 billion.

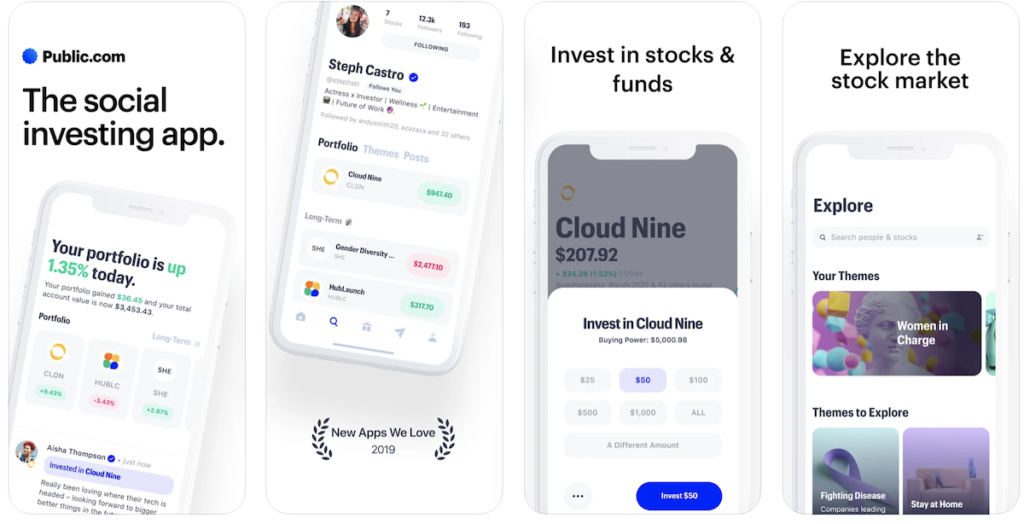

5. Public: Between $3 and $300

- Free stock value: Up to $300

- Available on: Apple iOS (4.7 rating – 54,708 reviews) and Google Android (4.4 rating – 41,370 votes)

At Public, its mission is to open the markets to all which is why trades are commission-free and there are never any account minimums to set up or maintain.

Public never charge any hidden service or convenience fees because, well, frankly, there's nothing convenient about a convenience fee.

The company is proud to keep Public free and open to all so that everything you invest and earn stays all yours.

Download: iOS | Android | Desktop

Public makes it possible to buy any stock with any amount of money — commission-free. And what's more, they keep it simple at Public and that goes for the terms and rules of claiming a free stock.

How does the New Member Free Stock Program work?

- Sign up for Public.

- Open an approved brokerage account.

- Deposit at least $20 into your account.

- Claim your free slice of stock from the button on the top right of your home screen!

How do I claim my free stock on Public?

Public will alert you as soon as you are cleared to claim your free slice of stock. Tap on the notification or the “Free Stock” button on the top right of your screen to claim your free slice of stock.

Once you have claimed your free slice of stock, the cash value of the free slice may not be withdrawn for 90 days.

The value of the slice of stock you receive varies from $3 to $300 and may change from time to time based on market movements.

Public.com is a commission-free investing app that caters to Millennials and Gen-Zers keen on investing in line with their social preferences and with good company. New users can receive a free slice of stocks valued between $3 to $300.

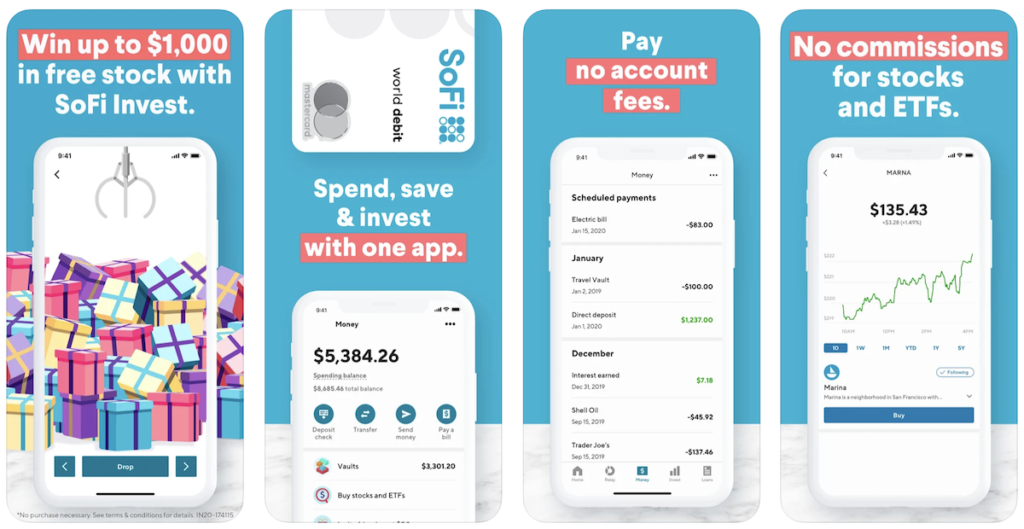

6. SoFi Invest: Get $25 worth of your favorite stock

- Free stock value: $20

- Available on: Apple iOS (4.8 rating – 62,118 reviews) and Google Android (4.8 rating – 60,135 votes)

SoFi has made one of the best apps for those who want to manage their money better.

Not only can you invest your money (all for free), but it offers customers multiple products and services to help them manage their money, including credit cards, tracking your net worth, personal loans, student loans and more.

SoFi Invest offers the following:

- Stocks, crypto, and automated investing—all in one place

- No trading fees or commissions, & no account minimums to invest in stocks

- Get a piece of popular stocks starting at $1 with Stock Bits

- Buy and sell Bitcoin, Litecoin, and Ethereum

- Discover trending stocks, ETFs

- Automated investing for a hands-off approach

It is one of the best investing apps for beginners and experienced investors alike. The free stock promotion is just the icing on the cake.

Download: iOS | Android | Desktop

SoFi offers a $25 bonus for new customers who open a SoFi Active Invest account and fund it with at least $10. To qualify for the bonus, you must:

- Use an active referral link (like this one)

- Fund the account with at least $10

- Deposit the funds within 14 days of opening the account

The $25 bonus is in the form of a fractional share in a company. There are no fees for the account.

Take action:

Sign up for a SoFi account then download the mobile app, tap Get Started, and select Start Investing under active investing account. There you’ll find step-by-step instructions on how to get started.

SoFi Invest allows members to buy and sell stocks, exchange-traded funds (ETFs), fractional shares, initial public offerings, and cryptocurrency. SoFi Invest also offers commission-free trades. Join now and get $25 worth of your favorite stock to start building your portfolio when you fund your SoFi Active Invest account with at least $10.

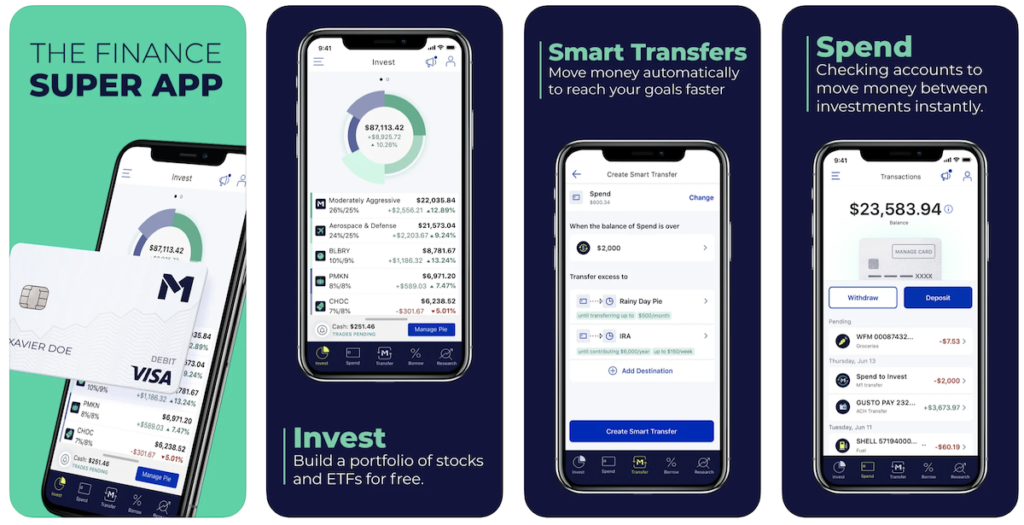

7. M1 Finance: Get up to $500 bonus

- Free stock value: $30

- Available on: Apple iOS (4.6 rating – 24,088 reviews) and Google Android (4.2 rating – 12,088 votes)

M1 Finance is an investment app that offers a combination of self-directed trading and automated investing. The app uses pie-based models to let you choose which stocks, ETFs, or portfolios you want to invest in. You can also use pre-built portfolios, called “Expert Pies”.

M1 Finance also offers digital banking, a credit card option, and a cash flow allocation feature. You can transfer money, set up direct deposit, and spend with a debit card.

Download: iOS | Android | Desktop

M1 Finance offers a $500 bonus to new customers who open an investment account and deposit at least $10,000 within 14 days.

Simply deposit your funds within two weeks of opening your new M1 Brokerage Account and get a cash bonus deposited to your account.

Promotional credit will depend on the deposited value made into the account:

| Deposited Value | Promotional Credit |

|---|---|

| $10,000 – $29,999.99 | $75 |

| $30,000 – $49,999.99 | $150 |

| $50,000 – $99,999.99 | $250 |

| $100,000+ | $500 |

This offer is exclusive to customers who have not previously created an M1 user account.

M1 Finance offers free automated investing as would any robo-advisor. And while it classifies as a robo-advisor in terms of features and functionality, it varies in a few key ways. Fund your account with $10,000+ and get up to a $500 bonus. It’s that easy.

Free Stocks for Signing Up Summary List

Ready to get free shares of stock? Investors can earn free stock through these brokerages.

-

4.5COLLECT FREE STOCK

Robinhood is a free-trading app that allows you to trade stocks, crypto, and more without paying commissions. Plus, they'll give you a free stock worth between $5 and $200 for joining.

-

4.5CLAIM 12 FREE STOCKS

Webull offers a promotion where you can get up to 12 free stocks worth between $3 and $3,000 each. To qualify, you need to make an initial deposit of any amount. The free stocks are randomly chosen from Webull's inventory of settled shares. They are from companies listed on NYSE or NASDAQ with a minimum market cap of $2.5 billion.

-

5.0GET YOUR BONUS ACORNS REVIEW

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

-

4.0GET $5 ON STASH

Stash aims to make investing approachable for beginners. The service has no account minimum and low monthly fees. If you’re looking for a little hand-holding while you build a portfolio of stocks and ETFs, Stash may be a good fit. Sign up and add $5 or more to your personal portfolio, and get a $5 bonus to start.

-

5.0GET UP TO $300 FOR JOINING

Public.com is a commission-free investing app that caters to Millennials and Gen-Zers keen on investing in line with their social preferences and with good company. New users can receive a free slice of stocks valued between $3 to $300.

Offer valid for U.S. residents 18+ and subject to account approval. There may be other fees associated with trading. See public.com/disclosures/.

-

5.0GET $25 NOW

SoFi Invest allows members to buy and sell stocks, exchange-traded funds (ETFs), fractional shares, initial public offerings, and cryptocurrency. SoFi Invest also offers commission-free trades. Join now and get $25 worth of your favorite stock to start building your portfolio when you fund your SoFi Active Invest account with at least $10.

-

5.0GET UP TO 16 FREE STOCKS

Smart trading anytime, anywhere on Moomoo stock tradign app. It's a one-stop investment platform and you can join now and get free stocks!

-

4.5CLAIM BONUS NOW

M1 Finance offers free automated investing as would any robo-advisor. And while it classifies as a robo-advisor in terms of features and functionality, it varies in a few key ways. Fund your account with $10,000+ and get up to a $500 bonus. It’s that easy.

In the investing world, there's been a surge of interest in apps offering free stocks to attract new users to their platforms. These stock trading apps aim to make the stock market more accessible to new investors and younger generations. But what does this mean for those eager to begin their investing journey?

Several platforms, such as Robinhood, Webull, and Firstrade, provide new users with free stock shares upon signing up and opening a brokerage account. Typically, these platforms use a “pick a card game” or similar mechanisms where you might earn free stocks valued anywhere from $5 to $200, depending on luck and the app's specific promotional campaign.

There are dozens of free stock trading apps that offer you free stocks for signing up. Apps like Robinhood will give you a free stock worth up to $200 and no minimum deposit is required. Another lucrative offer is Webull which will give you up to $2,300 with two free stocks, after an initial deposit of $5.

Online brokerage firms and apps like Stockpile and Robinhood can give free stocks as part of their marketing initiatives. They gift new clients new stocks in hopes to have them as long-term customers. Even though they are free trading apps, they make money through from payment for order flow.

The best brokerage account depends on if you're a new investor or an experienced investor or trader. If you are just starting out consider getting an Acorns account that is the best micro-investing app for new investors. If you want to dabble with options and use margin trading then consider getting Robinhood and upgrade to Robinhood Gold ($5 monthly fee).

Commission-free trading means that users can buy and sell stocks, ETFs, options, and sometimes even alternative assets like crypto without paying any commission fees. This has been a game-changer for active traders who once had to pay high fixed fees for each trade, affecting their investment portfolio growth.

While some investing platforms require an initial deposit or linking a bank account, others might award free shares simply for creating an account. It’s always important to read the terms and conditions to understand the exact steps and requirements.

While many stock trading apps emphasize individual stocks and ETFs, others offer a wider range of options including mutual funds, retirement accounts like IRAs, and even bonds or CDs.

It's important to note that when you sell stocks or withdraw cash bonuses, this could constitute taxable income. Earnings from free stocks or bonuses might be subject to capital gains tax. It's always recommended to consult a tax professional for advice.

While the prospect of earning free stocks and commission-free trading is enticing, remember investing involves risk. Stock values can go up and down, and there's no guarantee of returns. Furthermore, while many apps offer professional-grade tools and real-time stock alerts, some might have fewer features, so it's always best to choose a platform that aligns with your investing goals and knowledge.

Ways to Be Successful in Trading Stocks

You can only get so far with getting a free stock or fee-free trading. If you want to build real wealth then you need a competitive advantage.

That's where stock research websites and apps like Seeking Alpha can help you find the right appreciating assets to buy.

It’s no secret that investing money can make you money daily and earning crazy returns is possible. But what stocks should you invest in? What companies are worth checking out? For me, I use Seeking Alpha which is an investment research platform that puts institutional-quality tools and resources in the hands of the everyday investor. Here is why I use it:

- This is a comprehensive stock screener with several features so you can cut through the noise.

- Tools to help identify high-quality stocks that pay dividends.

- Transcripts of earnings calls and more are all available in one place for free.

- It’s like having your own personal Ivy League-efficiency analyze companies before they hit public markets – only without paying tuition!

- The site even links up account holders from brokerage firms such as Charles Schwab or Fidelity Investments if they have an active investment strategy going on too.

- World's largest investing community

- Find profitable investing ideas, improve your portfolio, research stocks better and faster as well as track the news to find investing opportunities

- Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations

- Find stocks likely to outperform and make you money

- Proprietary quant records have an impressive track record leading to massive market outperformance

Get Free Stocks

When you're looking to get a free stock then there is no harm in signing for multiple brokerages. There are plenty of ways to get free money when you open an account and claim a stock bonus.

Most of these apps offer commission-free trading and real-time market data so you may find a new investment platform for self-directed trading or automated investing to build cash flow investments.

While I like Robinhood‘s free stock bonus when you sign up (no deposit required), Moomoo is the better offer that offers up to 16 free stocks when you meet deposit limits. The share of stock you receive will fluctuate with market movements.

Ready to get a free stock?

Smart trading anytime, anywhere on Moomoo stock tradign app. It's a one-stop investment platform and you can join now and get free stocks!

Which ones allow you to pick what stock you want? (A fraction of Berkshire stock, for example.)