You’re in for a treat once you learn about the best real estate investing apps that every investor needs on their phone. There are so many great apps available, and we’ve narrowed it down to these eight essential real estate investing apps that can help you get your feet wet with real estate.

It’s time to find out what they are.

Best Real Estate Investing Apps:

- Best for Low Minimum Investment: Arrived Homes

- Best for Diversification: EquityMultiple

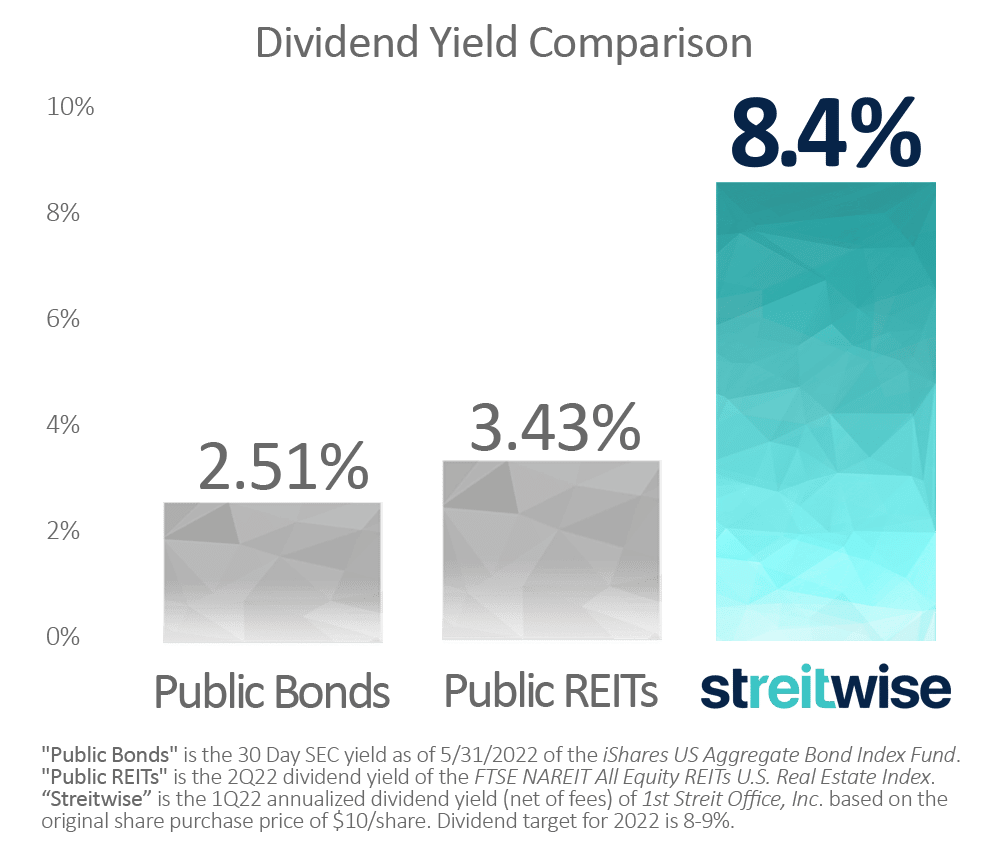

- Best for High Dividends: Streitwise

- Best for Commercial Real Estate: CrowdStreet

- Best for Farmland: FarmTogether

- Best Public Nontraded REITs: RealtyMogul

- Best for Entry-Level Investors: DiversyFund

- Best for Real Estate Notes: Groundfloor

- Best Alternative for Farmland: AcreTrader

1. Best for Low Minimum Investment: Arrived Homes

Arrived is a great real estate investing platform to use if you want a low minimum investment threshold for real estate investing. You can get started with as little as $100! It’s an especially useful tool to use if you want to diversify your portfolio and have someone else handle all the work that comes with being a landlord. All you really need to do is sign up, and collect your rental income each quarter.

The management fee is a modest 1% asset management fee, but it's worth it considering how easy it is to get started. You can sign up for free and view the different properties available to invest in. Buy shares of properties, earn rental income and appreciation — let Arrived take care of the rest.

2. Best for Diverse Offerings: EquityMultiple

EquityMultiple is a great option for crowdfunding real estate investing for accredited investors. It’s been around since 2015 and has an average return of 16.8% for its investors. You can easily diversify your portfolio by investing in properties from across the nation no matter where you are located — it's the beauty of diverse offerings from EquityMultiple.

EquityMultiple offers the ability to invest in high-yield, professionally managed real estate, starting with as little as $5,000. A lot higher than the last two account minimums, but comes with a proven historical rate of return, so your money is safe here.

3. Best for High Dividends: Streitwise

Streitwise is a real estate investment company that enables investors of all wealth levels the ability to own a portion of commercial real estate through an equity REIT. With Streitwise you can now access a professionally-managed, tax-advantaged portfolio of real estate assets with over four years of 8%+ returns and earn passive income.

Streitwise allows anyone (accredited or not) to easily invest in commercial real estate normally not available to regular investors. The minimum investment required is $5,000, similar to EquityMultiple. They have really simple fees of only a 2% annual management fee.

4. Best for Commercial Real Estate: CrowdStreet

CrowdStreet is one of the best real estate sites if you want access to institutional-grade commercial properties across North America. You can tap into pools of capital that provide direct access to real estate projects that are backed up by mortgages on the properties. Or you can use them to get connected with project developers and invest in unique projects.

You'll need a cool $25,000 to get started and be an accredited investor. Even so, thousands of investors have used the CrowdStreet Marketplace to invest more than $1 billion across hundreds of deals, earning millions in distributions.

5. Best for Farmland: FarmTogether

FarmTogether enables accredited investors and institutions to invest directly in high-quality farmland assets vetted by rigorous, institutional due diligence and active asset management.

A minimum investment of $15,000 is required and you can diversify with an asset with an average 13.0% annual return. Offerings are curated by an expert team with cross-industry experience across farmland investing, agriculture, and tech demonstrated by $1.2B+ of collective capital deployed.

Whether you’re looking to diversify your assets, hedge against inflation, generate income, or invest in an asset whose value is underpinned by its’ crucial role in the global economy — farmland offers an increasingly compelling investment opportunity.

- Rating: ★★★★★

- Minimum Investment: $15,000

- Fees: 1-2% asset management fee

6. Best for Public Nontraded REITs: RealtyMogul

RealtyMogul is a solid real estate investment opportunity for anyone seeking diversification among public non-traded REITs. You can diversify with thoroughly vetted commercial real estate with the potential to generate income and grow in value.

What's more is that you can get access to private market offerings, invest in private placements and REITS, and gain exposure to more deals. With a minimum investment of $5,000 and fees that vary based on investment type, RealtyMogul is worth a look.

7. Best for Entry-Level Investors: DiversyFund

DiversyFund of the best real estate investing apps that's available for entry-level investors. Non-accredited investors can use it to buy properties using the app or through the website with a minimum investment of $500.

You can also benefit from no management fees and no transaction fees. Plus, DiversyFund is well-known for its high double-digit returns and is best suited for long-term investors.

Their growth REIT pays out once the properties are sold, and all dividends are reinvested. It's a great option if you want to make money in real estate and have your money make you money.

8. Best for Real Estate Notes: Groundfloor

Groundfloor offers short-term, high-yield real estate debt investments to the general public. They believe that everyone should have the freedom to invest on their own terms.

Getting started is easy with a low $10 minimum investment and no investor fees to worry about. Once signed up, you can build your own portfolio of short term, high yield, real estate debt investments based on your own personal risk/reward profile.

Debt products inherently carry less risk, which is why they've been able to generate consistent 10%+ returns for its investors over the past six years, with repayments received in 6-9 months on average.

9. Alternative for Farmland Investing: AcreTrader

AcreTrader is a great investment opportunity for land and farm investors who want to buy and sell parcels of farmland. There’s no subscription fee and you can even track the entire market in real-time. It’s free to list your properties here as well, so it’s definitely an app worth checking out if you want easy access to farmland across North America.

A minimum investment of $15,000 to $25,000 is required and you can diversify with an asset with an average 11.0% annual return. Alongside a rapidly growing global population and demand for food, farmland offers a truly diversified investment opportunity with attractive long-term returns.

- Rating: ★★★★★

- Minimum Investment: $15k – $25k

- Fees: 0.75% and 1% per year based on asset value

How to Make Money with Real Estate Investing

If you're trying to build your net worth then you likely have considered using real estate crowdfunding platforms.

These investment options let non-accredited investors and accredited investors invest in real estate investment trusts, single-family homes, apartment complexes, commercial retail, and eREITs with the expectation of capital appreciation.

The supplemental income can be a great asset to diversify your investment portfolio for long-term growth.

Once you have a list of the best real estate apps in your pocket, it’s time to make some money with these investment opportunities.

If you're a beginner, start investing with crowdfunding sites for non-accredited investors such as GROUNDFLOOR, Fundrise or HappyNest. These are great for new investors who want an easy way to diversify their portfolios without having a lot of capital and can get started with only $10.

Invest in blue-chip properties if you're trying to secure larger yields from real estate investments. Consider going straight into buying prime properties that require a higher minimum investment such as EquityMultiple or RealtyMogul.

Just get started and start collecting dividends from these high dividend-paying options like Streitwise. There are many real estate apps that offer high dividends, so find the one that works best for you and start collecting cash flow right away.

If you ask your financial advisor, they'll likely greenlight real estate investing but always be sure to do your own due diligence.

Real Estate Investments FAQs

The best apps for real estate investment include:

Best for Real Estate Notes: Groundfloor

Best for Entry-Level Investors: DiversyFund

Best for Low Minimum Investment: Arrived Homes

Best for Diversification: EquityMultiple

Best for High Dividends: Streitwise

Best for Commercial Real Estate: CrowdStreet

Best for Farmland: AcreTrader

Best Public Nontraded REITs: RealtyMogul

Real estate investors can avoid hiring real estate agents or dealing with messy rental property fixes by using these apps. Real estate deals are just a click away by using a real estate crowdfunding platform.

If you're a beginner, start investing with crowdfunding sites for non-accredited investors such as GROUNDFLOOR, Fundrise or HappyNest. These are great for new investors who want an easy way to diversify their portfolios without having a lot of capital. Using a real estate app that aligns with your goals and investment strategy and timeline should be an important aspect of your due diligence process.

There are a ton of investment strategies and ways to make money in the real estate market. Whether you run a real estate business, manage property listings or a commercial property, buy and flip foreclosed properties, flipping houses, or manage new rental properties.

Even the most novice investor or retail investors can get started through mobile apps that offer investment opportunities in the real estate industry.

If you are reading this article, then it probably means you are either working actively towards investing money into real estate.

It’s smart to learn about how to invest and not spend this money on investments that won't bring the desired return or make you money daily. The reason is that investing any amount of money will not guarantee financial security unless the money is invested in ways that allow it to compound.

Therefore, if you're looking to invest a large amount of money into real estate, you may want to consider using the following resources:

How to Invest $10,000

Ways To Invest $25,000

Ways To Invest $50,000

Ways to Invest $200,000

Ways to Invest $100,000

How to Invest $500,000

Invest in Real Estate Now

If you’re looking for the best real estate apps to invest in, then you need to check out these nine real estate crowdfunding platforms.

They can be used across North America and Europe so you have a wide variety of properties to choose from.

Just remember that not all of them require minimum investments, so you can diversify your portfolio with just a few dollars if needed. With this kind of access at the tip of your fingers, what more could a real estate investor want?

Have I missed any great real estate investing apps or other favorite resources? Let me know in the comments section below!

Now you know about the best real estate investing apps that can help you get started with your investments!

For more traditional ways to invest in real estate, you can see our post here: How to Invest in Real Estate: 5 Ways to Get Started

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.