Online banks offer higher interest rates than brick-and-mortar banks. This means that stashing cash in an online savings account now pays off because they have fewer overhead costs. Since online banks are vying for to be your new online bank, they tend to offer higher yields.

Banking online is safe, FDIC insured and is a great way to earn interest on your money as it is protected. But which online banks offer the best savings accounts in 2024?

CIT Platinum Savings is a high-interest savings account from CIT Bank. It offers one of the highest APYs on the market. The account has two tiers: a low tier of 0.25% APY and an upper tier of 5.00% APY. To qualify for the upper tier, you must maintain a minimum balance of $5,000.

Best Online Savings Account Overview

If you’re looking into savings accounts, we’ve got a list of the top earning accounts from various financial institutions. These savings accounts make it so it actually pays to stash your cash. We rated these based on whether they have any monthly service fees, minimum balance requirements, and whether they offer high yield online savings.

| Savings account | Best for |

|---|---|

| CIT Bank | Best Overall |

| Current | No hidden fees |

| Aspiration | Conscious consumers |

| Axos | ATM access |

| Chime | Automatic savings |

| SoFi | Learning to save |

CIT Bank: Best overall

CIT Bank operates as a proud division of First Citizens Bank, which stands tall as the 32nd-largest bank in the United States. With a specialization in digital personal banking, CIT Bank streamlines the process of online savings, ensuring a user-friendly experience.

They've garnered a reputation for offering competitive APYs, and a significant advantage is that they don't impose monthly maintenance fees on their customers.

One of the most appealing features of the CIT Platinum Savings is its potential to earn an impressive APY of up to 5.00% for balances that exceed $5,000. Depositors can find peace of mind with this account, as it's FDIC-insured, guaranteeing protection for deposits up to the maximum legal limit.

Moreover, the bank has received a slew of positive reviews, with many customers commenting on its seamless user interface and commendable customer service. To get started, all that's needed is a minimum opening deposit of $100.

Adding to its allure, the CIT Platinum Savings doesn't burden customers with monthly fees. It offers unlimited transfers and withdrawals, granting users full control and flexibility over their funds.

Plus, with 24/7 access, banking convenience is just a click away. For those seeking to amplify their interest earnings while enjoying ease of access and peace of mind, CIT Bank's Platinum Savings emerges as a top contender.

CIT Platinum Savings is a high-interest savings account from CIT Bank. It offers one of the highest APYs on the market. The account has two tiers: a low tier of 0.25% APY and an upper tier of 5.00% APY. To qualify for the upper tier, you must maintain a minimum balance of $5,000.

Current is a neobank that works differently than traditional savings accounts, far from it actually since it offers a hybrid checking/savings account. What separates Current from other banks is that it offers 4% interest on its savings “pods” for balances up to $6,000.

Savings Pods are a way to save for whatever you want, whether that’s a rainy day fund, a vacation, or even monthly expenses like groceries. Current has different savings pods where you can deposit $2,000 in each earn to earn up to $240 in interest over the year.

This is a significant increase from the traditional 0.07% offered by most traditional banks. In addition, there are no fees associated with Current’s savings account. This makes it an ideal option for those looking to save money.

Current also has a slew of other features, such as a debit card that offers cash back, overdraft protection, a debit card for kids, getting paid 2 days early, and a cash advance feature.

Aspiration: Best for conscious consumers

Aspiration is best for conscious consumers as Aspiration is one of the best socially responsible companies. Aspiration's most distinct characteristic is its emphasis on social awareness. Aspiration collects each enabled debit swipe and disburses the funds to reforestation initiatives. Aspiration donates 10% of its profits to charities chosen by the customers annually. They are also fully FDIC insured so your money is safe with them.

Aspiration currently offers an interest rate on its Aspiration Plus account of 5.00% annual percentage yield. Conscience Coalition members earn up to 10% cash back on their purchases with no ceiling on how much money they may make. With no hidden costs, you'll receive all of these benefits.

If you want to upgrade to Aspiration Plus, you'll have to pay a $7.99 monthly fee (or $5.99 per month if you pay annually).

If you want to avoid paying any fees, Aspiration offers a fee-free, 3.00% annual percentage yield interest Spend & Save plan.

Axos: Best for ATM access

Most experts recommend Axos Bank’s High Yield Savings, where you can earn a very impressive .61% annual percentage yield which is an APY that’s 6X the national average. Comes with zero monthly maintenance fees and zero minimum balance requirements.

On a $10,000 balance, you’ll earn $61 annually compared to just $10 (national average).

For 20 years, Axos has been a leader in digital banking. And as an FDIC-insured, publicly traded company with offices and employees across the US, they have the foundation to support you and stay ahead of your evolving financial needs.

Chime: Best for automatic savings

I'm a fan of Chime because you can get started saving without having to think about it, with no monthly or service expenses and no minimum balance requirement. Chime also fully integrates its checking and savings accounts. A Chime Checking Account is required to be eligible for a Savings Account.

Chime provides a free account when you join through it (there's no initial deposit or minimum balance required). You'll get a Visa debit card with your checking account.

Every time you make a purchase or pay a bill using your card, the transaction will be rounded up to the next dollar and the extra amount added straight to your savings account. You may also have up to 10% of your monthly income transferred to your savings account, and you'll get 11x the national average!

Chime has increased their Annual Percentage Yield and is now offering 1.50% APY¹ on your Savings Account. That’s 11x2 the national average!

You'll be enrolled in one of the high-yielding accounts working to ensure that your savings plan gets a boost.

¹The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of August 25th, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

2 The average national savings account interest rate of 0.13% is determined by FDIC as of August 15, 2022 based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Visit National Rates and Rate Caps to learn more.

SoFi: Best for learning to save

The SoFi account is one of the best online checking and savings accounts out there. You can be among the first to get a 1.25% annual percentage yield on checking and savings.

Only when you sign up for SoFi Bank today will you get advanced access to 2.00% APY. Plus, pay no account or overdraft fees, get a 2-day-early-paycheck, and more.

If the higher APY isn’t enough, there are also no monthly fees or account opening fees. This account has it all: you can deposit checks, get real-time alerts, freeze or unfreeze your card, change your pin, and more.

Plus, being a SoFi member gives you access to a team of financial experts that can assist with a wide range of needs. You're also eligible for up to a $25 bonus when you sign up for a SoFi Checking & Savings account and deposit at least $10.

Banks with 5% Interest Savings Accounts

“A penny saved is a penny earned,” or so the saying goes. But when it comes to choosing a savings account that will make the most of your pennies, nickels, and dimes, reading the fine print makes a huge difference. The higher interest rate you can find, the more your savings will accrue to build wealth over time.

If you’re looking into savings accounts, we’ve got a list of the top earning accounts from various financial institutions. Some offer better interest rates than others, but they’re all above 5%. And with that kind of interest rate, the pennies you save today could easily grow into dollars down the road.

Ready to start saving big? Here are seven high-yield savings accounts you should consider that offer a 5% interest rate (or more).

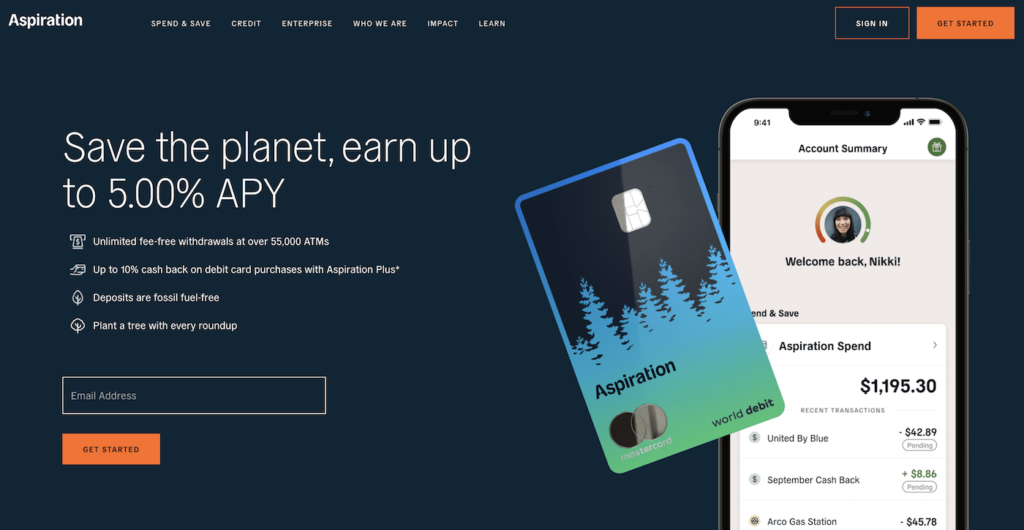

Aspiration

As mentioned earlier, Aspiration puts your savings to work as more than just rainy day money. In fact, you can choose to “plant a climate change-fighting tree with every purchase you make” if you open an Aspiration account. However, you don’t need to have a checking account established to open a savings account.

In fact, all you need to open an account is to be 18 years or older and a U.S. citizen or permanent resident and have a valid email address. Aspiration will perform a soft credit check to verify your identity, so you will need your social security number as well as a government issued ID. A minimum of $10 is also required to fund the savings account.

There are two different types of savings accounts at Aspiration: Basic and Plus. The basic savings account allows you to pay what is fair, which can be $0 per month if you choose. You will earn 3% APY on the first $10,000 you save, but the real savings begin with the Plus account.

With the Aspiration Plus account, you unlock the 5% interest rate that puts this financial institution at the top of our list. For $7.99 per month, you’ll also have access to 10% cash back on Conscience Coalition purchases from businesses that prioritize sustainability. If you do have an Aspiration checking account (called Spend), there’s no limit to how many transfers you can schedule between your checking and savings. Without a Spend account, however, you’re limited to one outside bank account transfer per day.

As a bonus, if you open a new Spend & Save account (both checking and savings) and choose the Plus savings account, you’ll receive $200 free if you spend $1,000 within the first 60 days. Opting for the basic savings plan will still get you a reward of $150 for the same stipulations.

Though you do have to pay $8 per month in order to access the 5% interest rate, the money you could be saving may balance that fee out.

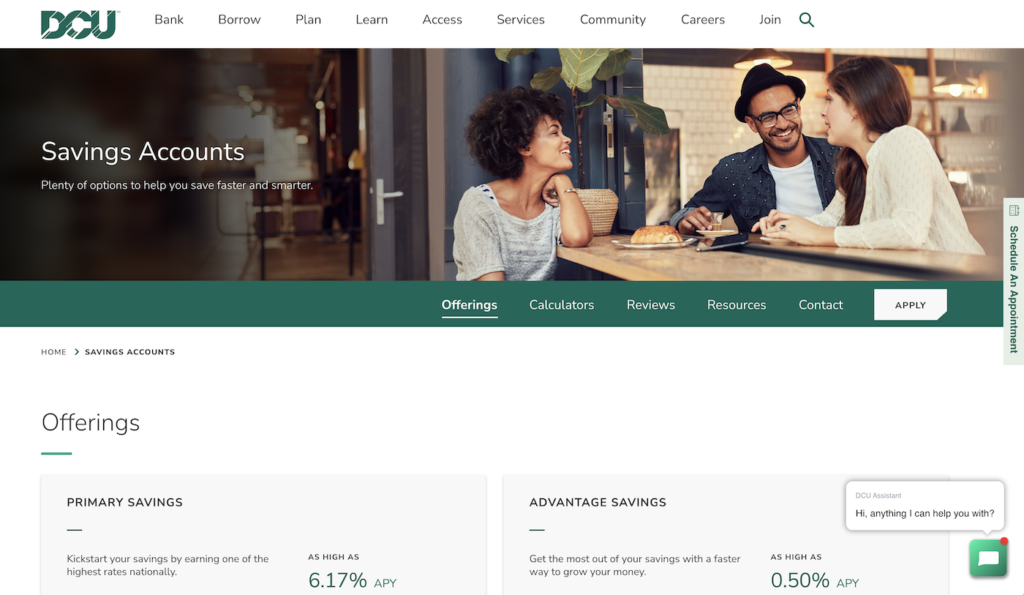

Digital Federal Credit Union

The folks at Digital Federal Credit Union offer a variety of savings accounts for various occasions. From saving for the holidays to choosing your own reason, there are plenty of opportunities to stow away your money for the right occasion.

Opening an account at Digital Federal Credit Union requires the basics, such as a government issued ID, proof of address, your social security card, funding information, and, of course, an age over 18 years. The process takes about five minutes total and can be done online.

While the Advantage Savings Account offers no minimum balance to open and no monthly fees, you’ll only earn 0.50% APY. The dividends are compounded on a monthly basis, but it’s with the Primary Savings Account that you’ll earn up to 6.17% APY on balances up to $1,000. For that account, you’ll need $5, but you won’t pay a monthly fee.

With a Digital Federal Credit Union Primary savings account, you will only earn a high percentage on the first $1,000 you deposit, but you won’t be cutting into those savings with a monthly fee. Plus, they offer many other financial services if you’re looking to keep your transactions within the same institution.

Blue Federal Credit Union

If you’re looking for a straightforward savings account that makes squirreling away money an easy task, look no further than Blue Federal Credit Union. This particular financial institution works off a tiered system, offering 5% interest on the first $1,000 saved. After that, the tiered APY ranges from 1.8% to 0.15%. Plus, you won’t have to fulfill any requirements in order to earn this 5% APY.

In fact, all you need to open an account at Blue Federal Credit Union is $5 and the typical slew of personal information. An email address begins the process, along with an ID, social security number, and an answer to the decision whether you want to add a joint owner or not.

One of the best things about a savings account at Blue Federal Credit Union is that you can make deposits and withdrawals at any time. With the tiered structure, you do have the ability to earn a respectable APY on your balances.

While there aren’t necessarily any other perks to the Blue savings account, there are a few other types of savings accounts you can open as well. Check out more of Blue Federal Credit Union’s savings accounts to see how much you can earn for your savings.

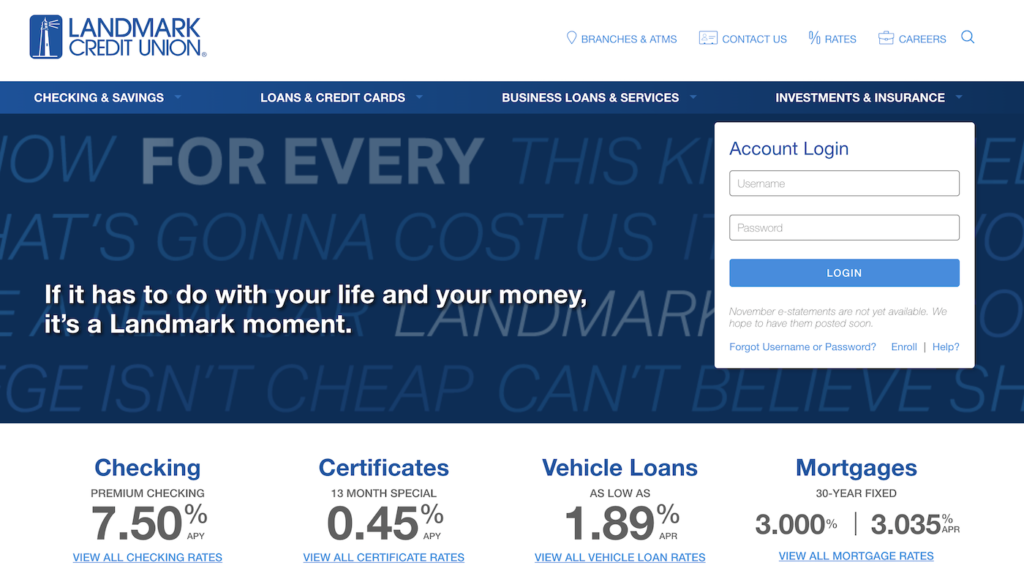

Landmark Credit Union

Like many other savings accounts on our list, this one from Landmark Credit Union requires a minimum $5 balance to open. You’ll also need an ID, social security number, and a few other bits of personal information.

However, Landmark Credit Union does not charge monthly fees for their savings accounts. The entry-level savings account is called VIP savings and will only earn you 0.10% APY on your balance. If you choose the Signature Money Market savings account, however, you’ll gain access to an interest rate of up to 0.04%. You can also open a premium checking account that offers a 7.50% APY.

Unfortunately, though you only need $5 to begin an account, you will only start earning interest on a $25 balance. That does force you to put a bit more into the pot, but it can increase your savings over time.

Mango Money

Mango Money might sound like a funny name for a bank, but they’re serious about offering a high interest rate on your savings balance. There are some caveats to earning such a high APY, one of which includes the fact that you must be a Mango Cardholder in order to open a savings account.

To be a Mango Cardholder, you’ll have to join the Mango Money family. This doesn’t mean signing up for another credit card though. In fact, the Mango card is actually a prepaid Mastercard that’s meant more to act as a way to limit your spending than anything else.

Once you become a Mango Cardholder, you must deposit $25 in order to begin your savings account. You’ll receive up to six transfers out each month, and there’s one stipulation. In order to earn the high APY of 6%, you’ll have to make purchases of $1,500 or more per month. If you don’t spend $1,500 per month but spend more than $750, you’ll earn 2% APY on your balance.

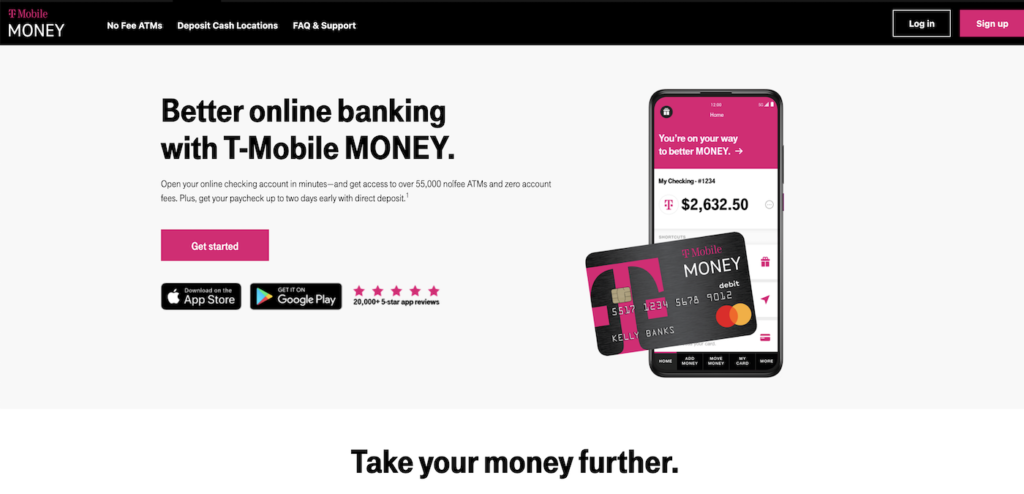

T-Mobile Money

You may think of them as only a cell phone company, but T-Mobile does offer more. In fact, you can open an online checking account with them. Though it might not be a traditional savings account, it can still save you money.

Signing up for a T-Mobile Money account takes just a few minutes. You’ll gain access to over 55,000 free ATMs and won’t pay any account fees. Plus, you can get your paycheck 2 days early with direct deposit and T-Mobile covers you up to $50 in overdraft protection.

Everyone earns 1% APY on all balances, but in order to earn high interest on your balance, you’ll have to make at least 10 qualifying purchases per month. Then, you’ll earn up to 4% APY on balances up to $3,000 and 1% APY on all balances after that.

NetSpend

If you aren’t already a part of the NetSpend family, you’ll have to join in order to take advantage of their savings accounts’ perks. Opening an account requires no minimum balance and no credit check, plus there’s no activation fee either.

In order to earn the 5% APY available, your average daily balance must be $1,000 or more. If it’s over $1,000, you’ll earn 5% APY on the first $1,000 and 0.50% on the remaining balance.

NetSpend allows you to transfer money to and from your checking and savings accounts for free. However, you can only make up to six transfers per month. You can also sign up for Autosave to automate your savings.

FAQs

Yes! The seven institutions we’ve listed above all pay 5% APY on their savings accounts. You can also check with your existing bank to see if they offer a savings account with a 5% interest rate.

Mango Money offers 6% APY on their savings accounts. In comparison, this rate is much higher than offered at traditional banks like Goldman Sachs, Bank of America, American Express, Citibank, Axos Bank, Ally Bank, Vio Bank, Synchrony Bank, CIT Bank, Barclays Bank, and other traditional brick and mortar banks.

If you’re looking for the highest interest rate, Mango Money is the bank you’ll want to contact. There are other ways to obtain high interest on your money, including many investment opportunities.

A high-yield savings account is an interest-bearing account that typically pays a better rate of return than a traditional savings account. Although the exact amount varies, the national average of high yield savings accounts generally offer an annual percentage yield (APY) between 0.04%. These banks listed on this post all offer 5% or more which is rare.

What to Look for in a Savings Account

As you compare savings accounts, look beyond just the interest rate to consider the following factors.

Interest rate and APY

Savings accounts can easily be distinguished by the annual percentage yield (APY), which is often expressed as an interest rate. For example, our list of seven savings accounts all have an annual percentage yield of 5%, which means you’ll earn 5% interest on your balance over a year’s time.

As you can imagine, a higher APY interest rate will do more to compound your savings over time. Earning 5% APY may not seem like much, but it’s better than not earning interest on your money at all. This is especially true for money that’s stashed away and/or not invested.

Initial deposit

Very rarely will you find a savings account that doesn't require some sort of minimum deposit requirement. That being said, there are plenty of savings accounts out there that keep the bar low, at anywhere between $10-25. Most banks will require an opening deposit at the time of the opening of your account, so make sure to budget for that up front.

Minimum balance requirements

Along with an initial investment, many banks require you to hold a certain minimum balance within the account. Dipping below this number may not have any short-term effects if you’re able to restore that balance, but be sure to read the fine print, especially if you’re saving in a low-income household.

Account fees

Saving on bank fees can be a great way to not only improve your budget but add to your savings balance as well. Savings accounts can incur account fees for particular actions, such as transferring money more often than is allowed for free. As you look at savings accounts, investigate potential cases for these account fees and any monthly maintenance fees and keep them in mind if you do sign up.

Rate tiers

Saving money is all about building up that balance. But if you’ve got a sizable deposit to make, some banks will reward you differently for a larger balance. Typically, banks will structure APYs into a tiered system, which pays more or less depending on how much you’ve put into the account.

Accessibility and ease of use

Building an emergency fund with a savings account doesn’t always mean you have to go into a brick-and-mortar bank to open an account. In fact, there are plenty of online savings accounts available. While opening a savings account at an institution you’re already a member of could allow you to exchange money between your checking and savings accounts, having a dedicated online savings account could streamline your savings plan, too.

FDIC insured

The Federal Deposit Insurance Corporation (FDIC) is a government agency that was created in 1933 to protect consumers' money in case of a bank failure. The FDIC insures deposits up to $250,000 per depositor, per bank.

Deposits are a key part of the U.S. financial system, and they are one of the most important ways that consumers can protect their money.

When you deposit your money in a bank, that money is insured by the FDIC. This means that if the bank fails, your money is still safe and you will get it back.

How to Open an Online Savings Account

You'll need some basic information to open an online savings account. If you'll have a co-owner on the account, you'll need their information too. Typically, you'll need to provide your name, current address, other recent addresses if you've moved recently, and your Social Security number.

When you are ready to open an online savings account, make sure you make sure the online savings account has the features most people utilize.

What are the benefits of online banking?

The Benefits of The Best Online Savings Accounts

Opening a savings account excites most consumers about as much as collecting the $100 for ‘Passing Go' in a game of Monopoly. You sink some cash into a high-interest savings account that you will not touch until the proverbial rainy day. If you live in Phoenix, your savings account remains untouched for most of the year (haha). On the other hand, rainy days abound for the Seattle savings account holders.

A savings account sounds like a bland way to stash away money, but you can spice up your finances by considering six features that define the best high-interest savings accounts.

Take an interest in interst rates

Consumer Federation recently released a report that stated only four percent of the United States based banks pay interest on savings accounts of more than 0.25. Money market accounts pay higher interest rates, but you have to carry a much higher minimum balance and pay more in transaction and account maintenance fees. Shopping for the best basic savings account rates involves researching what banks pay interest for customers who open online accounts.

Many banks, such as Axos offer online savings accounts that pay nearly .61% APY (some of the highest rates in the nation). You will never get rich by opening a savings account, but you still want your hard-earned cash to work for you in the form of the best interest rate.

Automatic deposits

When you accept a new job, one part of the new employee orientation involves completing a form that dictates how you want your paycheck deposited. We all want a large chunk of our pay to go directly into a checking account. Yet, the best savings accounts like Aspiration offer a feature that allows for an automatic deposit.

There's a good chance your bank is using your money to fund oil projects that destroy the climate. Put your money where your values are. Join Aspiration today.

“Most people don’t have the time or discipline to make regular contributions to savings on their own,” said Steve Brobeck, executive director of the Consumer Federation of America. Choose a bank that transfers a set percentage of your pay each week to your bank account. Even better, some banks make automatic transfers from checking to savings accounts one time per month.

Low monthly fees

Savings accounts should not cost banks much money to maintain. After all, the transaction activity for a typical savings account amounts to nothing more than regularly scheduled automatic deposits. However, banks like to collect fees on anything, from withdrawing too much from a checking account to sneezing while you wait in line to make a money market transaction.

Savings account fees vary, depending on the type of account and the average monthly balance of the account. Consider a bank that charges less than $2 per month in savings account fees and avoids banks that charge a minimum monthly balance fee.

Acess to cash

Liquidity, that often thrown around financial term, has relevance for savings account holders. You want to have instant access to your savings account cash via online transfers and withdrawals from ATMs. You might need a substantial amount of money for an emergency that your checking account does not cover. A federal banking law allows only six savings account withdrawals per month. Some banks permit less than six savings account withdrawals a month and on top of that, the banks add transaction fees to give you access to your money.

Deposit insurance

Savings account deposit insurance is a no-brainer, yet many millennials forget to check a bank’s policy on protecting hard-earned cash. Federal deposit insurance protects savings account balances up to $250,000. Some of the highest interest paying banks have acquired Federal Deposit Insurance Corporation (FDIC) protection for savings account holders. This means you do not sacrifice savings account interest yields for gaining a peace of mind.

Open an account online

It is not just the convenience of opening an online savings account. A growing number of banks offer free online banking tools that help millennials learn how to save money. To recap these are some of the best online savings accounts that you can compare:

What advice would you give to a beginner who wants to start budgeting and improving their money management skills?