With people losing jobs due to the recession, learning how to drastically cut expenses is vital. This usually means learning new ways to live cheap and frugally so that you can save more money each month.

The concept of cheap living doesn't mean living like a hermit and not having any fun in life. Because I get it, I want to enjoy life to the fullest but I like to avoid overspending on purchases and get good deals. So, what do I resort to? Cheap living, of course.

By finding unique ways to save, I can live frugally, while still enjoying life and having more money in my pocket. I try to beat the personal savings rate among Americans by living this way. In June 2020, the personal saving rate in the U.S. amounted to 7.8 percent according to Statistica.

I find it easy to do, as there are many different ways of getting paid to save or saving money on electricity and even on credit card bills so anyone can drastically cut expenses. And there’s no way to think that as you pay less, you’ll also get less. Often, you can still get the same services and buy the same products.

Don't believe me? Here are 30 frugal tips to reduce your daily expenses and save money.

Cutting Everyday Expenses

1. Save on bank fees

The first step if you want to learn how to cut expenses drastically is to save money on outrageous bank fees. Many large financial institutions charge monthly maintenance fees that are usually between $7 to $12. So, talk to your bank about this to see if they offer a fee-free account or learn about the requirements to avoid the monthly checking account fees.

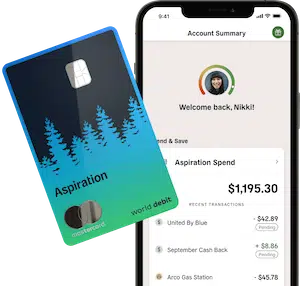

If they don’t cooperate with you, it's time to switch to a better bank like Aspiration. This fee-free checking account pays up to 5% cash back and up to 11x average interest rate.

It's smart to opt for a bank with better security and fewer bank charges. Once you cut the bank fee expenses, you'll be saving more money each month and can focus on building your savings and getting high interest on your saved funds.

There's a good chance your bank is using your money to fund oil projects that destroy the climate. Put your money where your values are. Join Aspiration today.

2. Buy used electronics

Electronics items are one of the most consumable goods that can add up. We always buy new, latest electronics goods, gadgets, phones, etc without thinking about their prices.

This habit should be stopped and we should try to buy old electronic goods, in working condition. Secondhand, working condition goods can be much cheaper than brand new products.

Gazelle is a website that buys and sells used smartphones and other devices, try it once and see if you can save some dollars.

3. Leave your family $1M

Who doesn't want to be a millionaire?

While we don't all have trust funds waiting for us, there is still a way to provide protection for your loved ones with up to $1 million in term life insurance.

Wouldn’t it be great if you could do this for as little as $8 a month without dealing with all the hassle of wasting your time or money?

You don't have to have money in your pockets to get a free quote from the best life insurance companies:

|

Primary Rating:

4.9

|

|

Pros:

|

4. Get cheaper renters or homeowners insurance

Many people don’t bother looking into the cheapest and best renters insurance because they think it’s too expensive. But this couldn’t be further from the truth. In fact, renter’s insurance and homeowners' insurance is very affordable.

According to the Independent Insurance Agents & Brokers of America, you can obtain $30,000 of property coverage and $100,000 of liability coverage for just $12 a month. That’s less than many pay for a movie ticket. Some companies have even more competitive prices, you can protect your stuff for as little as $5/month with Lemonade Insurance, for example.

Lemonade Insurance offers a new approach to renters, condo and home insurance. They even give back up to 40% of unclaimed money to the nonprofit of your choosing.

5. Build an emergency fund

This is the major money move no one wants to talk about, but absolutely should. Having money in the bank for emergencies can help you improve your financial standing. You’ll want three to six months’ worth of expenses in your emergency fund or find ways to make quick money.

Either way, be sure to stash your money in the right savings account that’ll grow your money. Start with an online savings account like Aspiration that will pay a great APY and still give you instant access to your money in case of an emergency. You can open an account and they'll even give you a $150 welcome bonus.

For Rocket Money to lower your bill, you'll upload a copy of your most recent bill with one of the service providers or connect directly to your online account. Then, you'll provide information about the service you're already receiving. After that, Rocket Money will negotiate a lower rate for you.

7. Get yourself a roommate

Another critical way to cut expenses is by having a tenant who can share the costs with you. If you live in an apartment or even rented a house with a bigger space, look for a roommate who can share costs with you and also help you to maintain the place.

Sharing the expenses will be much helpful for you to lower the overall monthly housing costs and is a great way to cut on monthly expenses. According to a report on SmartAsset, roommates save on average $1,056 per month each, or about $12,600 per year each. This means that together two roommates have a combined savings of more than $25,000 annually (depending on the state).

8. Claim free stocks

While learning how to drastically cut expenses, why not increase your net worth with a free stock?

Robinhood is a free investing app for your phone. I really mean free all around – free to join and they don’t charge any fees to buy or sell the stock.

Better yet, if you join through this link you can get a free stock like Apple, Ford, or Sprint when you join (must complete signup).

The value of the free share may be anywhere between $2.50 and $225 and fluctuates based on market movements. You’ve got nothing to lose.

Robinhood is a free-trading app that allows you to trade stocks, crypto, and more without paying commissions. Plus, they'll give you a free stock worth between $5 and $200 for joining.

9. Go with one car

Your car is the most expensive item after your home. According to Consumer Expenditures in 2019 by the U.S. Department of Labor's U.S. Bureau of Labor Statistics, the average vehicle costs $9,576 per year to own and operate. That's a whole lot of money spent on maintaining an extra vehicle that you may not need.

Today, most of the average housing families maintain two or more cars. But if you have one car and planning to buy another one, think again.

It is better if you carry on with only one car, if possible. More than one car means, more fuel expense, more repair and paint job costs, more cost on car insurance, and several others. So, pick one of your dream cars and stick to it and maintain that car well every year.

10. Earning extra cash is important too

Some people love saving money but enjoy making money even more. This opportunity is for those who want to cut expenses but also want to earn extra cash for savings. Here's how it works: by using the internet as you do every day, Nielsen invites you to make a difference – and you can really earn some cash.

Here's how: Just by downloading the company's app — you can collect $50. The app will just track your app usage to help them understand consumers. This company has been around since 1923 (they're the company that tracks TV ratings) and now they want to learn more about the modern consumer.

You don’t have to do anything other than initially register your computer or phone.

To qualify you must live in the U.S. be between 18 and 45 years of age. All you do is download the app and earn $50 a year per device. If you want to be a pro at maximizing your income, here's an opportunity for you that literally requires zero effort.

By participating in Nielsen research, you can improve products and services you use online today. Nielsen Computer and Mobile Panel combines your unique internet usage with people like you to build a picture of internet behavior.

11. Avoid unnecessary shopping

Shopping is necessary when you are doing it with a purpose. But if you tend to buy unnecessary items, it’ll push you towards overspending. You’ll start window shopping, or surfing online stores with nothing particular in mind.

You’ll surely buy items that you don’t require. That is a very dangerous thing to do.

To stop this obsession, you need to stop carrying your credit cards and keep limited cash in your wallet.

12. Get cash back for every purchase you make

You'd be silly not to get cash back for items you would have bought anyway. You can do this by shopping online with a cash back site like Rakuten. Even if you are not a big shopper, when you do shop online, you obviously want to find the best deals. Rakuten is an excellent way to get paid for shopping online through their cash back portal.

Every time you are shopping online, simply start at Rakuten so you can start earning cash back on your purchases. That's it, it's pretty simple, and they are conveniently offering a $10 sign up bonus through this link, so act fast.

Rakuten can get you up to 40% cash back at over 2,500 stores. They don't mess around with points, fees, or any forms, just straight up cash back. You can signup and get a $30 bonus today.

13. Get totally free money for scanning receipts

It may be hard to believe, but Ibotta pays you for scanning receipts. No, really, it does.

The grocery cash back app presents you with a list of offers currently available on a wide range of products, from food to drinks all the way through to cleaning products and if you buy them and scan the receipts — you're getting paid.

Here’s how it works:

- Look for a product you were planning on buying, and click on it.

- Select a participating store that you’re buying the item from.

- Upload a picture of your receipt.

- That’s it! Simply sit back and wait for the cash to show up in your PayPal.

Ibotta is free to download. Plus, you’ll get a $10 sign-up bonus after uploading your first receipt.

Ibotta will pay you for going shopping, it's that easy and you can get a $10 bonus after uploading your first receipt.

13. Prepare a list before shopping

In my opinion, this is the best option to save money on shopping. You do not have to avoid credit cards, you do not have to limit carrying cash, just stick to your list and that's it!

When you’re shopping without a list, most of the time you end up overspending money due to impulse buying and unplanned purchases.

Creating a list before going for grocery shopping is especially important. You’ll be able to buy items that fit your meal plan and stop wasting.

15. Visit local library

Another good way to focus on cheap living is to save money by using your library membership. Many libraries offer free movies, TV shows, and audiobooks. Some libraries may offer local attraction passes to their members free.

Most libraries have free Wi-Fi and lots of other facilities for young members.

16. Save on monthly grocery costs

You can easily save money on groceries by using apps or just common sense. The price of groceries may increase day by day. But you can’t avoid buying such items as eggs, milk, cereal, meat, veggies, etc.

How can you feed your family well if you do not buy such items?

In that case, you need to apply some common sense. You should buy seasonal veggies as much as possible, as their availability is good and cost you less.

Try to buy in bulk and freeze them well. The same rules can be applied to egg and milk, but you should always check the expiry dates before buying.

17. Lower your cable bills

Having a cable subscription nowadays is practically a waste of money. Our cellphones have already re-animated the meaning of entertainment worldwide.

Now we search and watch everything on our smartphones. But still, cable companies charge a whole lot whoever uses cable facility.

So, it is best to cancel your cable services and upgrade your cell phone connection package. You’ll notice you are paying less in data services than the amount you paid earlier as cell phone data package and cable services combined.

18. Cook your food at home

This may sound quite funny and absurd., But, if you stop eating out at expensive restaurants and start cooking every meal at home, it will be way cheaper than the other option.

Restaurants may serve you the same food you can prepare, with adding too many surcharges and taxes. Apart from that, there is no guarantee that they will serve you fresh food all the time.

You may try multiple experiments with your food and add ingredients as per your choice. The food will be fresh at home, with no preservatives or harmful coloring.

19. Manage high-interest debts

If you have multiple high-interest debts like credit card debts or payday loans, you may have a hard time managing the monthly payments each month.

That big amount will affect your monthly budget. You may have to arrange an extra amount to adjust all the expenses apart from monthly debt payments.

So, you should look out for suitable debt help solutions that can solve your debt problems once and for all. Once you get rid of high-interest debts, it’ll be easier to save more each month.

20. Use coupons to cut down bills

Before making the payment for any goods or services, make sure you check out your coupons. If you have sufficient coupons with you, you might be getting that item free!

Try different coupon searching websites like RetailMeNot to get various kinds of coupons to help with cheap living. But remember, too much couponing may also generate the risk of overspending.

21. Always maintain records of income and expenses

You need to know where your money is coming from and how much, and also where it is going and how much. For that reason, keeping a record is necessary for everyone. It will provide proof of your hardship and achievements. Many people track it themselves using Excel spreadsheets or free online budgeting apps like Empower.

Plus, keeping a daily and weekly spending record is the first step toward establishing a monthly budget even on a low income.

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

22. Celebrate a “No Spending” week every month

Check out your spending pattern of the previous month, and choose a week to stop any kind of spending.

For that, you need to gather items that you require almost every day. Once you gather all the essentials, lock your credit cards and cash in your locker and hide the keys.

Do not spend a single penny throughout that week.

You’ll notice that this process can help you to save from your monthly budget every time.

23. Invest your pocket change

Another way to learn how to save money is by using micro-investing apps. With apps like Acorns, you’ll start small and stack up change over time with the Acorns “round-up” feature. That means if you spend $15.25 on your connected debit or credit card, for example, 75 cents gets dropped into your Acorns account.

Then the app does the whole investing thing for you. It’s that simple. Now you can brag to your friends, too.

The idea is you won’t miss the digital pocket change — you know, out of sight, out of mind. And those automatic savings stack up faster than you’d think.

The app is free to download on the app store or google play, and the service costs $1 a month for balances under $1 million — plus you’ll get that $10 bonus just for starting out. Or you can sign up with your student email and it’s free.

The sooner you start investing, the sooner your money can start to grow toward your goals.

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

24. Scan your receipts and earn

Yup, it’s true! There are several companies out there that will give you free money just for scanning receipts.

Fetch Rewards is a mobile rewards app that pays you for shopping (from any store).

This is a great way to earn extra spending money, the easy way, and can add up to a large wad of cash with time.

With Fetch, you get rewarded for anything you buy. Snap a receipt to get started. Shop all your favorites & get rewarded on Fetch. Try the free app now. Earn points and redeem.

25. Repair old clothes and use

Don’t toss out your old dresses just because they are old and have broken buttons or minor stitching issues. Repair those clothes with some closely-matched thread and buttons.

If you like, you can add some extra pieces to make them new again.

26. Turn off your television

You may cut down a big amount of money from your monthly expenses once you lower your television usage. There are multiple benefits you may get by doing this.

You’ll see fewer promotional ads, a lower electric bill, and a lower cable bill after downgrading your subscription.

27. Drink water to reduce healthcare bills

Drinking plenty of water will help you to flush out toxins that body releases. Drinking 1 glass full of water before bath helps you to reduce blood pressure. So, it’ll help you to save on healthcare costs.

It also has financial benefits. Drinking a big glass of water before each meal makes you fuller for a long time. As a result, you'll eat less.

28. Avoid addiction for cutting expenses

Do not smoke, do not drink, and absolutely…say NO to drugs!

Smoking causes cancer. Too much drinking causes liver diseases and many other health problems. If you want to add years to your life and save a good amount each day, keep yourself away from this hell.

29. Start building passive income

Arrived is a great real estate investing platform to use if you want a low minimum investment threshold for real estate investing. You can get started with as little as $100!

It’s an especially useful tool to use if you want to diversify your portfolio and have someone else handle all the work that comes with being a landlord. All you really need to do is sign up, and collect your rental income each quarter.

The management fee is a modest 1% asset management fee, but it's worth it considering how easy it is to get started. You can sign up for free and view the different properties available to invest in. Buy shares of properties, earn rental income and appreciation — let Arrived take care of the rest.

Then you can literally beat the stock market year after year and start making money in your sleep. If you want to earn the big bucks then you can learn how to get started by getting more information from Arrived here.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.

30. Use your head before using credit cards

If you have a habit of buying things only using credit cards, it is better that you must keep them in a locker and hide the keys. Do not carry credit cards in your wallet.

The idea is to keep your cards “out of sight and out of mind”. This way you can control your urges and can lower the usage of credit cards.

By reducing credit card usage, you can also put an end to overspending. Once you reduce overspending, you will be able to lower your credit card debt.

31. Use cash for retail buying

Retailers know that consumers normally spend 30% more on shopping if they carry credit cards than cash. So, practically, using hard cash to buy things can save you a lot.

You may not control your impulse buying habit but due to lack of cash, you will have to stop.

32. Save on power bills

Adjust your thermostat heating to save on power bills. Apart from that, use energy-efficient CFLs or LEDs to light up your place. Buy branded, quality electrical appliances that will last longer and give you more savings.

33. Travel frugally to cut expenses

Plan so that you can get as much as a discount on tickets, hotel fare, bus rides, and food. Pick up a location during the off-season, it’ll help you to bargain with hotel fare.

34. Live in a smaller house or tiny home

Just because you can afford a big house, you shouldn’t buy one. Know your requirements, think about the future. Living in a small house or even tiny home can be comfortable.

Choose a house according to your needs, don’t overdo it.

You can save thousands of dollars every year by living in a small house or a tiny home investment. It is because the associated costs with a smaller house are also very low.

Conclusion on How to Drastically Cut Expenses

Never give up! These are some ideas on how to drastically cut expenses so you can save $1,000 or more this month.

Cutting expenses doesn’t mean eating rice and corn every day, using the same clothes throughout the weekend, or using old goods. You can still live a fun and happy life by utilizing smart money-saving tips and thinking creatively.

You can think about a lot more options and can even invest your savings to earn even more. Let me know what you have implemented and how the wheel of saving is spinning. Good luck.