What is the difference between VUG and QQQ?

The main difference between VUG and QQQ is who offers the exchange-traded fund (ETF). Vanguard offers VUG while Invesco offers QQQ. Another significant difference is the number of stocks in each, with VUG having 287 different companies in the index compared to 100 with QQQ.

There are a few key considerations when determining whether to invest in VUG or QQQ. The first is your investment goals. If you're looking for long-term growth, VUG may be a better choice since it offers a broader range of companies. However, if you're looking for more immediate gains, QQQ may be a better pick since it has a higher concentration of tech stocks.

The second consideration is your risk tolerance. Because QQQ is more heavily weighted towards tech stocks, it's considered a more volatile investment. So if you're risk-averse, VUG may be a better choice.

The third consideration is fees. Both VUG and QQQ have low expense ratios, but VUG's is slightly lower at 0.04% compared to 0.20% for QQQ.

When it comes to choosing between VUG and QQQ, there's no clear-cut answer. The best decision depends on your individual investment goals, risk tolerance, and fee considerations.

VUG Overview

Vanguard Growth Index Fund (VUG) is a better choice for long-term growth and has a lower expense ratio. QQQ is more volatile but may be a better pick for more immediate gains.

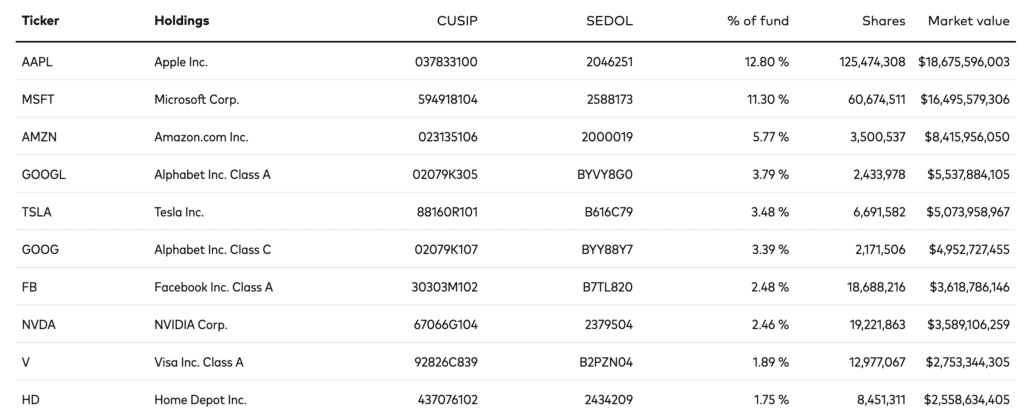

Here are VUG's top holdings:

QQQ Overview

Invesco QQQ Trust (QQQ) is a better choice for those looking for more immediate gains, while VUG is a better pick for long-term growth. When it comes to fees, VUG has a lower expense ratio.

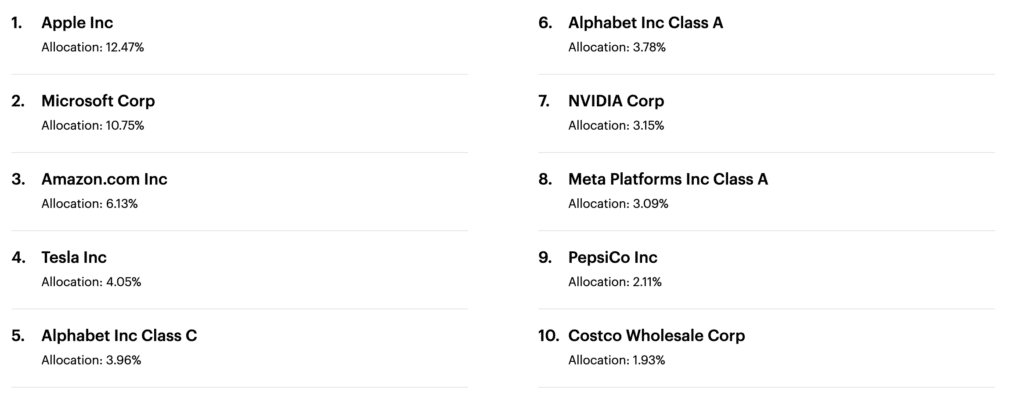

Here are QQQ's top holdings:

VUG vs. QQQ Overview

Some important comparison metrics here are expense ratio, issuer, AUM, and shares outstanding, among others. Furthermore, ADV in the 9th and 10th row, which stands for Average Daily Volume, can help investors avoid illiquid ETFs.

| QQQ | VUG | |

|---|---|---|

| Name | Invesco QQQ Trust | Vanguard Growth ETF |

| ETF Database Category | Large Cap Growth Equities | Large Cap Growth Equities |

| Index | NASDAQ-100 Index | CRSP U.S. Large Cap Growth Index |

| Expense Ratio | 0.20% | 0.04% |

| Issuer | Invesco | Vanguard |

| Structure | UIT | ETF |

| Inception Date | 1999-03-10 | 2004-01-26 |

| AUM | $158B | $68.6B |

| Shares Outstanding | 547M | 300M |

| ADV (1 month) | 66,920,616.0 | 1,405,967.0 |

| ADV (3 month) | 78,008,864.0 | 1,367,932.0 |

| ETF Home Page | View Page | View Page |

What Should I Invest In?

Whether you want to invest 20k or invest 250k — you should do it smartly and confidently.

Besides ETFs like VUG and QQQ, you should also consider adding some mutual funds and index funds to your portfolio, which can be done using a robo-advisor like Betterment.

Index funds.

Investing in index funds is like investing in the stock market without taking on too much risk. The risk of investing in index funds is very minimal yet the benefits are massive. The trick is to diversify your stocks by buying the largest companies through your index fund.

According to Bankrate, the best index funds to own this year are as follows:

- Fidelity ZERO Large Cap Index (FNILX)

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF Trust (SPY)

- iShares Core S&P 500 ETF (IVV)

- Schwab S&P 500 Index Fund (SWPPX)

These index funds track the S&P 500 Index Fund and offer you a way to invest your $50,000 in stocks of the S&P 500 at a low cost, while still enjoying diversification and lower risk.

Mutual funds.

Another way to invest your $50,000 in the stock market is through mutual funds. A mutual fund is an investment vehicle that holds a portfolio of stocks, bonds, or other securities.

Since they hold many different securities, it makes it a very attractive investment option for someone who has $50,000 to invest. Investing your money in a mutual fund instead of individual stocks means you get diversification, convenience and lower costs.

According to Investopedia, the top 5 biggest mutual funds in the stock exchange are:

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- Fidelity 500 Index Fund (FXAIX)

- Vanguard Institutional Index Mutual Fund (VINIX)

- Fidelity Government Cash Reserves (FDRXX)

- Vanguard Federal Money Market Fund (VMFXX)

Some people may wonder how mutual funds are different than index funds? An index fund only seeks market-average returns (safe), while active mutual funds have fund managers that try to outperform the market. This means that the fees for active mutual funds are higher than index funds and less predictable returns.

Invest using a roboadvisor.

These days you probably are seeing ads for a new robo advisor on the daily. The truth is, they keep on popping up left and right.

These robo advisors are helpful for consumers as they provide an automated and logarithm-based advising service and act as a financial advisor providing online financial advice online with little or no human consultation.

Sounds complicated. But they make it easy. Well, some of them like Betterment do.

Betterment provides automatic portfolio management and only charges 0.25% annually. This is very reasonable compared to other robo-advisors management fees, especially since there is no other platform that offers as much value to its customers as Betterment.

Overall, robo-advisors are a smart way to invest any amount of money without much risk. In fact, since 1928, the S&P 500 (a collection of the 500 largest stocks in the U.S.) has averaged roughly 7% in annual returns, even after adjusting for inflation.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.