Times are tough.

This prompted consumers to shift to find ways to find creative ways to save money on groceries, save money at the pump, or even cut Netflix (goodbye Office marathons!) to make ends meet.

It's no secret that money makes the world go around. In fact, research shows that income has a positive relationship with happiness. Having more money is directly proportional to more comfort in life.

Now there are certain monthly expenses that are required such as rent, mortgage, food, and even entertainment. But there are certain expenses that you can cut out so you can save money. Simple enough? But now imagine if you are getting some percent of spent money back in your pockets.

That would be awesome, right?

Well, now you can get cash back on your shopping trips with the help of popular grocery apps, rebate apps, cash back apps, and shopping apps. We’ve compiled the best money saving apps and sorted them into shopping categories, so you can scroll through and start making smart financial moves and get your favorite top-rated savings apps downloaded.

Best Money Saving Apps

In a hurry? Here's the list:

Best Money Saving Grocery Apps

Ready to see the best apps to save money on groceries? All of these best money saving apps and grocery coupon apps are available for both Android and iPhones. You can start extreme couponing without getting overwhelmed with these free apps in order to save more cash each month.

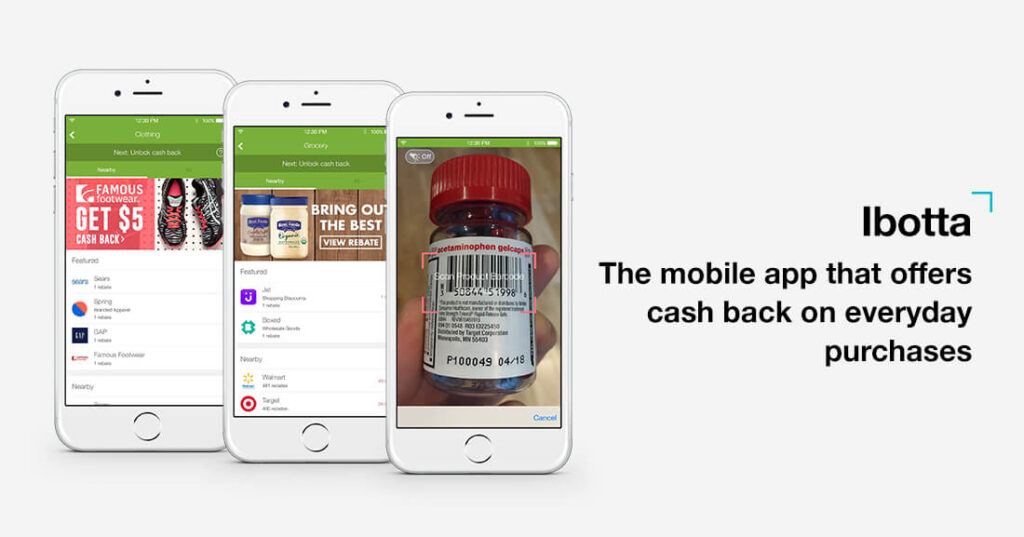

1. Ibotta

Ibotta is straightforward in getting you money back that you earned plus you can earn an extra $10 signup bonus with this Ibotta referral code. You won't need coupons or promo codes here. Before going shopping, search and add the offers of items you are planning to buy on the app. Redeem your offers by taking a photo of your receipt and get cash back.

After a quick successful validation, cashback will be credited to your balance. The process is as simple as that. Several payment options are available like PayPal, Venmo and gift cards. With Ibotta, you can shop at major recognized stores and apps like Walmart, Safeway, CVS, Target, eBay, Uber, and so many more stores. Ibotta is one of our favorite grocery cash back app, a free app that pays you real cash. What's not to love?

Ibotta will pay you for going shopping, it's that easy and you can get a $10 bonus after uploading your first receipt.

2. Checkout 51

Checkout 51 has both a website and an app that gets you cash back on your grocery trips. It's pretty simple to use and works any time at any store. You can check offers from the Checkout 51 website or app to get started. Checkout 51 is very similar to Ibotta's process of browsing deals and saving them, going shopping, then uploading the receipt and getting cash back. It's another

But there are few things to keep in mind while using Checkout 51. The offers are refreshed every Thursday and whatever deals and offers you save, you must redeem and upload your receipt before the following Wednesday night, or else the offers expire. You should note that the payouts start at $20 to get your cash back into your bank account. You can use multiple money saving apps with the same receipt, the savings just add up.

3. Fetch Rewards

Fetch Rewards is probably the most versatile rebate coupon app because you can scan ANY receipt and get rewards. Fetch Rewards makes it easy to save on your everyday grocery purchases by removing the limitations of other apps. No store limitations, no having to clip special offers, no worrying about missing out on savings. All you need to do is snap a picture of your receipt and points will be put into your account. It is that easy.

You can buy in any recognized store, upload the receipt and get points. You can redeem the points for gift cards. As your points accumulate you can redeem them for FREE gift cards to hundreds of popular retailers. You can even cash out your earnings for a virtual Visa or Mastercard. Just remember that you must upload your receipts within 14 days of purchase.

With Fetch, you get rewarded for anything you buy. Snap a receipt to get started. Shop all your favorites & get rewarded on Fetch. Try the free app now. Earn points and redeem.

4. Dosh

Dosh app provides you with updates of the latest coupons, rebates and promo codes applicable at major stores in your area. Along with groceries, you can literally get cash back on everything because the Dosh app connects to your card.

After creating the account, link your debit or credit card with Dosh. Browse through the offers, save them and buy them using Dosh app. Pay with your linked card at 1,000s of stores and restaurants, and get up to 10% cash back automatically in your Dosh Wallet. Once you rack up $30 in rewards, you can cash out. Do what you want. Transfer your cash to bank accounts, PayPal, or donate to charity from the app. Dosh app is available for both IOS and Android.

Best Money Saving Cash Back Apps

All of these best money saving apps and cashback apps are available for both Android and iPhones. If you aren't getting cash back for your purchases then you are wasting money. Plain and simple, you can avoid that by checking out these best money saving cash back apps.

5. Drop

Drop lets you earn cashback points for every purchase made from the app. You'll need to link a debit or credit card to your Drop app to get started. Once that's done, for every time you go shopping at one of the covered stores, you will get reward points.

Shopping can be done in stores or online, but payment must be done within the Drop app in order to get points. The points can be redeemed as gift cards to Amazon, Macy's, Groupon and more!

Drop is the free app that rewards you for shopping at your favorite brands. Join over 4 million members earning millions in cash rewards at Amazon, Netflix, and Starbucks.

6. Shopkick

Shopkick lets you earn free gift cards while shopping at your favorite stores. The reward points earned are referred to as “kicks”. After getting a certain number of kicks, you can redeem them for gift cards to major stores like Amazon, Groupon, Starbucks and many so many more stores.

One way to earn kicks is to go shopping like you usually would and simply scan your receipt to the app. You can also earn kicks with a lot of other methods:

- By viewing online products inside the app

- Walking into their partner stores

- By scanning the barcodes of selected products

- By making online purchases with the app

- By watching videos

- By purchasing online with the linked card

- By visiting online stores

There are gift cards available for specified kicks. Earn more kicks to redeem hundreds of free gift cards.

Best Money Saving Shopping Apps

All of these shopping coupon apps and best money saving apps are available for both Android and iPhones.

7. Receipt Hog

Receipt Hog has more types of rewards compared to other apps. The process is the same. Upload the photo of your shopping receipts and earn rewards. Your rewards can then be redeemed for virtual slot machines, sweepstake prizes, gift cards, and real money via PayPal.

You can earn more by trying out slot machines or can redeem the points with gift cards. Redeeming with PayPal takes around 5 to 7 working days to get deposited to bank accounts.

How to Manage Your Money Better

We all have issues with money from time to time. Sometimes, it feels as though you can never have enough cash, no matter how carefully you save, or how hard you work. It's no wonder then, that when the new year rolls around, many people find themselves making resolutions that have something to do with their financial health.

Whether you simply want to have more control over your financial independence, or there's something in particular that you're hoping to save up for this year, here are our top financial new year's resolutions that you can start planning for today!

Save More Money

Having a savings goal is probably one of the simplest financial new year's resolutions out there. The idea is that instead of spending everything you earn as soon as you get it, you think carefully about how you want to use your cash, and potentially put some of it away for a rainy day. The amount of money that you decide to save will depend on your goals.

For instance, you might decide that you want to put $2,000 aside for a rainy-day fund, or you might want $500 for a new computer.

Decide why you want to save money and what you eventually want to accomplish with the cash that you save, then build your strategy out from there.

Remember, you'll also need to have a basic idea of how much money you bring in each month, and how much you pay out, so you know what you can afford to save.

Get Better with Debts

There are many different ways that you can improve the relationship that you have with your debt.

For instance, some people simply need to find a way to pay off their debts quicker, so that they don't have to deal with the expense of interest every month. Other people find it useful to consolidate their debts so that they're not dealing with multiple payments every time they get their wages sent to their bank account.

One good way to change your approach to debt in the year ahead is to make sure that you're careful with the loans that you take out.

Commit to comparing your options online before you borrow anything so that you know you're always getting the best deal.

Spend Less Money

You might think that spending less money and saving more money is the same thing, but the truth is that it often takes a lot more effort and focus to “live cheap” than it does to save.

You can set your bank account up to automatically transfer funds from your income into a savings account without thinking about it, but it requires a lot of focus to remind yourself that you shouldn't be spending on things like takeaways and new clothes when you really want to.

Actively learning how to spend less money is difficult, but it's not impossible. A great way to get started is to begin tracking all of your expenses. When you can see first-hand how much cash you spend on things that you don't necessarily need, it's much easier to change your spending strategies.

Create a Budget

A lot of people know that they should have a budget even on a low income. Budgeting is the best way to make sure that you're keeping track of your spending and using your money appropriately. However, it's often difficult to find the time to sit down and actually organize an effective budget.

If you have trouble with budgeting, then the new year could be the perfect time to start thinking about how you can adjust your spending habits.

There are even plenty of budgeting apps that simplify the budgeting process for you, by allowing you to organize your spending into different categories and track your expenses automatically.

Get More Income

Finally, if no matter how carefully you save, you never feel like you have enough cash, then it might be time to change your work situation.

Ask yourself whether you could benefit from applying for a different kind of job, or whether it might be a good idea to take on an extra career as a freelancer in your spare time. You'd be surprised how many great opportunities are available online today.

The more income you get out of your side-jobs and projects, the more you'll have to save towards your financial goals. If you've been lamenting your pay for a while now, take this month as an opportunity to do something differently.

Easily Save Money Every Day With These Best Money Saving Apps

The above-mentioned savings apps are helpful in reducing your monthly expenses and saving money. All of these free mobile coupon and cash-back shopping apps are available for most iOS and Android devices.

The bottom line is if you want to save more money you should be using these best money saving apps. With these apps, shoppers have the opportunity to earn cash back on select products by performing easy tasks, purchasing the product, then providing proof of purchase. These coupon, rebate, grocery, and cash back apps can help you get paid to save to help pay off debt, save for a vacation, or treat yourself to more delicious groceries.

Enjoy!