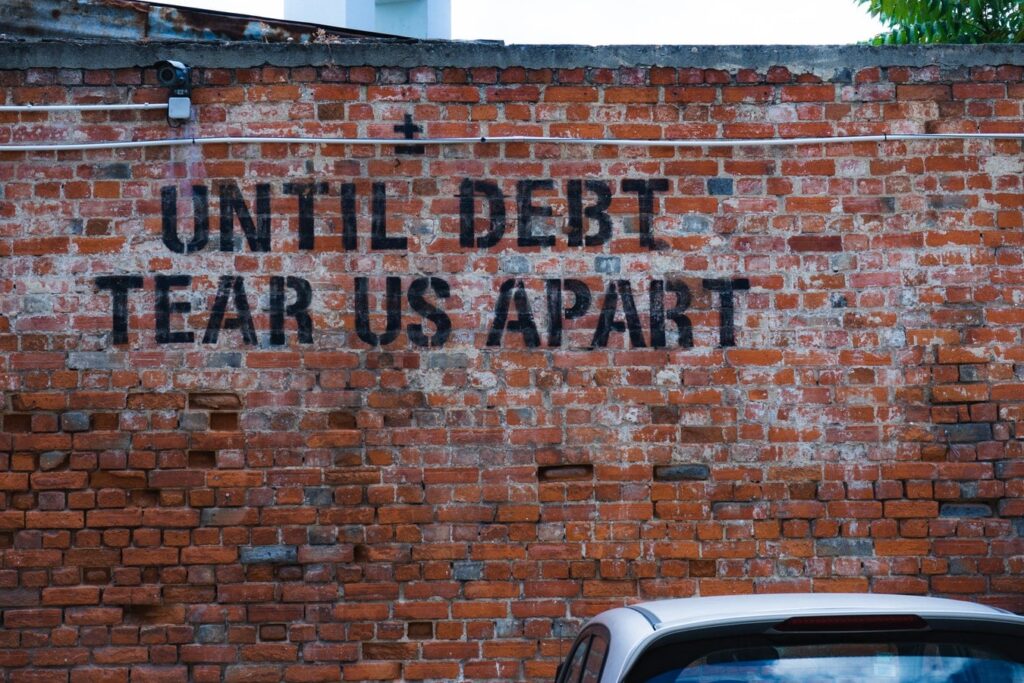

Debt – a dreaded word that, sadly, many of us are going to have to face at some point in our lives. If you’ve already been to college or university, you’ll likely have already built up a fair amount from student loans, for example.

Regardless of how much debt you have, however, it never seems like a good idea – the amounts just keep on mounting up and making life harder and harder! You might even find yourself struggling to pay for your day-to-day essentials at times. But there is a solution. In fact, there are many solutions – and it’s all about finding the one that works for you.

Debt doesn’t have to be the end of everything – 99% of the time, it actually isn’t. Here are thirteen great ways for you to start getting out of debt and freeing yourself up from financial demands, starting today.

But first, let's learn about how debt is holding you back in life.

How Debt is Holding You Back

Debt Saps Wealth

Even though it’s possible to use debt as a way to jump-start financial success, you should realize that, ultimately, debt saps wealth. This is especially true of consumer debt with high interest rates, such as credit card debt. When you are paying interest to someone else, you reduce your disposable income in a way that leaves less for you to use the way you want.

Paying interest means that your money is going to someone else — and not going to build a profitable side business, improve your financial future through wise investments, or even to a great family vacation. Pay off your debt as quickly as you can in order to ensure that your money is being used for your financial future.

Debt Can Affect Your Ability to Find Work

Another way that debt can hold you back is in your professional life. While not all jobs require a credit check, some employers might want to know your credit history. If you are going to work in the financial sector, or if you have a sensitive job, you might be considered vulnerable and unsuited if you have a high amount of debt.

Getting out of debt can help you improve job prospects in some cases. Not only that, but most people feel a jolt of confidence when they pay off debt. Being debt free can translate into confidence and a good attitude that can help you get hired, as well as help you negotiate a higher salary. You might not even realize how debt has been weighing on your confidence and attitude until you pay it off and feel better about yourself and your situation.

Debt Can Impact Your Relationships

Stress introduced into relationships because of debt can really make a difference. What happens when you are in debt can cause stress and anxiety, and lead to difficulties with your loved ones. Indeed, marriages have been ruined because of the stresses that come with being in debt.

Plus, your anxiety can impact relationships with children, parents, friends, and coworkers. Get out of debt, and you will find yourself more relaxed, and better able to focus on building good relationships with those around you.

Here is how you can get out of debt.

How to Get Out of Debt Faster

While millennials, as a whole, are typically saddled with more debt than the generations before them, there is nothing inevitable about a life controlled by debt. With the right knowledge, habits, and resources at your disposal, you can become totally debt-free within a short period of time.

Here's how.

1. Get a Grasp on the Numbers

The first step to eradicating your debt is to fully understand how much you owe and how you can feasibly pay it all back. You can use a number of net worth trackers and budgeting apps to find out the full amount that you owe and how much you should be putting away each month to service your debt.

This first step is undoubtedly the scariest, as most people would rather keep their heads in the sand when it comes to their financial troubles. However, knowing the truth is the first step toward liberation.

2. Work Out Your Budget

The next step is to recalibrate your life in a way that frees up more cash for debt repayments. Prioritize your most urgent, high-interest debts and then figure out where you can trim your expenditures to service them.

Use a budget planning tool like the one offered by Mint and Empower to reduce your utility bills wherever possible, before looking at any lifestyle changes you can afford to make. Simple steps like not eating lunch out will save you thousands every single year, so leave no stone unturned when looking for savings.

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

3. Create a Debt Management Plan (DMP)

Once you get an overall view of your financial standing, it's time to come up with a concrete debt management plan. You can easily come up with one by using the tips in this post on how to manage debt.

The goal of debt management plans is to help people pay off debt and learn how to eliminate it for years to come.

Unlike many other debt relief programs, a debt management plan can increase your credit score which has a very long positive effect on your future financial goals. Here are the basics:

Make a Budget

If you’re faced with hefty debts and are struggling to make ends meet – re-evaluate your budget. It's entirely possible to learn how to budget on a low income and learning how to get out of debt is possible.

Redo your monthly or weekly budgeting and keep receipts. Look at areas where you could stand to cut down on costs.

Make changes to the purchases you make, if only temporarily. Unfortunately, getting out of debt often means making concessions – and the biggest concessions you may have to make right away will concern your existing spending habits.

Free apps like Mint and Empower can really help out beginners if they don't want to mess with creating their own budgeting template.

Avalanche vs. Snowball

When you are focusing on paying down debt, you'll want to narrow down the debt amount with the highest interest rate. Once that account is paid off, move on to the next highest rate and so on.

This is the avalanche method because you are building momentum by accelerating your payments and getting more spending power to pay off the next debt.

If your debt accounts have similar interest rates, then consider using the snowball approach instead. This is where you will pay off the account with the smallest balance and once that's paid off tackle the next smallest balance.

Once you start seeing these small wins, you'll focus on paying them off faster and help you reach your goal of becoming debt free.

4. Save Wisely and Invest

This one might seem obvious, but most people never save the right way. First of all, simply squirreling away what you can into a separate bank account isn't going to make your debts go anywhere.

Wise saving means making your money work for you, so explore low-risk investment options even if you have little money to spare. This will help boost your available capital without requiring any work from you. You can start investing even if you have little money to spare with apps like Acorns.

Acorns is a leading investing and budgeting app, and here’s an example of how it works:

- You sign up for Acorns and link your bank account to the app

- You purchase your morning coffee for $2.25

- Acorns rounds up spare change from the purchase to $3 and automatically invests the extra $0.75 for you

Acorns lets you choose different investment portfolios to suit your long-term goals and level of risk tolerance. Your actual investments are a mix of various ETFs, so Acorns isn’t doing anything you can’t do independently. However, the app is useful for building those good investing habits.

Acorns costs $3 per month. You also get perks like earning bonus cash back from 12,000+ retailers and free ATM withdrawals if you use an Acorns debit card.

Paying $36 per year isn’t worth it if you invest independently. But, if you want to start investing with little money and need guidance, apps like Acorns are worth using.

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

5. Maximize Your Income

Those on a fixed income may feel especially trapped by their debt, but this needn't be the case. Explore avenues for maximizing your income as a way to service your debt.

This could be as simple as letting out a spare room, taking part in the gig economy, or doing some part-time freelancing work on top of your full-time job. There are countless ways to boost your income, so make sure to do some research and see which ones work for you.

While making extra money takes time, you may find yourself in situations where you need access to quick cash. Most people turn to payday loans or personal loans — however, I am here to tell you that there are better ways.

There are apps that will literally spot you money and you don't get charged any fees and no harm to your credit either. Cash advance apps can spot you $200 whenever you need it.

|

30-day free trial

|

|

|

Primary Rating:

5.0

|

Primary Rating:

4.8

|

|

Pros:

|

Pros:

|

|

Fees: 30-day free trial

|

Fees: $1/mo

|

- App Store: 4.8 – 146k reviews

- App Store: 4.8 – 652k reviews

If you're in need of a quick cash boost to make debt payments, check out the following posts:

- Different Ways to Get Paid Today

- How to Make Money Without a Job

- Under the Table Jobs that Pay Cash on the Spot

6. Negotiate Lower Interest Rates on Your Debt

You can also consolidate your various debts into one manageable system. One of the most popular ways to do this is to refinance your home.

Whether you want to lower your monthly mortgage payments, pay off your mortgage faster or get cash from your home, companies like LoanDepot will help you land the best deal for your refinance. You can also choose this method to reduce your existing mortgage payments by switching lenders and getting a lower rate and saving thousands.

Rather than visiting a financial advisor, homeowners can now get quotes from the top mortgage lenders to determine how best to go about this popular method of debt reduction.

7. Balance Transfer

If you're dealing with high-interest credit card payments then it makes sense to do balance transfer your credit card balances to a credit card with 0% APR.

This can be a big money-saver if you choose the right card.

My favorite card with the best credit card rewards is the Discover it® credit card which has no fees at all. You can also get a 0% Intro APR for 15 months on purchases and balance transfers, so if you have any credit card debt with high-interest rates, it’s worth switching over so you save on interest. Then you can find ways to pay off the credit card debt while saving on interest.

Plus, you can earn 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, gas stations and when you pay using PayPal, up to the quarterly maximum when you activate.

Also, this card is beneficial if you wanted to claim a $100 bonus after you make any purchase with your new card in your first 3 months. You will receive the $100 back in the form of a statement credit.

Annual Fee: $0

Regular APR: 11.99%-22.99% Variable APR

Intro APR: 0% intro APR for 15 months on purchases and balance transfers

8. Create an Emergency Fund

Too often as a society do we fall into the trap of being ill-prepared for unanticipated financial burdens. Out of necessity and desperation, we turn to credit cards and personal loans to cover the costs that we didn’t see coming.

While credit cards and personal loans have their purposes, we have become overly dependent on them, and this dependence coupled with high-interest rates keeps us bound to the mounting debt around us.

This is the main reason having an emergency fund is so important – to enable us to cover unforeseen expenses without accruing additional debt and without breaking the bank.

The get started, start building your emergency fund which should be three to six months’ worth of expenses. If that amount isn’t possible right now, aim for one months’ worth, which is still a good place to start.

9. Get Your Credit Score in Check

Debt can have a massive effect on your credit score, which – if you didn’t know already – is your passport to borrowing further money in the future.

Mortgages, credit cards, money borrowing apps you name it – your credit score shows companies how reliable you are at being able to pay the money back.

If you’re in debt and are worried about your credit score – and your ability to take on finance in the future – it’s high time you undertook a solid, thorough credit report and discussed your options for healing that score.

10. Consolidation

One of the most effective ways to get out of debt with several creditors at once is – as many debt experts will tell you – to consolidate what you owe into one lump sum with a separate lender.

This can effectively lower interest rates, can ensure that debtors stop pursuing you, and may also help to heal your credit rating – though this isn’t guaranteed. Your best option, before you consider consolidation in any form, is to consult a debt advisor to discuss your options. Never be afraid to reach out for help.

11. Start Selling

Yes – believe it or not – one of the most effective ways to start breaking down debt – which carries very little risk – is to start looking at your existing assets and possessions, and to start thinking about cashing them in.

This may sound horrifying – but in the case of mounting debt, it may be an option you have to take. Consider selling apps, consignment shops or services such as eBay – where you can easily generate cash for your old, unused items – or even look at your bigger assets to sell on if the debt is mounting even faster.

You can even learn how to make $1,000 fast in our recent post.

12. Stop All Credit Cards

Yes – some people can really make credit cards work for them – but you should only ever consider using them if you are going to be physically able to stand up to their monthly demands. There are many personal finance gurus who teach that you should cut up all your credit cards, close your credit card accounts, and live entirely on a cash-only basis.

Spreading and delaying costs is an attractive proposal – and it works for plenty of people – but if you don’t keep up to monthly payments, you’re going to be digging yourself an even bigger hole.

Do yourself a favor, especially if your credit score is taking a hit – get those cards paid off with a sensible plan as a priority – and cancel them.

13. Consider Freelancing

Another way around keeping up with debt is earning extra cash – it’s not always so easy if you’re working every hour you’re sent, but it’s now easier than ever before to get set up on a freelancing site to make extra money.

Can you design corporate logos? Proofread? Write content? Provide voiceover work? If you have a talent, you can market it online – and it’s often a breeze making up some handy extra cash in just a handful of hours. This may well be your ticket to debt easing sooner rather than later.

FAQs

Whether you work with a credit counselor or on your own, you have several options for eliminating debt, known as debt relief: Apply for a debt consolidation loan, use a balance transfer credit card, opt for the snowball or avalanche methods or participate in a debt management plan

Yes, as long as you have money and assets, in addition to no debts. Living loan-free is a fantastic way to be able to meet your financial goals.

Pay off the highest-interest debt first. This is helpful for minimizing the amount of interest you pay. There's a good reason to pay off your highest interest debt first — it's the debt that's charging you the most interest.

With a bit of financial management and handling your money properly, you can pull yourself out of debt. Doing so has its perks. Living a debt-free lifestyle can save you money and allow you to also start saving toward your financial goals. It also can help lower your credit score as well as your stress levels.

Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

The Bottom Line

The millennial generation is on track to become one of the most heavily indebted in history. As of late 2020, Millennials ages 25-34 have $27,251 in debt, and most of it isn’t from student loans, according to CNBC. The reasons for this are numerous, including skyrocketing tuition fees, expensive housing, and a growing addiction to credit card debt among younger generations.

These strategies are great ways for you to start getting out of debt and freeing yourself up from financial demands, starting today. If you are in serious debt and see no escape it would be wise to consider seeking a credit counseling agency.

Escaping debt is never an easy process, but it's something that's possible for everyone, regardless of their financial situation. Take these steps today to ensure you're living debt-free as soon as possible.

Once you have your budget in control and your debt is slowly being paid off, don't stop there! Keep pushing and continue finding ways to pay off your debt fast.

Look for other ways to save like using money-saving apps and be sure to monitor your progress as you go. It's always smart to make adjustments as you progress and start building your emergency fund.

I hope you learned how to get out of debt with no money in this article, as we shared our top tips.

What are some strategies you have used to get out of debt quickly? Have you ever tried debt-crushing ideas on this list?