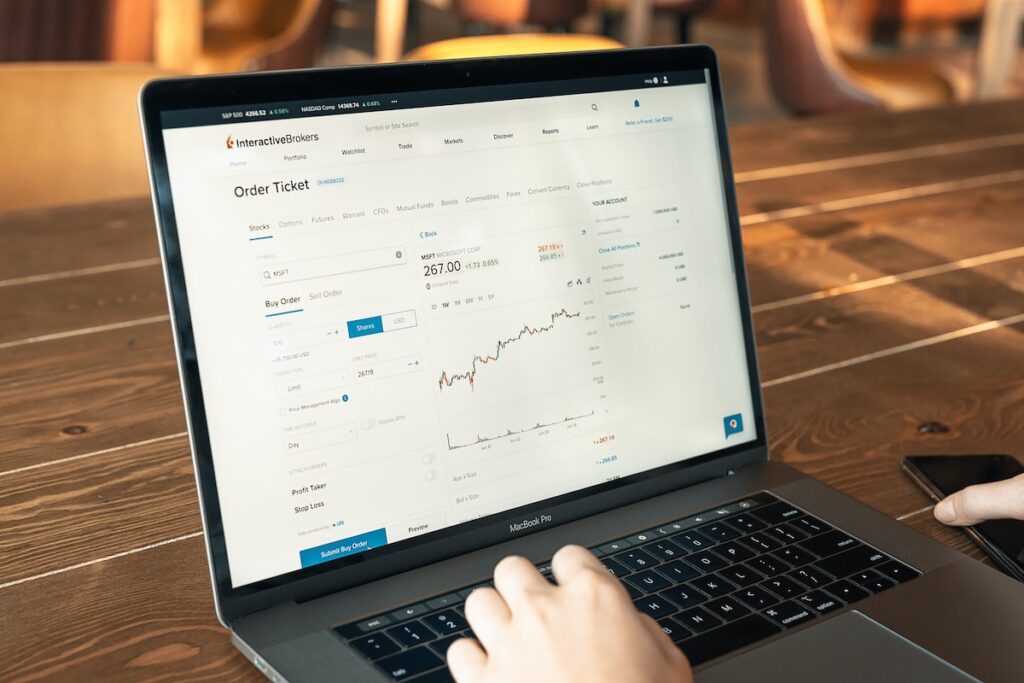

One way to make money daily is by investing in assets that are likely to increase in value. These could be stocks, real estate investing, or businesses. The key is finding assets that have a track record of consistent growth over time.

If you're looking for a more conservative investment, you can also look into bonds or CD's. While they don't have as high a rate of return as stocks, they also won't make you lose money over time either.

In my opinion, investing in stocks is the best way to make money daily. As a beginner, it's a good idea to only invest in companies that are well known and stable. You can do this by looking at their financial reports and seeing how they've performed over time.

But there are so many more ways to invest and make money daily.

How to Make Money Daily and Fast

Let's start by defining what it means to make money every day. For me, this implies your assets will either appreciate in value or give you a return of cash. However, it may represent something entirely different for you.

It's critical to weigh the dangers of investing your money when making any decision, especially for some of the riskier financial instruments. You'll also want to think about how long you plan to keep your investments. It's more probable that you'll profit from keeping your assets for a longer period than purchasing and selling them on the same day.

Continue reading to learn how to make money on a regular basis by investing in appreciating assets!

1. Invest in ETFs or Mutual Funds

Another way to make money by investing is through ETFs or mutual funds.

An ETF, or Exchange Traded Fund, is a type of investment that allows you to invest in a basket of assets. This could be stocks from a certain sector, bonds, or commodities.

Mutual funds are also a type of investment, where you're buying shares in a company that manages a pool of assets.

Both of these investments are great because they allow you to make money daily with little risk.

The main difference between the two is that ETFs offer more flexibility in terms of trading; whereas with mutual funds, it's harder to trade them on a daily basis.

Thanks to technology, it’s easier than ever to use a commission-free broker to begin investing in ETFs or mutual funds. Chances are, you can also grab a free stock for joining many of these brokerages.

And, the best part is many investing platforms let you invest in fractional shares of stocks and exchange-traded funds. This means you can buy slivers of stocks and ETFs instead of buying the entire security. So, if you’ve been eyeing Tesla or Amazon stock but don’t have thousands of dollars, you can still invest in those companies.

Popular online brokers with fractional share investing include:

- Robinhood: Enjoy commission-free trades of fractional shares of stocks and ETFs.

- Webull: Start investing in fractional shares with just $5 and get free stocks for signing up!

- SoFi Invest: Invest in over 4,000 stocks and ETFs starting at just $5.

Ultimately, investment apps like Robinhood and other leading brokers let you diversify your portfolio without needing much capital. Plus, you have the flexibility to buy companies you like or ETFs that contain dozens or hundreds of companies.

Overall, SoFi Invest is best for beginner investors with little money who are looking for an intuitive and easy trading experience and want to open an active or automated investing account or explore cryptocurrencies.

SoFi Invest allows members to buy and sell stocks, exchange-traded funds (ETFs), fractional shares, initial public offerings, and cryptocurrency. SoFi Invest also offers commission-free trades. Join now and get $25 worth of your favorite stock to start building your portfolio when you fund your SoFi Active Invest account with at least $10.

2. Invest in Debt

Real estate crowdfunding is one way to invest in real estate with little money. But did you also know you can invest in real estate debt?

Companies like Groundfloor let you invest in short-term real estate debt to earn interest. In a nutshell, investors help fund real estate development projects by loaning out money. In exchange, they earn interest on that loan until the loans are repaid.

Groundfloor only requires $10 to begin investing, so it’s very beginner-friendly. The loan marketplace also has a variety of projects, each with varying loan terms, interest rates, and risk.

The main risk of debt investing is that borrowers default and you lose your money. However, since Groundfloor has a $10 investment minimum, you can diversify your portfolio across multiple projects to mitigate some of this risk.

3. Invest in Crowdfunded Real Estate to Grow Your Money

While it might surprise you, real estate investing apps are another excellent way to start investing and make money daily and fast.

Historically, real estate investing was for the wealthy who could afford to acquire land. But these days, you can invest in this asset class with only $10.

Real estate crowdfunding companies basically pool money together from numerous investors and buy real estate. Usually, properties are multi-family homes or commercial real estate that generate rental income for shareholders. Investors can also benefit from property appreciation.

One leading company in this space is Arrived Homes.

Arrived is a great real estate investing platform to use if you want a low minimum investment threshold for real estate investing. You can get started with as little as $100!

It’s an especially useful tool to use if you want to diversify your portfolio and have someone else handle all the work that comes with being a landlord. All you really need to do is sign up, and collect your rental income each quarter.

The management fee is a modest 1% asset management fee, but it's worth it considering how easy it is to get started. You can sign up for free and view the different properties available to invest in. Buy shares of properties, earn rental income and appreciation — let Arrived take care of the rest.

Then you can literally beat the stock market year after year and start making money in your sleep. If you want to earn the big bucks then you can learn how to get started by getting more information from Arrived here.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.

4. Dividend Investing

Dividend can make you money daily and fast if done right. This investing strategy is all about buying businesses that pay out dividends as a significant portion of their annual earnings or profits as a return to shareholders.

For investors, this provides an excellent income stream without having to worry about selling securities each month or quarter to generate cash.

In return, you’ll need enough capital to purchase at least one company’s shares. And, when you find a solid dividend stock, you can buy in small portions over time. Plus, make sure to reinvest your dividends each month or quarter in order to compound your returns and build wealth more quickly.

Examples of profitable dividend companies include:

- Apple (APPL): Dividend yield of .49%

- Johnson & Johnson (JNJ): Dividend yield of 2.56%

- Cisco Systems (CSCO): Dividend yield of 2.5%

Overall, dividend investing is a great way to start making money daily and fast. You can achieve good investment returns over time by buying quality companies that you understand and that have excellent track records of increasing dividends.

Related: Best Ways to Invest 200k

5. Make Money Daily with a High Yield Savings Account

Thanks to inflation, parking your money in a high-interest savings account isn’t a great long-term investment idea. But depending on your risk appetite or if you need your money liquid for buying a home or another large purchase, they make sense.

What's more — while banks might be paying measly interest rates right now, many online-only checking and savings accounts have more attractive offers.

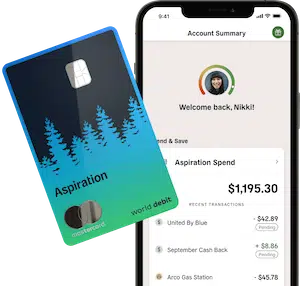

For example, with Aspiration Spend & Save, you can earn up to 5.00% APY on your savings. Similarly, money-management apps like Unifimoney let you earn 0.20% on your balance and also invest in stocks, precious metals, and cryptocurrencies. Plus, you can get up to $5,000 in free Bitcoin for joining Unifimoney.

Again, high-interest savings accounts or online-only banks aren’t a great long-term investment idea because you can earn more with other investments. But if you want to invest with little money but need access to your funds soon, you should park your idle cash somewhere it earns meaningful interest.

There's a good chance your bank is using your money to fund oil projects that destroy the climate. Put your money where your values are. Join Aspiration today.

6. Invest in Peer to Peer Lending for a Daily Profit

This is a way to make a direct impact on the lives of people. This is how it works: you sign up on a platform like LendingClub or Prosper and start giving loans to peers registered on the platform. You can buy into a thousand different loans to spread out risks and earn a profit in the form of interest.

You can choose from a variety of sites that allow you to invest in peer-to-peer loans, such as the following:

- LendingClub: Invest $25 or more and earn up to 8.78% APY

- Prosper: Invest $10 or more and earn up to 6.84% APY

The main risk of P2P lending is that it’s fairly illiquid, meaning that you can’t access your money for 60–90 days without getting into early repayment problems. However, if you’re comfortable with the risks and can afford to tie up your money for a while, P2P lending can be a great way to make money on a daily basis.

Overall, peer-to-peer lending is another great way to make money daily and fast by lending your money to individuals and earning interest on it.

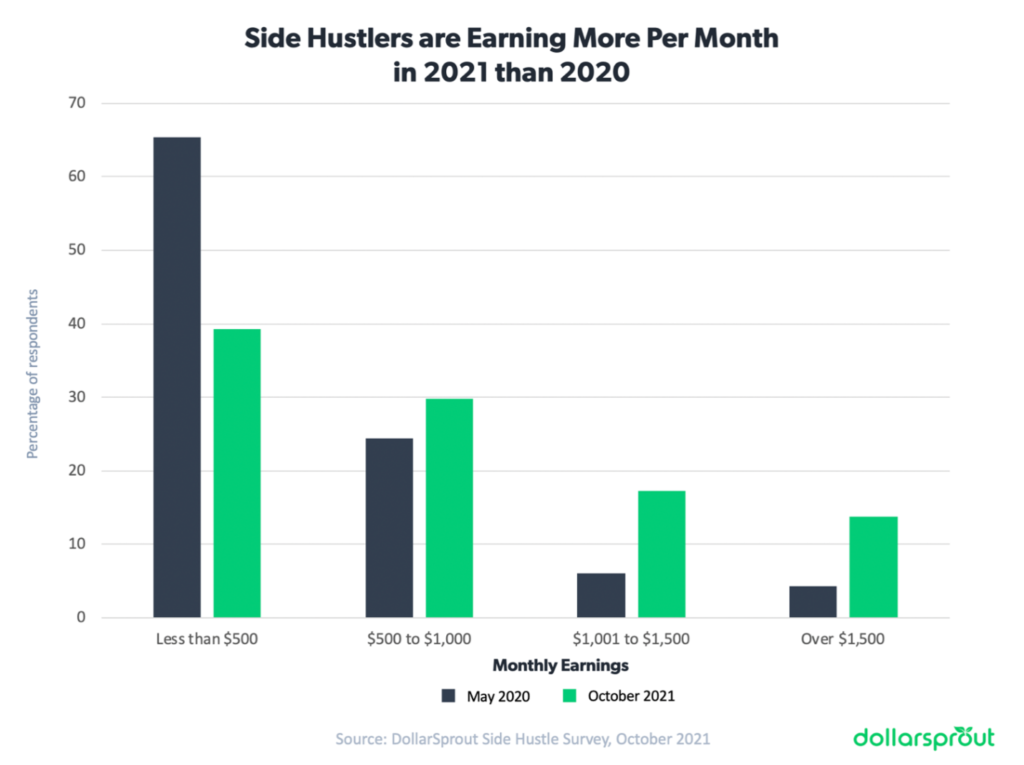

7. Invest in a Side Hustle

You can earn money every day simply by having a side hustle. A side hustle is any type of business that you run in your spare time.

If you're looking for a quick and easy way to make money daily, then starting a side hustle is the perfect option for you.

Also, if you don't like the idea of having so much responsibility on your hands with an actual business, this is still a great choice since you can make money pretty quickly.

Here are some side hustles you could look into:

- Freelancing: This is where you offer your own skills as a service for others! You can do this with any type of skill that requires expertise, such as web design or consulting.

- Online Jobs: There are many online jobs that don't require any prior experience. You could look into things like online surveys, data entry, or even becoming a virtual assistant.

- Start a Blog: This is a great way to share your passions with the world while also making some money! You can create ads, sell products, or even offer services to your readers.

The great thing about side hustles is that you don't need any startup costs. So, if you're low on funds, this is a great option for you.

On the other hand, you won't be able to make very much money daily with these hustles – since they take time before they can start turning profits. But once you find your rhythm and build an audience, you can make a lot more money over time.

The key to making a side income is being consistent and never giving up!

8. Make Money Daily with Bitcoin

This is a technique in which your Bitcoins are kept in a crypto savings account allowing you to generate interest on your holdings.

There are a few crypto interest accounts that offer this, with the most popular one being Coinbase.

Coinbase is widely recognized as a digital wallet, but it also offers a crypto savings account feature for eligible US customers. With this option, you can earn up to 1.50% APY on US Dollar Coins (USDC) simply by holding them in your Coinbase account.

Unlike other companies, Coinbase does not lend out its USDC, making this a convenient and secure way to earn interest on your cryptocurrency holdings while waiting to make trades.

Additionally, if you're a new customer and open an account, you can get up to $200 in free crypto through its Coinbase Learn section.

Coinbase is a well-known cryptocurrency exchange that makes it easy to buy, sell, and exchange cryptocurrency. Coinbase makes buying Bitcoin as easy as buying a stock through an online brokerage.

9. Make Money Daily with Mining

Another method of making money with Bitcoin I want to tell you about is mining.

Bitcoin mining, which has evolved exponentially over the years, is of course the activity that verifies and authenticates all Bitcoin transactions.

Miners compete for the awards, paid in Bitcoin, by racing to complete the required tasks first. They typically employ banks of computers (‘rigs’) for this purpose.

By mining, you can earn cryptocurrency without having to pay for it. Minors receive BTC as a reward for completing “blocks” of verified transactions that are added to the blockchain.

Miners are rewarded based on who solves complex hashing puzzles first. You will definitely need a GPU (graphics processing unit) or an application-specific integrated circuit (ASIC) in order to get started with a mining rig.

The best Bitcoin mining software is CG Miner, BFG Miner, MultiMiner, and Easy Miner.

10. Invest in Bonds

Another way to make money daily is to invest in bonds.

Bonds are a way for companies and governments to borrow money from the public by selling them a percentage of a bond or a set of stocks, or they can be bought through investment firms. Bonds offer lower interest rates than most other investments but mature faster.

In short-term bonds, the price may vary substantially over a short period of time and very little over the long term. Long-term bonds are much less volatile, but investors do take a considerable risk that they will not receive their entire investment back when it matures.

With this type of investment, you earn interest each year until the bond reaches maturity. Bonds generally offer a lower return than stocks, but they are much less risky.

You can purchase bond mutual funds or exchange-traded funds (ETFs) that invest in a variety of bonds. These funds spread the risk over many different types of bonds, and they are a way to invest in bonds without having to purchase individual bonds.

11. Invest in Art to Get Daily Returns

Contemporary art has offered an annual return of 14% over the last 25 years, as of December 2020, versus a 9.5% annual return from the S&P 500, according to the Citi Global Art Market chart.

If you want to invest in art, Masterworks is a good place to start. You can buy and sell shares in multimillion-dollar paintings on the Masterworks platform. If you decide to keep your shares until the painting sells, you’ll receive proceeds from the sale.

Read more on how to invest in art in order to decide if it’s a smart way for you to make money daily.

- Invest in multimillion-dollar paintings

- Attractive historical price appreciation

- Buy and sell shares on the secondary market

12. Treasury Bonds

Treasury bonds can be an excellent investment for those looking for safety and a fixed rate of interest that’s paid semiannually until the bond’s maturity.

There are 4 different types of treasury bonds (NerdWallet):

- Treasury bills (or T-bills): Short-term debt securities that mature in less than one year. Though T-bills are sold with a wide range of maturities, the most common terms are for four, eight, 13, 26 and 52 weeks.

- Treasury notes (or T-notes): Intermediate-term debt securities that mature in two, three, five, seven and 10 years.

- Treasury bonds (or T-bonds): Long-term debt securities that mature between 10 and 30 years.

- Treasury Inflation-Protected Securities (or TIPS): Another type of Treasury bond, adjusted over time to keep up with inflation.

Overall, treasury bonds should play a strong role in your portfolio’s asset allocation because it provides steady returns and can help offset the volatility in the stock market. You can purchase Treasury bonds directly from the Treasury Department through its website, TreasuryDirect, or through any brokerage account.

13. Annuities

This is a low-yielding investment that could pay as low as 3% on your capital. An annuity is a way to supplement your income during retirement.

Annuities can be a smart option since it provides regular payments, tax benefits, and a potential death benefit. The other advantage is that your capital is kept safe and your returns are guaranteed.

14. Start a Business

Starting a business is one of my favorite ways to get rich because of how much money you can make. Invest your money in that promising business venture you put on the back burner for lack of money. If it is a high-risk business be sure to conduct research into your prospect, seek expert advice and develop a solid business plan before starting out.

Of course, the amount of money required to start your business depends on your business model and industry. However, a 2009 study conducted by the Ewing Marion Kauffman Foundation puts the average cost of starting a business is around a 30k investment.

Alternatively, starting a business with no money might initially seem like a far-fetched idea, but it’s not impossible. You can even use a personal loan to start a business, in certain situations. The bottom line is that nothing is stopping you from launching a business.

15. Max Out your Retirement Accounts

You can invest in index funds and mutual funds in your retirement accounts and shoot for maxing out these accounts.

If your employer offers a 401(k) that matches employee contributions, and you aren’t currently contributing enough to earn that match, let your extra 10k free up some space in your budget so you can do so.

The other option is to contribute to a Roth IRA or traditional IRA. These retirement accounts do have annual contribution limits — $6,000 in 2021 ($7,000 if age 50 or older). You can pad these retirement accounts in order to help prepare yourself for retirement down the road. Your retirement accounts commonly invest in index funds and ETFs, mutual funds, and are low-risk investments because your investments are diversified.

16. Index Funds

Investing in index funds is like investing in the stock market without taking on too much risk. The risk of investing in index funds is very minimal yet the benefits are massive. The trick is to diversify your stocks by buying the largest companies through your index fund.

According to Bankrate, the best index funds to own this year are as follows:

- Fidelity ZERO Large Cap Index (FNILX)

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF Trust (SPY)

- iShares Core S&P 500 ETF (IVV)

- Schwab S&P 500 Index Fund (SWPPX)

These index funds track the S&P 500 Index Fund and offer you a way to invest your money in stocks of the S&P 500 at a low cost, while still enjoying diversification and lower risk.

17. Microinvesting Apps

If you need a helping hand with investing your money, micro investing apps could be your solution.

Micro investing apps work by rounding-up money from your daily purchases to the nearest dollar to invest on your behalf. Acorns is a leading investing and budgeting app, and here’s an example how it works:

- You sign up for Acorns and link your bank account to the app

- You purchase your morning coffee for $2.25

- Acorns rounds up spare change from the purchase to $3 and automatically invests the extra $0.75 for you

Acorns lets you choose different investment portfolios to suit your long-term goals and level of risk tolerance. Your actual investments are a mix of various ETFs, so Acorns isn’t doing anything you can’t do independently. However, the app is useful for building those good investing habits.

Acorns costs $3 per month. You also get perks like earning bonus cash back from 12,000+ retailers and free ATM withdrawals if you use an Acorns debit card.

Paying $36 per year isn’t worth it if you invest independently. But, if you want to invest with a little bit of money and need guidance, apps like Acorns are worth using.

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

18. Make Money Daily with a Robo Advisor

Another way to begin investing without much money is to use a robo advisor. Like traditional financial advisors, robo advisors build an investment portfolio for you to match your goals and risk tolerance.

People like robo advisors because they’re simple: you just open an account, answer a brief investing questionnaire, and deposit funds. From there, your robo advisors invests for you and can even handle tasks like portfolio rebalancing.

One popular robo advisor that’s great for beginner investors is M1 Finance. M1 Finance is best for making automated, long-term investments. Similar to Robinhood, M1 Finance allows users to buy fractional shares. This is great for diversifying your portfolio as you can buy multiple stocks and ETFs at your preferred price. It’s a robo advisor and one of the cooler features the M1 Finance app offers is the choice to construct investment pies.

A Pie is a portfolio that is fragmented into different stocks and ETFs you’d like to invest in. It looks just like a – you guessed it – a pie chart. Once you’ve chosen your assets, select what percentage of your money you’d like to each of them, and the app will automate your investments.

Plus, they’re one of the only top-tier robo advisors that has $0 commission fees and $0 account minimum when you join through this link.

M1 Finance offers free automated investing as would any robo-advisor. And while it classifies as a robo-advisor in terms of features and functionality, it varies in a few key ways. Fund your account with $10,000+ and get up to a $500 bonus. It’s that easy.

Wealthfront is another leading robo-advisor that’s similar to M1 Finance. You need at least $500 to begin investing, and Wealthfront also charges 0.25% in annual advisory fees.

The bottom line is robo advisors help you invest with little money by taking the work off of your plate. You’re still investing in individual stocks and ETFs as well, so it’s similar to DIY-investing in this regard.

18. Invest in Commodities

The commodities market is one of the most important asset classes in the world, as it influences nearly all aspects of our day-to-day lives. It is ideal for beginners due to its flexibility and volatility, which can bring great returns over a long period of time.

Commodities are interchangeable goods that are used in manufacturing processes around the world and they are an important part of our everyday life. They can be divided into four major categories:

- Precious metals (gold, silver, copper, palladium, and platinum).

- Energy resources (natural gas, crude oil, coal, and propane).

- Agricultural – soft commodities (coffee, corn, sugar, cotton, soybeans, rice, and cocoa).

- Livestock (pork bellies, live cattle, feeder cattle, and lean hogs).

To gain access to this market, foremost, you need to register for an account with an online broker that offers commodity trading from gold and crude oil to pork bellies and coffee. These assets are an efficient way to expand and diversify your portfolio.

19. Options Trading

Nowadays, it’s so easy to trade options without spending hours learning how to master it. This is possible through apps like Gatsby.

Gatsby makes options trading simple by removing the commissions and the jargon.

The app is built for those who don’t know very much about options trading but still want to try it out. Overall, it’s very user-friendly and a well-built app and one of the best options trading platforms.

You can trade options with your friends, earn Gatsby Rewards points on every trade you do, track breaking news and important alerts, and never pay any commissions or contract fees (free).

20. Trade Forex and Make Money Daily

Trading in the forex market can be thrilling and exciting. The Forex market is open 24 hours a day, five days a week, and currencies are traded all over the world. This means that there's always an opportunity to trade, no matter what time of day or night it is.

There are many different factors that can influence the value of a currency pair, so Forex trading is a great way to take advantage of these changes in value, no matter how small they may be.

A handful of knowledge on how forex trading works will not suffice. Other than learning about foreign exchange and the complexities of the asset classes, there are a whole lot of factors that FX brokers need to know.

With over a hundred forex brokers in the market, choosing the best forex trading platform is the first step on getting started.

Investing Tips

When investing your goal should be to generate income and make money fast. Making money requires you to understand that you may lose money.

So it's important to have an investment strategy in place where your money is invested using proven strategies that work and can help you have a prosperous financial future.

Your investment options can be tailored in a smart way by using the tips below.

Be sure to get portfolio management

If you are working with at least $100,000 in liquid cash — you are considered a high-net-worth client who would benefit from a personal touch. With that amount of capital, you can start investing with Empower.

Empower has two options. The first is a free planning tool that collects information from your financial accounts and helps you make improvements to increase returns. That’s a great option for anyone, no matter where you bank or invest.

The second option is using their asset management service that has a minimum account size of $100,000 to start. Once you join, you can get help setting goals for your money — primarily for your retirement. If you invest your money here, the app will invest your money based on the Modern Portfolio Theory (MPT) which ensures true diversification and they go a step beyond tax-loss harvesting. They will optimize your tax burden and your portfolio will be tax-efficient.

According to the company’s own tests, they outperformed the S&P 500 by more than 1.5% annually with less volatility. Overall, it is a safe bet to open an Account at Empower to help you grow your $100,000 safely.

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

Be sure to pay off your debt first

The easiest way to invest your money is by getting out of debt by paying it off. It may sound odd but paying off your debt is the first and biggest investment you can make with your money in your account. The interest on any debt you have grows with time and the sooner you pay it off, the more you will save.

You should know that the secret to success is paying off high-interest debt. Sure saving money and spending less is important but paying down debt is a worthy goal. Before you go off and invest any money, make sure your debt with the highest interest rates is paid off, in many cases that is going to be credit cards.

“So before you go dip your chunk of money into stocks, you’ll likely get a better return on your money if you pay off your high-interest CONSUMER debt.”

According to the latest reports, the average credit card interest rate is 17.98% for new offers and 14.58% for existing accounts. While the average stock market return for 10 years is 9.2%, according to Goldman Sachs data for the past 140 years.

Are you picking up what I’m putting down? Or is your credit card debt all paid off? Let’s move on.

Frequently Asked Questions

Is it worth investing with little money?

It’s absolutely worth investing with little money. Starting to invest builds good habits, so even if you don’t have much money, you’re developing skills that will serve you for your entire life. Plus, the power of time and compound interest means that a small starting investment can grow into a more significant amount with time.

Where should I invest my small amounts of money?

Choosing the right small investment idea depends on your goals and level of risk tolerance. For hands-off investing, options like robo-advisors or investing in real estate crowdfunding make sense.

You can also try DIY-investing through online brokers like Webull or Robinhood. Finally, if you’re feeling entrepreneurial, you can always start your own online business or learn a new skill as your investment.

Robinhood is a free-trading app that allows you to trade stocks, crypto, and more without paying commissions. Plus, they'll give you a free stock worth between $5 and $200 for joining.

How to Invest and Make Money Daily Summary

It doesn’t matter if you’re a broke college student or are trying to build wealth now that you have your first job; investing and making money daily and fast is possible.

And, as mentioned, you don’t need to focus on your annual return and obsess over the numbers. Small investment ideas are the start of much larger ones, and it’s developing good habits and learning how to invest that’s most important.

So, pick an investment idea or two from our list and have at it! You might be surprised how a small investment idea can grow given enough time and attention.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.

How does the payment method works and can I withdraw any time of the month

What is the profit rate on $500 per day or per month

Waouh, this is the best article I have read on this matter. Thanks. Dr A.M. 🇧🇪