- Invest in multimillion-dollar paintings

- Attractive historical price appreciation

- Buy and sell shares on the secondary market

Is it possible to make a profit from art investing? Is this new asset class just a lot of hot air?

You probably already know that art has the ability to transform a home. Over the last several years, the art market has developed into one of the most exciting investment fads. Those who are seeking alternative investments are looking for works of art from various artists for art buying. Painting and sculptural collectors frequently acquire works in order to increase their investment portfolio and net worth.

But should you purchase art as an investment and how does it work? Continue reading to learn how potential investors can use art as an investment for significant returns.

How do art investments work?

Art, like stocks and bonds, may appreciate in value. The cash value of an artist's work will rise dramatically if they go on to a successful career. According to Art Basel's annual report, global art market sales were estimated at more than $67 billion in 2018.

Art is a long-term investment

It takes time for profits from art investing to materialize. Experts suggest that art investing is best suited for patient investors with a time frame of 10 years or more, so think long term.

Paintings are sometimes included in estate plans by art investors as assets to be passed on to their descendants. It can be a great way to build generational wealth.

The art market follows rules of its own

The value of art as an asset has the advantage of not fluctuating with the stock market. As with any market, there is always a certain amount of risk involved. It's important for investors to keep in mind that the art market as a whole has fluctuated drastically over the years and that any investor should remain diversified.

Despite the fact that your stock portfolio isn't performing well, your investment in art may be doing well—good news for the prudent investor seeking to diversify a portfolio and minimize risk. And, ideally, fine art will increase in value over time, although this is not always the case.

Art is risky

Every piece of art is one-of-a-kind, and the art market experiences peaks and valleys in much the same way as any other market.

Because determining the true worth of a work is almost impossible, you should be willing to take some risk.

How to invest in art

Determine how much money you're willing to invest at first. It should be something you can afford to lose if the artwork devalues. Are you investing with limited funds or do you have $10,000 to invest? Remember to include any storage and maintenance expenses into the equation.

Learn everything you can about the world of art. Visit galleries in your area and discover what they have to offer; speak with curators, who will most likely be happy to answer any queries you may have.

If you live in or around a city, you're probably near to gallery exhibitions and art fairs, where up-and-coming artists are often seen.

To learn how the market works, look at sites like Artnet and online auction houses like Sotheby's.

You may start narrowing down your research once you've seen something that piques your interest. You can look for pricing information for possible investors with the shazam for art app called Magnus, which will provide up-to-date quotations. Take a photo of the piece and they'll tell you all you need to know about it.

You should then have your artwork evaluated by a professional appraiser to assess its quality.

You may either buy an artwork yourself – which is typically the more expensive alternative – or invest in it through an online marketplace.

Many high-end artworks is sold over the Internet these days, making investing in art possible for just about anyone. However, be sure you're purchasing from a reputable gallery, dealer, or investment firm before buying online.

Masterworks

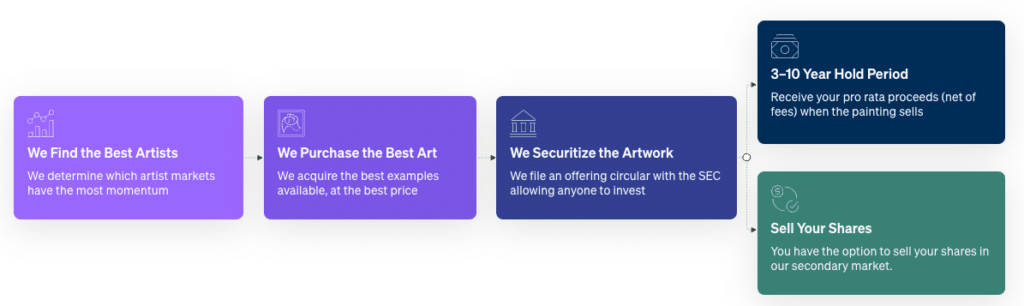

Masterworks is a fantastic choice for the novice art investor, in part because they do much of the legwork for you. Masterworks purchases paintings and issues shares to investors, keeping you up to date on the investment's progress.

You don't actually own or keep the art with Masterworks. Instead, you and other investors invest in high-value works authenticated by experts. Minimums differ depending on the current terms for particular investment opportunities available at the time you make your deposit.

Masterworks charges an annual account fee of 1.5% plus 20% commission on the profits at sale. This ensures that they actively monitor the performance of your investment and keep it from being mishandled by art handlers or galleries.

Even with the fees, you can get started investing in art with only $20. They do not have minimum investment amounts and you can choose different offerings available to you as they are available.

Masterworks is transparent with its fees and policies, which makes it a great choice for those looking to invest in art without too much research or personal investment.

If Masterworks' terms sound appealing to you, be sure to check them out before investing elsewhere so that your money doesn't go to waste.

What to know before investing in art

It should only be a small part of your portfolio

Art may be a minor portion of a well-rounded investment portfolio for most people. You can profit, but you're incredibly unlikely to get a big return from art alone.

According to the experts, fine art investing should be around 10% to 20% of your portfolio. So if you have $100,000 to invest, $10,000 should be invested on art by using a platform like Masterworks (easiest method) or buying fine art yourself.

- Invest in multimillion-dollar paintings

- Attractive historical price appreciation

- Buy and sell shares on the secondary market

Consider it a real estate investment; it's not required. Don't rely on an art investment for long-term income. Remember that any profits will be taxed, since the IRS considers art a collectible.

Art is non-liquid

Art, like other non-liquid or illiquid assets, is a non-cash or illiquid asset. This implies it's difficult to turn into cash right away.

Liquid assets, such as equities, bonds, and savings accounts, create money more rapidly. Even if a piece of real estate or art has huge monetary value, selling it might take a long time because to its illiquidity.

Despite the fact that it is feasible to sell your work, most investors don't. An auction house, which is usually your best bet for selling, often charges significant costs. Since art prices are ever-changing, there are no assurances that selling will result in a profit.

When should you invest in art?

Here are some indicators that the benefit might outweigh the danger.

You enjoy art

First and foremost, you'll have a much simpler time profiting from art if you love it. If you spend hours every day looking at or creating art, then this probably is an investment that will benefit you.

You enjoy learning about different kinds of art

Keep in mind that investing in art is a lot like learning about the stock market. You need to read up on it before you decide if your risk tolerance and understanding are sufficient to invest.

You have a bit of extra money floating around

Investing in a piece of art is time-consuming and expensive, so you should have some extra cash on hand. If you don't have the money to spare for an investment, then buying isn't worth it.

You get pleasure out of investing

Art investors get satisfaction from knowing that their collection or one they've bought is appreciated by other people. Investing in art can be a hobby, so it should bring you happiness and provide an outside source of enjoyment. And if not, this might not be the investment for you.

You can afford the maintenance

Art collectors have more control over their assets, which can be appealing. However, you are responsible for maintaining the artwork in good shape, which implies monitoring factors like moisture and light exposure.

If you display the artwork, you'll need to make sure it's in good condition. If you store it, you'll have to pay for that as well. The cost of an authenticity certificate and insurance premiums add up when you total up your maintenance costs.

What to look for when buying art

Because the art world is vast, narrow down your search by selecting a genre or period that appeals to you. Then enlist the aid of an expert.

If you are new to buying art, find an experienced investor who can give you advice about your target artists. Look at the artist's previous works and check out critical reviews on his or her work.

Remember that some pieces are more valuable than others because of their condition, authenticity, provenance, rarity, time of purchase, and title.

It's important to do your research before you buy, so spend time looking at the artist's work and talking to experts.

What to look for when selling art

Find an expert who knows the ins and outs of the market and has strong relationships with both buyers and other experts.

Auctions can be a great place to sell artwork, but you'll need to work with them to prepare your pieces for viewing and transport. They also charge exorbitant fees; plus, there's no guarantee that you'll get a good price.

An art dealer can help you get more money for your work, but make sure that this person benefits from the sale. Some dealers will charge you if they sell your artworks for less than what they would have sold it at; others might take advantage of their inside knowledge to buy low and sell high.

Is fine art a good investment?

At the end of the day, this question is ultimately a matter of personal investment goals.

If you want a sure thing when it comes to your money, or if you don't have much cash to begin with, the odds are that art investing isn't for you. If you're a first-time investor, give your portfolio time to mature before leaping in.

An investment in a painting or sculpture may be an exciting way to diversify a portfolio for experienced, confident investors who are passionate about art and have additional cash to cover the expenses.

Is art the next breakout asset class?

Is your portfolio prepared for the next big stock market crash?

If you’re like the majority of investors out there, it probably is not. That’s because, more than a decade into this bull market, it’s become all too easy to become complacent, to assume that returns will always be there and that a traditional portfolio of equities and bonds will offer more than enough safety to weather any coming storm.

But that’s just not true.

Reuters has reported that global equities funds see their first outflows in 2021, and there are warning signs on the horizon. Remember, markets took a nosedive in 2020 during the coronavirus, and all of the gains so far this year have only got us back to even with where we were last summer.

What’s more, the experts are starting to worry. By July 2022, it is projected that there is probability of 9.06 percent that the United States will fall into another economic recession. This is an increase from the projection of the preceding month where the probability came to 7.08 percent. The U.S. recession probabilities are predicted a year in advance by using the difference between 10-year and 3-month treasury rates.

Whatever happens, investors today are facing new uncertainties about global trade, future returns, and more.

But there is a solution: art.

It’s true. While the S&P declined 5.1% in 2018, the art market returned 10.6%, and was called “the best investment of 2018” by the Wall Street Journal. Why is art so powerful as an asset class?

It’s noncorrelated

Asset correlation measures how investments move in relation to one another. At the most basic level, assets that move in the same direction at the same time are considered to be highly correlated, while those that go in opposite directions, with one going up when the other goes down, are considered to be negatively correlated.

When building a diversified portfolio with $25k to invest or $50k to invest, it’s important to include assets that are not correlated to the overall market in order to provide protection in the case of a downturn. The way to do this is by including some non-correlated assets, or those that are entirely isolated from the stock market, in your portfolio.

Art is the ultimate non-correlated asset. Whereas stocks can be very reactive to day-to-day news and swings, the art market is far slower to move, continuing to appreciate at a slow and steady pace no matter what the broader market does.

It’s resilient

The fall of 2008 was a dark time for world markets. Fresh on the heels of the unwinding of the subprime mortgage market, the collapse of investment bank Lehman Brothers in September 2008 turned a run-of-the-mill stock downturn into a full blown global financial crisis. That year, the S&P 500 fell by more than 37%.

Through this period, however, the art market was far more resilient. Yes, prices fell, but they were quick to rebound, despite the long hangover that dogged stocks for years. Based on MeiMoses, the leading art index at the time, from 2007 to 2009, auction prices fell by roughly 27.2%. Meanwhile, the S&P 500 fell 57% from its peak and hit a 12-year low in early March 2009. Through all this, art remained strong. In February 2009, for example, just five months after the collapse of Lehman Brothers, the sale of fashion designer Yves Saint Laurent’s collection brought in a record-breaking $483.8 million.

It’s global

Unlike most stocks and bonds, which are limited to the U.S. and other countries where those assets are traded, art is a global commodity. It can be bought and sold between collectors and investors anywhere on Earth, making it a truly worldwide market. Access to this large pool of potential buyers insulates the art market for country-by-country economic concerns and ensures a steady stream of new investment.

It’s in demand

As financial markets began to unravel in 2007 and 2008, demand for fine art soared to new heights. For instance, in 2005 roughly $630 million dollars flowed into the market for paintings sold at auction for $5 million or more. In 2008, however, the value of these masterpieces changing hands at auction nearly quadrupled to a record-breaking $2.2 billion.

And this hasn’t slowed down, either. By 2012, the market was already ahead of its 2008 peak and continued to grow to new heights, achieving a staggering $4.2 billion record for sales in 2015.

It outperforms the stock market

Plain and simple, art did better than stocks in 2020. While the last year was sharply volatile for most parts of the public market, the art market in 2020 looked remarkably similar to prior years.

Contemporary art has offered an annual return of 14% over the last 25 years, as of December 2020, versus a 9.5% annual return from the S&P 500, according to the Citi Global Art Market chart.

With these advantages in mind, Masterworks has become the first company to allow investors to buy shares of great masterpieces by artists like Picasso, Monet, and Warhol. For too long, access to these blue-chip art investments have been limited to the ultra-rich and connected.

No longer. Through fractional ownership, Masterworks has opened the door to top-tier, blue-chip art investments to everyone.

- Invest in multimillion-dollar paintings

- Attractive historical price appreciation

- Buy and sell shares on the secondary market

Investing in Art

You can start to get into the world of buying and selling art by starting small. Buy works over time and enjoy spending time going through the several factors of examing art and doing your due diligence. Join exclusive communities to learn about well-known artists and new artists to add to your art buying.

Also, follow all of the other tips in this guide to build a smart investment portfolio hat includes art. The profit potential of art investment is high, and a new or novice investor may find it quite gratifying. Though it should only be part of your entire portfolio, art may add value to other assets.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.