If the recent pandemic of COVID-19 has highlighted nothing else, it has shown the wisdom of living on a well-planned budget and how to save and manage one’s finances in this suddenly changed world.

Many times, other unforeseen occurrences may also happen. This could be the loss of jobs, sudden health conditions, or increased commodity rates which may cause undue anxiety as to how to survive the unfriendly situation. But the proper foresight to handle such scenarios is to manage your money and employ budget wisely.

The exciting thing is that you can always review your money management plans at any time. Interestingly, there are many mobile apps that serve as a tool in helping to manage one’s budget, save funds and get interest at the same time:

|

30-day free trial

|

|

|

Primary Rating:

5.0

|

Primary Rating:

4.8

|

|

Pros:

|

Pros:

|

|

Fees: 30-day free trial

|

Fees: $1/mo

|

- App Store: 4.8 – 146k reviews

- App Store: 4.8 – 652k reviews

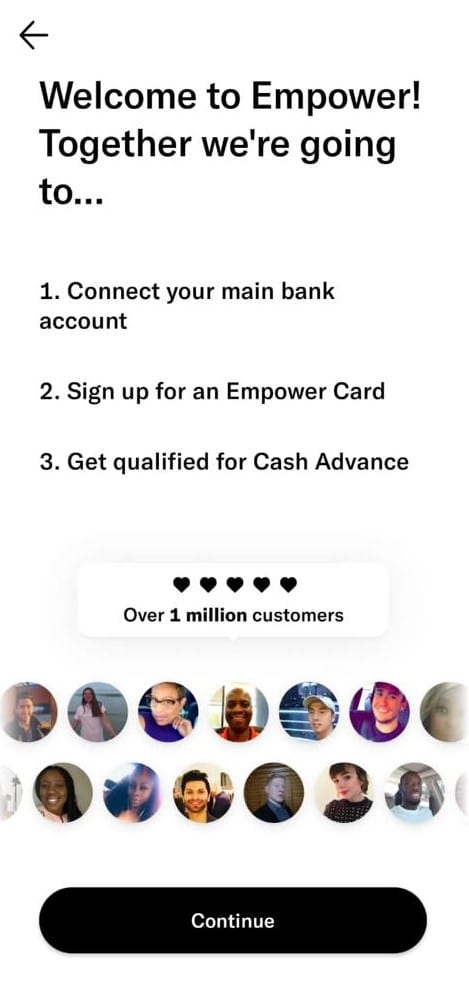

One such money management app is the Empower App.

Hence, this article explains how you can use the Empower App to manage your funds and know if it’s the right choice for you to manage your finances.

What is Empower?

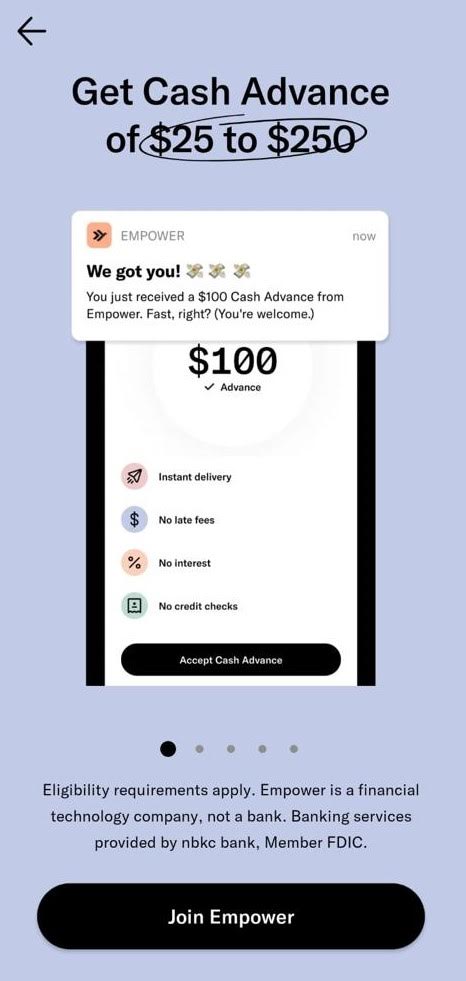

Empower is a mobile finance app designed to help users spend less and save more. It provides money management services online, thus making savings of funds seamless. For individuals who want to get a quick loan, Empower provides a cash advance of $250.

Interestingly, as it allows for these services, it does not take interest and does not sanction customers/users for late fees paid, including a non-mandatory requirement on credit checks. However, to enjoy these services, Empower will have to review your bank accounts to know if you are eligible.

What does it offer?

Well, Empower app makes budget scheduling and savings of one’s finances easy. Here are some of its key features:

- One of the best cash advance apps that offer $25 to $250 instantly

- Receive cashback rewards of up to 10%

- Faster payment of up to 2 days

- Monitor your spending

- Autosave with Empower

Empower Cash Advance

Empower's Cash Advance feature is a great way to get extra cash quickly. You can instantly get from $25 to $250 for emergencies without submitting credit card information. Although, you will have to pay the money back in your next salary.

For your eligibility to receive Cash Advance, Empower only needs to know your recurring direct deposits, average monthly direct deposits, and bank account history.

Other Apps that Offer Cash Advances

|

30-day free trial

|

|

|

Primary Rating:

5.0

|

Primary Rating:

4.8

|

|

Pros:

|

Pros:

|

|

Fees: 30-day free trial

|

Fees: $1/mo

|

- App Store: 4.8 – 146k reviews

- App Store: 4.8 – 652k reviews

Empower Thrive

Compared to other lines of credit offerings, Empower Thrive allows you to begin with $200 and grow to $1,000 with each payment. With Empower Thrive, payments made on time get 0% APR; late payments carry an APR of 35.99%.

Empower Autosave

The Autosave feature helps you set a plan for your financial goals automatically. Here, once you create a weekly saving target, Empower monitors how much you make and helps determine the amount to take out and when to take it. However, there’s no need to be scared about your funds as Autosave funds are FDIC insured through NBKC bank for up to $250,000.

Empower Card

You can easily make money with this feature when you use it at a qualifying merchant, as you can earn up to 10% cashback. With Empower Card, you are able to use your digital assets, like Apple Pay, Samsung Pay, or Google Pay.

With Empower card, you can get faster payments of up to two days and access over 37,000 ATMs across the United States. Interestingly, when you use Empower Card, there are no minimum balance, insufficient funds fees, and overdraft fees charges.

However, it would be good to note that Empower Card limits could be challenging. Withdrawals are limited to $500 a day, and spending is limited to $2,000 a day, depending on your spending habits. Also, keep in mind that throughout the first 30 days, you are only allowed to transfer, on average, $2,500, and afterward, $5,000.

Expense Tracking

Tracking your expenses is possible if you already have your data with Empower and select categories that best suit your lifestyle. It will help you know and see exactly what's going on and keep track of your situation.

For example, if your goal is to spend no more than $60 per week on kitchen purchases. Empower will track your purchases, and the app lets you know if you get close to $60.

As a result, regardless of any spending categories you choose, Empower will keep an eye on it for you. As part of the Express Tracking system, you'll also receive monthly reports showing how your money is being spent.

Interest Checking

With regard to interest-paying checking, Empower offers it. There is no guarantee that the APY will continue to be offered, however, it is good, since numerous checking accounts at traditional banks do not offer an APY or have reduced one.

Smart Recommendation

This feature by Empower helps users save money and better monitor their finances, as it comes with useful recommendations that can help you determine your financial goals based on your lifestyle and needs.

This feature also looks at your regular expenses like interest and phone bills to find better deals. If it does, you can even ask Empower to negotiate lower bills on your behalf. You can also find human, financial coaches on the app’s live chat. You can ask questions about your finances, and the coach will give you smart, personalized recommendations based on your situation.

For example, if you want to talk about whether you can afford an office space. The coach can assist you in going through your financial situation, including your debt-income ratio and a goal for a down payment, to help you determine the feasibility of your property ownership.

How much does Empower cost?

Empower only charges an $8 monthly subscription fee after you have enjoyed its 14-day free trial. In addition, you will only be charged a 1% foreign transaction fee if you get an Empower Card.

Furthermore, Empower won't charge you an overdraft fee and will refund your third-party bank's charges in the following cases:

- Any first overdraft fee caused by an AutoSave debit.

- First overdraft fees caused by Empower subscriptions fee.

- Charges associated with re-payments of cash advances.

How does Empower compare?

A close consideration of Empower’s impressive design makes it possible for users to take action within the app, making it unique from other financial saving apps. This app has a wide range of features, such as debt repayment, spending tracking, and transferring money.

For example, Mint.com assist in the payment of bills, and the creation of a monthly budget, but it does not have an Autosave feature as Empower sits above it in that aspect. Although, Empower’s drawback is that it doesn’t have an investment feature unlike a robust app like Mint.com.

Empower Pros and Cons

The following are the pros and cons of using the Empower App:

Pros

- No interest

- Monitors spending

- Up to 10% cash back on spending

- Offers debit card

- No credit check required

- No late fee

- Filled with various categories and budgeting

- Provides ease of linking personal bank accounts

- There is a $25,000 FDIC insurance limit on funds

- Your financial accounts can be easily connected to the app

Cons

- Low APY

- Foreign transaction fee

- The monthly fee is expensive

- Non-availability of critical bank features

- Have to be 18 years old or older

- Must have an alert-capable mobile phone in the U.S.

- To use the app, you must have a bank account at a U.S financial institution.

How do I open an account?

To open an account on Empower is clear and easy. You will have to go to Empower and click get started, then download the Android or the iOS app.

After downloading, the Empower app runs you through the onboarding process on what to expect; then, you can now sign up with your mobile number and receive an invitation.

Since the Empower app is a financial platform, you would be asked to provide the following details.

- Birth date

- Social security number

- U.S. mailing address,

Moreover, you will need to indicate how the account will be funded, which is usually done by transferring funds from your external bank account.

Is it safe and secure?

Yes, it is safe! Empower's banking services are provided by NBKC, a member of the FDIC bank, so you can rest assured that your finances are secure. Therefore, you are protected by the FDIC by up to $25,000 for any money transferred into your Empower account.

In addition, Empower uses end-to-end encryption (256-bit SSL) on its app and website. Customers can also set two-factor authentication to protect their accounts.

How do I contact Empower?

Empower provides phone, email, and live support. The phone line to reach is (888) 943-8967, and the email support is [email protected]. Meanwhile, you can always call their customer services between 9am – 6pm (PT) on Monday through Friday.

Is it worth it?

Yes, it is! Especially if you truly want to have control of your finances in this suddenly changed economy. Download the Empower App today and enjoy its unique features and user-friendly interfaces.

Empower app also supports syncing your financial institutions, banks, or credit cards, so you can easily access them when you need them. Simply select from a list of well-known financial institutions or search for the unlisted ones and you will be all set.

In fact, you can even connect to 401ks, cryptocurrency exchanges, credit cards, and more using the Empower app. It connects you with more than 10,000 financial institutions. However, keep in mind that linked accounts can take longer than three days to add, but rest assured your account data will remain intact once it has been successfully integrated.

Empower FAQS

No promo code is required. However, Empower will deposit $20 into your account if you refer a new user into your referral’s Empower account within two business days of successful referral completion.

You can get Cash Advance instantly if you meet the Empower requirement.

No! The service of Empower is only accessible via its mobile app.

No! Cashback is only available for retailers who have already activated their in-app perks. As far as in-app perks are concerned, only one is active at a time.

To get the Cash Advance, Empower would have to review your bank account details. The process involves checking if you receive at least three deposits of $1,000 plus income from the same employer and that you can maintain an account balance of $100. Once you meet this requirement, you will be eligible to receive up to a $250 Cash Advance.

Conclusion

Empower offers a lot of amazing and helpful features with its user-friendly interface. Users will appreciate that it provides a money management feature, allows user to see all their accounts in one place, and its affordable rate.

For those seeking a tool that helps them manage their finances, having access to independent financial advice from human financial coaches, and a feature that helps negotiate bills is a great asset to have and harness.

To that effect, you can sign up for 30 days and use the app and opt-out should in case you decide the app isn’t for you.

Empower features

Here are the following features you would find on Empower app:

| Cash Advance Limits | $25 to $250 |

| Early Direct Deposit | Up to 2 days |

| Cash Back Rewards | Up to 10% |

| Foreign Transaction Fee | 1% |

| Branches | None |

| Monthly Fees | $8 (after a 14-day trial) |

| Overdraft Fee | $0 |

| Mobile Check Deposits | None |

| Cash Deposits | None |

| Card Spending Limits | $2,000 per day |

| Transfer Limits | First 30 days: $2,500Day 31 and beyond: $5,000 |

| ATM withdrawal Limits | $500 per day |

| ATM Availability | 37,000+ within the US |

| Mobile App Availability | Mon-Fri, 9 am – 6 pm (PT) |

| Customer Service Email | [email protected] |

| Customer Service Number | (888) 943-8967 |

| Bill Pay | Unclear |

| Promotion Code | None |

- Up to $250 Instant overdraft coverage

- With Instant, you can overdraw your Albert Cash account up to your Instant limit

- Costs $14.99 per month after a 30 day free-trial