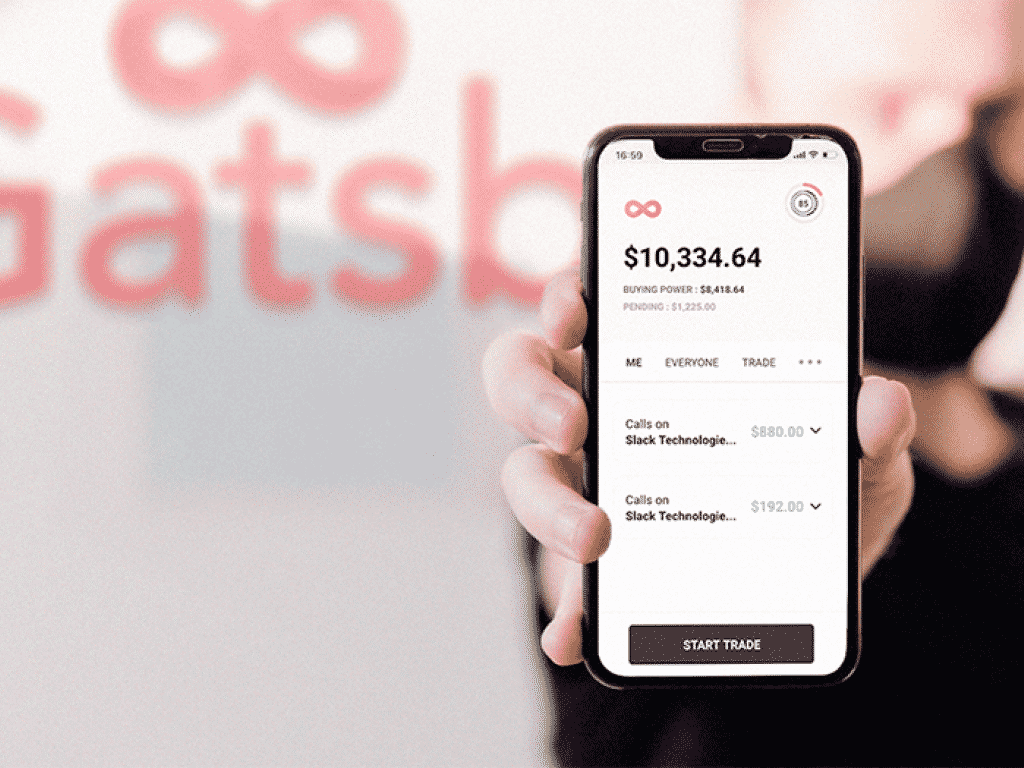

Gatsby is an options brokerage app that allows investors to buy or sell ETFs and stock shares with as little as $10 in their account.

I've been using the app for about a couple of weeks, making several options trades (even made $500 fast with one NIO call option).

Nevertheless, I've got a pretty good sense of the options app after using it, reading Gatsby Reddit reviews, and if it would be a viable option for some leverage on your investments or just to make speculative trades.

In this article, I'll go over Gatsby and compare it to another free trading app you may have heard of called Robinhood.

Let's jump right into this Gatsby app review.

What is Gatsby?

- Commissions: $0 per trade / $0 per contract

- Product Name: Gatsby Options

- Min Investment: $10

- Account Type: Traditional

Unlike traditional brokers who are known to charge between $1-100 per contract, Gatsby is completely commission-free. For example, TD Ameritrade still charges a $0.65 per contract option fee but is better overall if you're investing large amounts of money.

Not being required to pay commissions means you retain all your investment returns. In other words, you get to keep all the money you earn, and that gives you the opportunity to invest even more. This comes in handy since those commissions can really add up.

Plus, this options trading platform will even reward you for trading. After just two weeks of trading options, I was pleasantly surprised with a Gatsby Reward Earned, I got a $5 Amazon gift card sent to my inbox:

It's a great little gift card hack and can be seen as a way to get paid to trade. However, Gatsby doesn't offer a free stock for signing up like other Robinhood alternatives.

What are options?

Options are financial instruments that are derivatives based on the value of underlying securities such as stocks. An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they choose not to. Call options allow the holder to buy the asset at a stated price within a specific timeframe. Put options allow the holder to sell the asset at a stated price within a specific timeframe.

If you’re still learning about options trading, you don’t have to worry about getting puts and calls confused.

Gatsby labels each button with either a thumbs up or a thumbs down; the ‘puts’ button has a thumbs down to indicate that you believe the stock will fall, while the ‘calls’ button has a thumbs up to indicate the opposite.

This is one of the ways that Gatsby eliminates the tough terminology that comes with options trading. After all, why make an already complicated task even harder?

Who is Gatsby it for?

The Gatsby app is suitable for Level 2 options traders or people who want to take a more active approach to investing.

Although its friendly user interface and low capital requirement is attractive to beginners and experienced traders alike, it's recommendable to have background knowledge about options trading before signing up.

However, if you are investing over $50,000, you'll likely want to use a platform like TD Ameritrade for trading options. As this app doesn’t give you investment advice; it only provides brokerage services. TD Ameritrade provides not only the tools but guidance and learning guides for trading options, forex, commodity trading, and equities.

This app is also not recommended for someone who wants to earn a passive income. While some stocks, like dividends, generate money with minimal effort and generally bring you returns in the long-term, options trading requires active participation and works within a short timeline.

Sometimes you can invest and make money daily. But it's a risky game that isn’t the right fit for everyone, but Gatsby tries to make the process as simple as possible for anyone who’s interested.

How do you sign up for Gatsby?

To qualify for the app, you must be a citizen or permanent resident of the United States of America who is over the age of 18 and has a permanent address in the United States.

This is because signing up requires you to input information such as your personal phone number, your social security number, online bank details, and permanent address.

This is for accountability purposes for the app. Having this information allows it to prevent financial crimes like money laundering.

The app will also ask you a few other questions which will help it determine what type of trader you are so it can provide a more personalized experience.

How do you start trading on Gatsby?

After signing up, you can start trading with Gatsby by linking your bank account to the app and depositing money to trade with.

Gatsby uses Plaid, an inbuilt system, for its transactions and accepts a variety of money transfer options.

These include: ACH deposits, micro-deposits, wire transfers, and checks.

Withdrawing funds on Gatsby takes a minimum of 5 business days.

What are the pros of the app?

- Gatsby makes options trading simple by removing the commissions and the jargon.

- Trade options with your friends, earn Gatsby Rewards points on every trade you do.

- You can track breaking news and see important alerts, and never pay any commissions or contract fees.

- Get started now with just $10.

What are the cons of the app?

- Despite the app’s assertion that it can be used anywhere, it can only be used by Americans who live in the country.

- It only offers Level 2 trading, which may seem rudimentary to more advanced traders.

- It’s not compatible on some Android devices.

- Advanced options strategies like selling put options are not yet available.

Gatsby vs. Robinhood

In addition to allowing investors to buy and sell options just like Robinhood, Gatsby provides a social network that lets you see other users’ trading preferences. Its social media-like layout shows you whether other traders are buying calls or puts, which companies they’re trading, and at what time.

It also displays a tab with recent news updates on specific companies you’re interested in – this way you’re well-informed before investing any of your money. The best thing about this type of layout, however, is that it lets you observe trends, which may help in crafting better trading strategies. So how did I get all this information? I simply clicked on a company’s profile. Yes, it was that simple!

What is Robinhood? Robinhood is a free investing app for your phone. I really mean free all around – free to join and they don’t charge any fees to buy or sell the stock. You can get a share of stock like Apple, Ford, or Sprint for free when you join through this link. The value of the free share may be anywhere between $2.50 and $200 and fluctuates based on market movements. You’ve got nothing to lose.

With Robinhood, you get more investment options such as actually buying and selling stock, buying crypto, and more advanced options trading strategies. However, Gatsby will likely include advanced trading options later on.

But if you are interested in strictly trading options, it really depends on what you like. If you're a beginner, go with Gatsby as it's so simple to use. Speaking of simplicity, Gatsby has a user-friendly interface that’s easy to navigate whether you’re using iOS or Android. One of its features is the search bar, which gives you the choice to look up individual companies you wish to buy or sell contracts of. Once you’re on the company’s profile, you’re presented with an options chart that shows the company’s performance over a certain period. Two buttons prompting you to either ‘buy puts’ or ‘buy calls’ are directly below the chart.

If you're a more advanced options trader, then you have more bells and whistles with Robinhood. Robinhood offers free stocks, options, ETF and cryptocurrency trades, and its account minimum is $0, too. The investing app does not offer mutual funds and bonds as only taxable investment accounts are available. To chalk it up, if you're looking to limit costs or trade crypto, Robinhood is a solid choice.

Effortless Ways to Invest Money

Is it worth it?

Let’s do a quick recap: Gatsby is a trading app that focuses exclusively on options trading. Options trading differs from stock trading mainly because it works on a contract basis, has expiration dates, and requires greater strategy to achieve success. It has four different levels of trading, of which Gatsby operates on the second. Options trading is a gamble with high risks, but it also has a potential for high yields.

Options involve a high degree of risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses.

Gatsby’s interface is easy to use and semi-interactive. It simplifies options trading for its users, making it suitable for both beginners and advanced traders. The ability to see what and how other investors are trading can provide insight into which strategies to consider. The app also doesn’t charge commissions, which means the user will receive their returns in full. Unfortunately, the app comes with several pitfalls, including only being available for US users.

While it offers news coverage on companies and insight into trading preferences of other users, the app doesn’t provide any investment advice. Overall, this app seems to be geared towards intermediate traders – someone who isn’t a total beginner but isn’t too advanced either. But ultimately, you get to decide whether Gatsby is truly great or not.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.