We need to address an unpleasant problem in this country, the student loan crisis. This debt crisis has grown way out of control, affecting millions and millions of individuals. The current total amount of federal student loan debt in the United States is over $1.76 trillion. You guys, that's just mind-boggling.

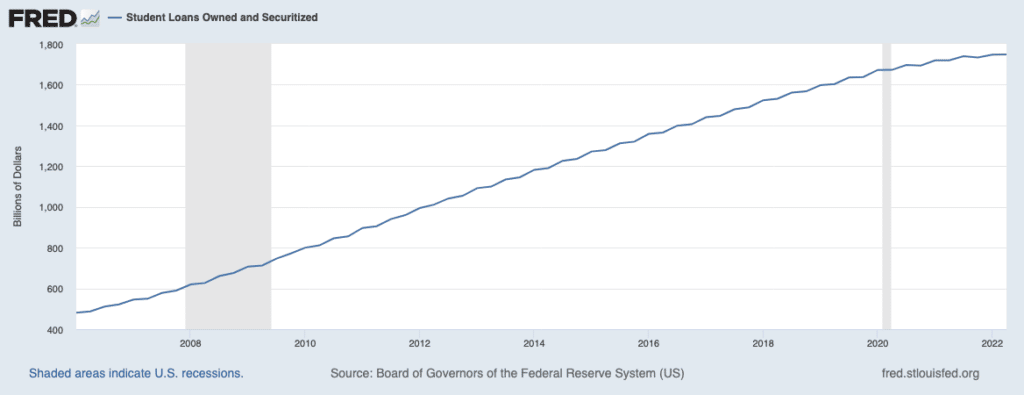

Total student loans have more than doubled in the last 10 years. The chart below shows that total student loans have climbed from $800 billion in 2010 to about $1.76 trillion today (that’s a trillion with a T).

How to Overcome the Student Loan Crisis

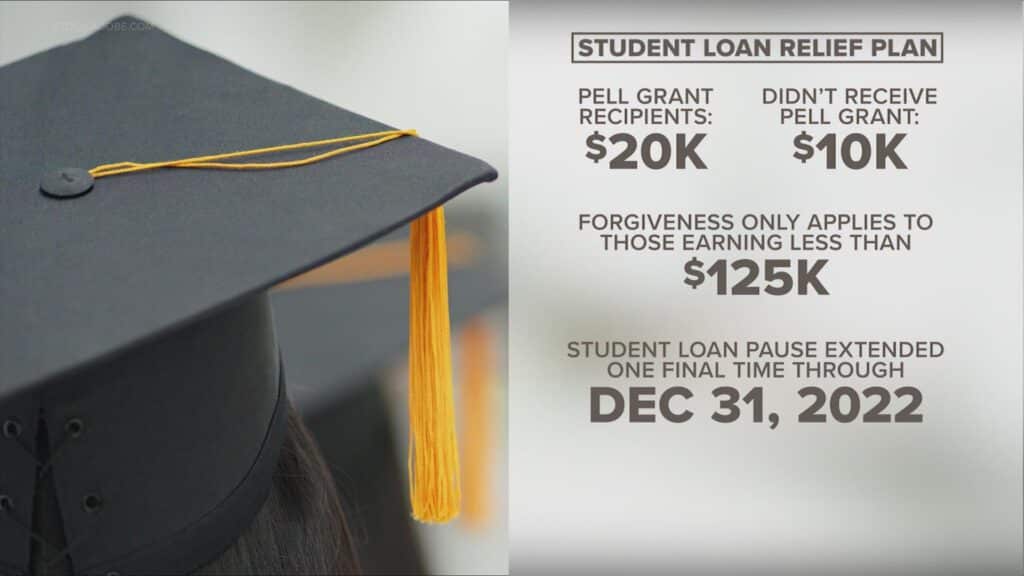

However, this year, there has been a lot that the Biden-Harris administration has done to combat the student loan crisis with the Student Loan Relief Plan.

Final Student Loan Pause Extension Through December 31

In August 2022, the U.S. Department of Education (Department) announced a final extension of the pause on student loan repayment, interest, and collections through December 31, 2022. Borrowers should plan to resume payments in January 2023.

You are free to continue making payments on your loans during the payment pause. Until the payment pause ends, you can pay more or less than your regular payment amount. You will not be billed. You may not be able to resume auto-debit payment during the payment pause.

The Biden-Harris Administration's Student Debt Relief Plan Explained

President Biden, Vice President Harris, and the U.S. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires. This plan includes loan forgiveness of up to $20,000. Many borrowers and families may be asking themselves “what do I have to do to claim this relief?” so I can get out of student loan debt. Here are the steps to take:

Step 1: Check if you're eligible

You're eligible for student loan debt relief if your annual federal income was below $125,000 (individual or married, filing separately) or $250,000 (married, filing jointly or head of household) in 2021 or 2020.

- $20,000 in debt relief: If you received a Pell Grant in college and meet the income threshold, you'll be eligible for up to $20,000 in debt relief.

- $10,000 in debt relief: If you did not receive a Pell Grant in college and meet the income threshold, you'll be eligible for up to $10,000 in debt relief.

Step 2: Prepare

Here's what you can do to get ready and to make sure you get our updates:

- Log in to your account on StudentAid.gov and make sure your contact info is up to date. We'll send you updates by both email and text message, so make sure to sign up to receive text alerts. If it's been a while since you've logged in, or you can't remember if you have an account username and password (FSA ID), we offer tips to help you access your account.

- If you don't have a StudentAid.gov account (FSA ID), you should create an account to help you manage your loans.

- Make sure your loan servicer has your most current contact information so they can reach you. If you don't know who your servicer is, you can log in and see your servicer(s) in your account dashboard.

Step 3: Submit your application (when available)

The application will be available online by early October 2022.

Get details about one-time student loan debt relief.

Stats on the Student Loan Crisis

Average Student Loan Debt (Forbes)

- $1.75 trillion in total student loan debt (including federal and private loans)

- $28,950 owed per borrower on average

- About 92% of all student debt are federal student loans; the remaining amount is private student loans

- 55% of students from public four-year institutions had student loans

- 57% of students from private nonprofit four-year institutions took on education debt

Private Student Loan Portfolio (Forbes)

- $131 billion in outstanding private student loan debt

- Only 7.6% of all education debt comes from private student loans

- 89% of private loans are owed for undergraduate degrees; 11% are owed for graduate school

- 92% of undergraduate private loans are co-signed, 66% of graduate private loans required a co-signer

- Essentially all private loans (99.9%) require school certification, a process where the school confirms the borrower’s student status and cost of attendance

The student loan debt crisis is growing and interest rates on these loans continue to rise.

The problem is only getting worse. Every year, more and more students are taking out loans to pay for college. And every year, the amount of debt they're graduating with is increasing.

There are a number of factors contributing to this crisis. The cost of tuition has been rising faster than the rate of inflation for many years. And in recent years, there has been a decrease in funding for need-based financial aid.

This has created a situation where more and more students are taking out loans to pay for college. And as the cost of tuition continues to rise, the amount of debt they're graduating with is increasing.

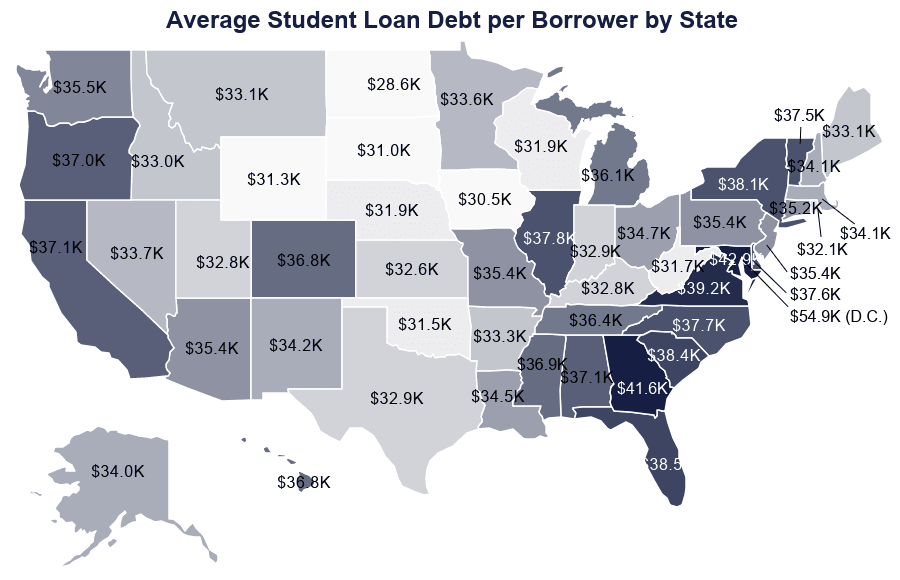

And the states with the most debt are staggering:

Three Causes of the Student Loan Crisis

1. Automation is Replacing Millions of Jobs

Automation is replacing jobs at a faster rate than in the past. Technology creates new jobs but the new jobs can’t keep up. For example, the American Trucking Association estimates that there are about 3.5 million truck drivers in the U.S., but driverless trucks could start replacing them over the next few years.

Automation will replace millions of blue-collar jobs (think retail as well), but it doesn’t stop there. Many white-collar jobs are at risk such as accountants, airline pilots, and pharmacists. Improving robots and software are starting to take over more of our tasks with better accuracy.

With the wave of automation replacing jobs, more people are pushed into advancing their education. Most of the new jobs created require more education.

Automation is ultimately making our lives easier but it’s one of the biggest causes of the student loan bubble. In fact, we’re entering a new economic paradigm and other potential solutions such as Universal Basic Income are gaining traction.

2. Stagnant Wages

Another outcome of automation is stagnant wages. When factoring inflation into the equation, our purchasing power is about at the same level as it was 40 years ago. But even worse, most of those gains have gone to the highest-paid workers.

True wages haven’t budged much for most Americans. But university costs, on the other hand, are climbing at a rate well above inflation. This makes it harder for average Americans and families to pay for student tuition. As a result, more students are taking out loans than ever before.

3. Government Meddling

The federal loan program was created with great intentions. But in practice, it’s helped spur the student loan debt crisis.

Most loans offered don’t take into account the field of study and job prospects after graduation. Some of the lowest paying degrees include: Studio Arts ($40,000), Social Work ($39,000), and Counseling/Psychology ($29,000).

How can we expect these workers to pay back student loans when some of the loans are higher than their annual income? It doesn’t make financial sense. But the government has indirectly encouraged bad student loan behavior and even encouraged it.

The artificial demand for higher education has pushed college costs up faster than inflation. As a result, universities have increased spending on administrative salaries and campus amenities. Inflation-adjusted tuition and fees have increased by 230% at state colleges and universities, and by 164% at community colleges since 1980.

Universities are feeding off vulnerable students that taking out student loans. Many students don’t understand how student loans work and the debt compounds. The interest payments alone are near impossible for some graduates to pay off… Maybe make a mandatory finance class for all freshmen?

Student Loan Bubble Won’t Burst Like the Housing Collapse

Student loans are the second largest amount of debt behind mortgages. But unlike the housing bubble in 2008, the student loan bubble won’t burst the same way.

The housing debt crisis was backed by current, tangible assets (houses). When borrowers defaulted on their mortgages, banks could reclaim the houses. But with the student loan debt crisis, the degrees can’t be taken away. The loans were given out in hopes that the students' future income could pay them off.

The mechanics aren’t the same for the student loan bubble. This is an important consideration and due to the three trends listed above, I don’t foresee a slowdown in the growth of total student loan debt. There might be a slight drop during the coming recession… but higher education is necessary to survive in our changing economy. That’s unless the government comes up with other “well-intentioned” policies.

What's the Real Return on Your Student Loan Debt?

In this country, it is ingrained in our brains at a very young age that it is either university or you will be working at McDonald's. Generations before us, or our parent's generations, there were jobs all over the board to be had.

Return on this college degree investment, back when our parents graduated made it a worthwhile endeavor. Now there are more college graduates than employment opportunities in every industry.

BLS predicts that between 2012 and 2022, the U.S. will see a net increase of 15,628,000 jobs. But of that number, only 4,230,500 will require a minimum of a college degree. Crippling student loans would only be worthwhile if you make sure you have a job offer lined up after college. Private student loan companies hand out loans to anyone with a pulse, and interest rates are more than 4%.

These rates increase year after year, not to mention that colleges and universities increase tuition 6% year after year. Tuitions have risen across the board 1000% by 1978. Colleges offer a multitude of majors with virtually no employable opportunities, colleges offer new editions textbooks every semester just to take more money out of your pocket.

Higher education has become one of the most profitable business models in the country. The fact that everyone is basically entitled a student loan, some of which do not have the ability to pay after college remains me of the subprime mortgage crisis. This is basically the way it is designed, the trillion-dollar debt is all by design. The majority of college students graduating are enslaved to their debts, being forced to postpone a costly wedding, buying a home, and children.

Got Student Loans? You Have Options

The silver lining to this story is that more millennials are pursuing higher education, even if they are taking out loans to do so. Some economists are troubled by the fact that fewer people under 30 are buying homes and other goods as more are paying for college, but higher education is, on the whole, a solid place to put your money.

In 2017, the median earnings for young adults with bachelor's degrees were 50 percent higher than those of their counterparts with high school diplomas. But for many members of Generation Debt, the benefits of having a diploma may seem a long way off.

If you want to learn more about your student loan options, here are some good student loan resources to consider:

- Want to pay off your student loans and need an actual repayment plan? Here’s everything you need to know to get started.

- Looking for the top rated student loan refinancing companies? Find out the top rated student loan refinancing companies.

- In a position where you actually NEED more student loans? If so, do it the right way. Here’s how to find the best private student loans.

- Up to $250 Instant overdraft coverage

- With Instant, you can overdraw your Albert Cash account up to your Instant limit

- Costs $14.99 per month after a 30 day free-trial