Have crippling student loan debt? Here are ways you can legally stop paying student loans. It may be worth your time to see if you qualify.

More than 40 million Americans have student loan debt. Of those borrowers, 5.6 million owe more than $50,000. That kind of crushing five-figure debt can take a real financial and mental toll.

You probably heard about student loans being discharged and now you are looking all around the internet if there are any legitimate student loan forgiveness programs available out there so you can stop paying student loans.

Is it too good to be true?

While looking for the real ways to get them discharged and quit paying student loans you also have to watch out for student loan forgiveness scams. There are a lot of them claiming they can get your debt forgiven, which is usually not the case.

There are also the legitimate ones that can guide you through the whole application process that helps you take advantage of any federal programs that might be available for you. So before you stop paying so you can avoid student loans sold to a collection agency you should learn about your forgiveness options.

Student loan forgiveness options have been around for some time now when President Obama reformed part of the Direct Loan program in 2010 by signing the Health Care and Education Reconciliation Act of 2010.

Student Loan Forgiveness programs have been set into place in order to help aid former students in paying for their education following graduation (sadly, these programs are only applicable to students with federal student loans, not private student loans).

Getting loan forgiveness is a lengthy process that only applies under certain circumstances.

How To Stop Paying Your Student Loans

Besides making more money or laughing at student loan memes, you may feel like your options are limited. Here are legitimate programs that could help you get your loans forgiven:

1. Student Loan Relief Plan

If there is anything you should know about student loans and how to get them paid off is the Student Loan Relief Plan.

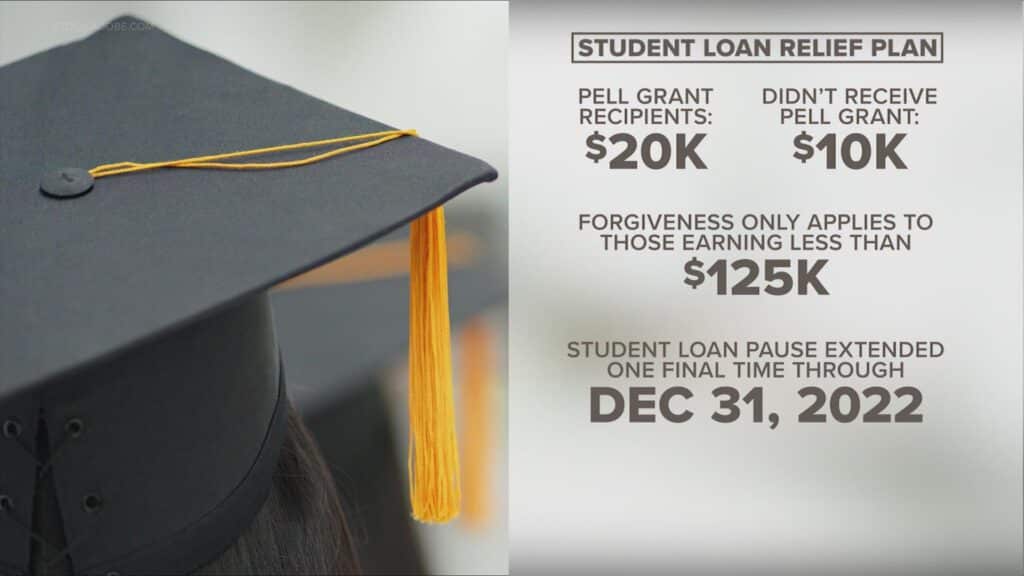

This year, there has been a lot that the Biden-Harris administration has done to combat the student loan crisis with the Student Loan Relief Plan.

Final Student Loan Pause Extension Through December 31

In August 2022, the U.S. Department of Education (Department) announced a final extension of the pause on student loan repayment, interest, and collections through December 31, 2022. Borrowers should plan to resume payments in January 2023.

You are free to continue making payments on your loans during the payment pause. Until the payment pause ends, you can pay more or less than your regular payment amount. You will not be billed. You may not be able to resume auto-debit payment during the payment pause.

The Biden-Harris Administration's Student Debt Relief Plan Explained

President Biden, Vice President Harris, and the U.S. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires. This plan includes loan forgiveness of up to $20,000. Many borrowers and families may be asking themselves “what do I have to do to claim this relief?” so I can get out of student loan debt. Here are the steps to take:

Step 1: Check if you're eligible

You're eligible for student loan debt relief if your annual federal income was below $125,000 (individual or married, filing separately) or $250,000 (married, filing jointly or head of household) in 2021 or 2020.

- $20,000 in debt relief: If you received a Pell Grant in college and meet the income threshold, you'll be eligible for up to $20,000 in debt relief.

- $10,000 in debt relief: If you did not receive a Pell Grant in college and meet the income threshold, you'll be eligible for up to $10,000 in debt relief.

Step 2: Prepare

Here's what you can do to get ready and to make sure you get updates:

- Log in to your account on StudentAid.gov and make sure your contact info is up to date. We'll send you updates by both email and text message, so make sure to sign up to receive text alerts. If it's been a while since you've logged in, or you can't remember if you have an account username and password (FSA ID), we offer tips to help you access your account.

- If you don't have a StudentAid.gov account (FSA ID), you should create an account to help you manage your loans.

- Make sure your loan servicer has your most current contact information so they can reach you. If you don't know who your servicer is, you can log in and see your servicer(s) in your account dashboard.

Step 3: Apply for Federal Student Loan Debt Relief

Apply today here (but no later than Dec. 31, 2023).

Filling out the application is easy and takes about 5 minutes. You don’t need to log in or provide any documents.

Application is open, but debt discharge is paused. As a result of a court order, they are temporarily blocked from processing debt discharges. They encourage you to apply if you are eligible. They will continue to review applications.They will quickly process discharges when we are able to do so and you will not need to reapply.

2. Enroll in Income-Driven Repayment

Most federal student loans are eligible for at least one income-driven repayment plan. If your income is low enough, your payment could be as low as $0 per month.

An income-driven repayment plan sets your monthly student loan payment at an amount that is intended to be affordable based on your income and family size. You can enroll in four income-driven repayment plans:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

If you’d like to repay your federal student loans under an income-driven plan, you need to fill out an application.

3. Public Service Loan Forgiveness

Available for Direct Loans.

If you are employed by a government or not-for-profit organization, you may be able to receive loan forgiveness under the Public Service Loan Forgiveness Program.

The PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

To qualify for PSLF, you must

- Work for a government agency or for certain types of nonprofit organizations

- Work full-time for that agency or organization

- Have Direct Loans (or consolidate other federal students loans to qualify)

- Repay your loans on an income-driven repayment plan

- Make 120 qualifying payments

Think you are eligible? You can use the PSLF Help Tool to assist you in starting the Employment Certification Form that you will eventually print, complete, and submit.

Learn more about the PSLF Program to see whether you might qualify.

4. Total and Permanent Disability Discharge

Total and Permanent Disability Discharge is available to federal student loan borrowers who are disabled and unable to engage in any substantial gainful activity (employment) because of physical or mental impairment.

The discharge would provide you with relief on your student loans by removing the debt completely that is under your name. You must be able to prove to the Department of Education (DoE) that you are in fact permanently disabled.

Few options to prove your disability

- If you have received a notice of award for SSDI or SSA you can submit this to the DoE to review. The notice must state that you are permanently disabled, as well as having your next review between 5-7 years. If your next review is less than 5 years, you will not qualify for a disability discharge.

- Your physician can submit a certified form stating that you are totally and permanently disabled. The physician would need to state what is your disability, how long it is expected to last, and whether he or she believes you are unable to engage in gainful activity due to your disability.

- If you are a veteran, the Veterans Affairs office can provide documentation to you that you are unemployable due to a service-related injury.

Your disability must have lasted, or is expected to last at least 60 months, or is expected to result in death.

5. Employer Assistance

If you are not eligible for federal programs, you may get lucky if your employer can help with those payments.

According to a report from Debt.com, about 4% of employers help their employees with their student loan payments. That number is going to increase next year.

All that it takes? Simply asking your employer if they offer assistance with student loan repayment.

The worst they can say is no.

6. Serve Your Country

If you are a veteran and served your country then you may be eligible for student loan forgiveness. Each branch has its own set of requirements and rules so it's worth checking out.

If you didn't serve, you can also benefit by volunteering your time with AmeriCorps or Peace Corps which can also grant loan forgiveness.

7. Closed School Discharge

Available for Direct Loans, FFEL Program loans, and Perkins Loans.

The closed school discharge program is available if you attended a school that closed while you were enrolled or if you withdrew 120 days before the school’s closure. (Note that the period changed from 90 days to 120 days as of July 1, 2014).

Only loans received at least in part on or after January 1, 1986, may be discharged. FFEL and Direct Stafford loans, PLUS, and Perkins loans are eligible. Consolidation loans are trickier. A consolidation loan usually consists of a number of underlying loans.

If any of these underlying loans could be canceled, you can apply for a closed school cancellation for these loans only. If granted, you will receive a credit for the amount of the underlying loans related to the closed school.

Learn about the eligibility requirements for closed school discharge and how you can apply.

8. Borrower Defense to Repayment

Available for Direct Loans.

The Obama administration introduced the Borrower Defense to Repayment (BDR) rule as a way to provide debt relief to students defrauded by their school.

The legislation was prompted by the closing of Corinthian Colleges, which left approximately 16,000 students with debt and no degree. Although borrowers have been able to seek loan forgiveness from fraudulent colleges since 1995, BDR makes the application process much easier.

For-Profit Schools went through several investigations between 2010 and 2016. What the investigations revealed that in some cases the colleges had over 50% dropout rate, they were overcharging students, using illegal recruitment tactics, misleading students about their accreditation and especially job placement.

Some colleges were even encouraging students to forge documents to get approved for loans they should never have gotten. At this point, these schools have cost the taxpayer around $24 billion dollars.

In the six months prior to leaving office, the Obama administration forgave nearly 28,000 loans.

Learn about borrower defense to repayment process, eligibility requirements, and how to apply.

9. Discharge Due to Death

Available for Direct Loans, FFEL Program loans, and Perkins Loans.

Federal student loans will be discharged due to the death of the borrower or of the student on whose behalf a PLUS loan was taken out.

Learn more about discharge due to death and what documentation is needed for discharge.

10. Discharge in Bankruptcy (in rare cases)

Available for Direct Loans, FFEL Program loans, and Perkins Loans.

In some cases, you can have your federal student loan discharged after declaring bankruptcy. However, discharge in bankruptcy is not an automatic process.

Learn about the process required to have federal student loans discharged in bankruptcy.

11. False Certification Discharge

Available for Direct Loans and FFEL Program loans.

You might be eligible for a discharge of your federal student loan if your school falsely certified your eligibility to receive a loan.

Learn about false certification discharge to see if you qualify and how to apply.

12. Unpaid Refund Discharge

Available for Direct Loans and FFEL Program loans.

If you withdrew from school and the school didn’t make a required return of loan funds to the loan servicer, you might be eligible for a discharge of the portion of your federal student loan(s) that the school failed to return.

Learn more about the unpaid refund discharge to see if you might qualify.

13. Forgery Discharge

Available for Direct Loans, as well as FFEL Program loans and Federal Perkins Loans held by the U.S. Department of Education.

Forgery is the creation of a false written document or alteration of a genuine one, with the intent to defraud. Victims of identity theft are frequently also the victims of forgery.

If you believe you were the victim of forgery, you might be eligible for a discharge of federal student loan(s) fraudulently made in your name.

Learn more about the forgery discharge to see whether you might qualify.

Differences Between Forgiveness, Cancellation, and Discharge

The terms forgiveness, cancellation, and discharge mean nearly the same thing, but they’re used in different ways. If you’re no longer required to make payments on your loans due to your job, this is generally called forgiveness or cancellation. If you’re no longer required to make payments on your loans due to other circumstances, such as a total and permanent disability or the closure of the school where you received your loans, this is generally called discharge.

It’s important to remember that outside of the circumstances that may qualify you to have your loans forgiven, canceled, or discharged, you remain responsible for repaying your loan—whether or not you complete your education, find a job related to your program of study, or are happy with the education you paid for with your loan. Even if you were a minor (under the age of 18) when you signed your promissory note or received the loan, you are still responsible for repaying your loan.

How to Apply For Forgiveness

Contact your loan servicer if you think you qualify. If you have a Perkins Loan, you should contact the school that made the loan or the loan servicer the school has designated.

Loan Payments During the Application Review Period

Depending on the type of forgiveness, cancellation, or discharge you’re applying for, you may have to make payments during your application review. Check with your loan servicer to find out whether you must continue making payments during the application review period.

My Application Was Approved

If you qualify for forgiveness, cancellation, or discharge of the full amount of your loan, you are no longer obligated to make loan payments. If you qualify for forgiveness, cancellation, or discharge of only a portion of your loan, you are responsible for repaying the remaining balance.

If you qualify for certain types of loan discharge, you may also receive a refund of some or all of the payments you made on the loan, and any adverse information related to your delinquency or default on the loan may be deleted from your credit record. If the loan was in default, the discharge may erase the default status. If you have no other defaulted loans, you would regain eligibility for federal student aid.

My Application Was Denied

If your application was denied, you’ll remain responsible for repaying your loan according to the terms of the promissory note that you signed. Talk to your loan servicer about repayment options if you have a Direct Loan or FFEL Program loan. Check out repayment options.

If your loan is in default, visit Getting Out of Default to find out how to begin repaying your loan and your options for getting out of default.

If you believe that your application was denied in error, contact your loan servicer for more information.

Should I Refinance My Student Loans?

You should avoid refinancing if you want to qualify for federal forgiveness programs.

Federal loans offer federal forgiveness programs that’ll help you pay off your student loan debt. The list below is a quick view of the types of forgiveness, cancellation, and discharge available for the different types of federal student loans.

| Type of Forgiveness, Cancellation, or Discharge | Direct Loans | Federal Family Education Loan (FFEL) Program Loans | Perkins Loans |

|---|---|---|---|

| Public Service Loan Forgiveness | X | X* | X* |

| Teacher Loan Forgiveness | X | X | |

| Perkins Loan Cancellation (includes Teacher Cancellation) | X | ||

| Total and Permanent Disability Discharge | X | X | X |

| Death Discharge | X | X | X |

| Bankruptcy Discharge (in rare cases) | X | X | X |

| Closed School Discharge | X | X | X |

| False Certification Discharge | X | X | |

| Unpaid Refund Discharge | X | X |

Or, if you want a repayment plan based on your income.

An income-driven repayment plan sets your monthly student loan payment at an amount that is intended to be affordable based on your income and family size. You can qualify for four income-driven repayment plans:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

If you’d like to repay your federal student loans under an income-driven plan, you need to fill out an application here.

If you refinance your loans through a private company you will no longer be eligible for income repayment plans.

But, you should refinance your student loans if you meet the following:

As soon as you have a stable income (and good credit)

As soon as you have a stable income and the ability to repay student loans you are likely eligible to refinance your student loans and save money.

It would be best if your credit score is high. That is because products for refinancing student loans are just like other types of loans: loan providers approve and provide amounts based on credit history. Thus, when you have plans to refinance a student loan, you should bolster your credit months before your effort.

If there are inaccuracies in the report, you should immediately seek corrections to remove accounts from your credit report. Your good credit standing would qualify you for more competitive rates and lower fees.

If you have loans with high interest rates

Two types of loans could be tapped: federal and private student loans. Logically, federal loans come with lower rates but the requirements could be stricter. You may also consider refinancing loans with longer terms, which come with lower rates. Many competitive private loan providers also offer more attractive rates and costs.

You have multiple, expensive loans

If you have multiple loans over $10,000 then it makes sense to look into refinancing options. Many lenders can help you consolidate multiple loans into one manageable monthly payment.

After grace periods

Many federal student loans offer a grace period for the first six months after you leave school. You don’t have to make monthly payments on your loans during this period.

This is very helpful in allowing you time to find employment in order to be able to repay the student loans. After the grace period is over, it is wise to look into refinancing options.

Am I ready to refinance?

Compare the best lenders to refinance student loans like SoFi, Earnest, Laurel Road, Commonbond, or LendKey:

- Easy online application

- 0.25% APR discount with autopay

- No hard credit pull required

- Customized loan terms

- Instant interest rate estimate

- Incomplete degrees are accepted*

- No hidden fees

- 0.25% rate discount with AutoPay

- Graduate, Parent PLUS, private loans

Ready to Get Out of Student Loan Debt?

With the options available there is a high chance that you could get out of student loan debt or more formally get your student loan debt forgiven, it is just a matter of taking the time and knowing your options.

Wow that’s awesome