Earnest offers student loan refinancing and private student loans for undergraduate and graduate students. It stands out for its flexible repayment options.

- Customizable payments and loan terms.

- Option to skip one payment every 12 months.

- You can see if you’ll qualify and what rate you’ll get without a hard credit check.

- Minimum credit score requirement of 650.

- No co-signer option for refinancing student loans.

Saving thousands of dollars on your student loan debt seems ideal, and that's just what Earnest promises. Is it legit, though? Earnest is a technology-enabled fintech lender, headquartered in San Francisco that offers personal loans and student loan refinancing.

But is it the right student loan refinancing company for you? Let's find out, together in our Earnest review.

Earnest Reviews

Earnest promises they can lower your rate, then allow you to customize and manage your payments online. They offer flexible payments and federal and private student loans are eligible with radical flexibility. Users save on average $30,939.

Heard enough? Head over to Earnest and check your rate in 3 minutes to see how much you can save.

Who is Earnest Best For?

Earnest is best suited for those who are just coming out of school and have little to no credit history. They have a lot of options for students and other individuals that are looking for a small loan and they have very unique flexibility.

For example, you can set your own monthly payments and change between fixed and variable rates without any fees. Earnest has lower than average rates in the industry (click to view comparison rates).

Find the Right Student Loan For You

- Easy online application

- 0.25% APR discount with autopay

- No hard credit pull required

- Customized loan terms

- Instant interest rate estimate

- Incomplete degrees are accepted*

- No hidden fees

- 0.25% rate discount with AutoPay

- Graduate, Parent PLUS, private loans

Visit Earnest to learn all of their options to see what they have for you.

Earnest Refinance Loan Details

Loan Amounts and Terms

Earnest will refinance loans as low as $5,000 (or $10,000 in California). The maximum amount you can refinance is $500,000. Loan terms are available between 5 and 20 years. You can get a solid repayment timeline fit to your own schedule, which is nice.

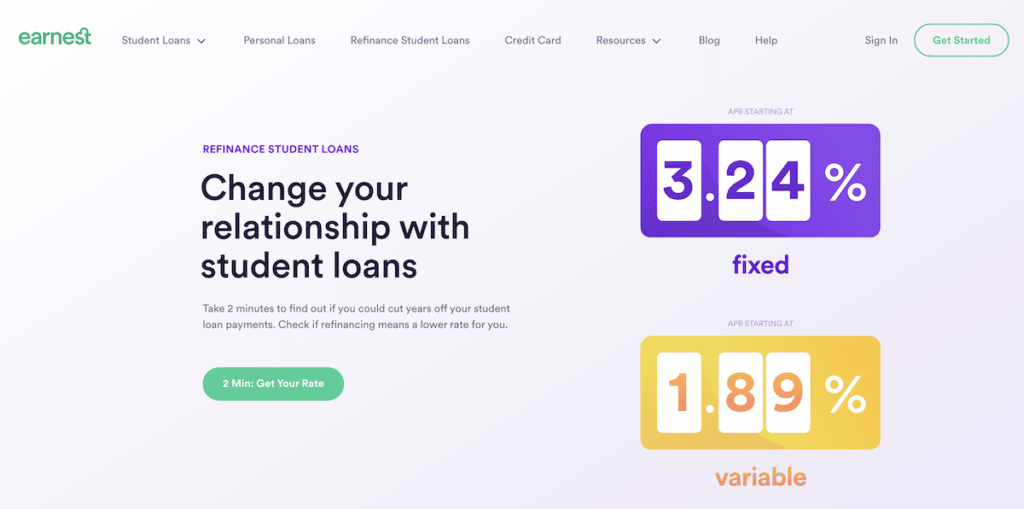

Earnest offers both fixed-rate and variable-rate loans. With a fixed-rate loan, your interest rate will never change over the life of your loan. Variable-rate loans start with a lower interest rate than fixed-rate loans, but may increase or decrease over time based on changes to an index rate.

Earnest does not provide refinancing loans to borrowers in Kentucky or Nevada.

Loan Costs and Fees

Earnest's variable rates start at 1.89 percent and rise to 7.99 percent and its fixed rates begin at 3.24 percent and rise to 7.99 percent (including the autopay discount). The best brates are only accessible to the most credit-worthy consumers and come with a 0.25 percent auto pay discount when paying using a checking or savings account. Earnest does not charge any origination fees, late penalties, or prepayment costs on their refinanced loans, much like their private student loans.

Repayment Options

Earnest offers only standard repayment options for refinancing. As soon as your previous student loan is paid off, you'll start making full payments to Earnest. You may be able to halt your loans for a limited time if you have a verified hardship. You could also put off payments if you enroll in grad school or join the military. During the time your loan is paused, interest will continue to accrue.

Noteworthy Perks and Features

You can also save money by refinancing or consolidating your student loans with Earnest. Like their private loans, refinanced debts come with a number of perks: one payment every twelve months can be skipped, and you get a 0.25% rate discount if you enroll in autopay. Other features include career support and a cosigner option, plus:

- Lower rates through better data. They use data other lenders don’t—like your savings patterns, investments, and career trajectory—to give you the rate you deserve.

- Customization to your budget & timeline. Precision Pricing saves money for student loan clients by using your budget to determine a unique rate and term—down to the month.

- Seamless from start to finish. Apply online, then manage your account payment preferences with our intuitive dashboard.

- Expert in-house service. They have an in-house Client Happiness team is available via call, text, or email for student loan clients.

Earnest Eligibility

To qualify for refinancing student loans with Earnest, you will need to have a credit score of at least 650 and be able to prove that you have an adequate income to pay off the loan.

Earnest offers student loan refinancing and private student loans for undergraduate and graduate students. It stands out for its flexible repayment options.

- Customizable payments and loan terms.

- Option to skip one payment every 12 months.

- You can see if you’ll qualify and what rate you’ll get without a hard credit check.

- Minimum credit score requirement of 650.

- No co-signer option for refinancing student loans.

How to Contact Earnest

You can reach Earnest at (888) 601-2801 Monday through Friday between 8 a.m. and 5 p.m. PST by phone or email them at [email protected].

Pros

- Customizable payments and loan terms.

- Option to skip one payment every 12 months.

- You can see if you’ll qualify and what rate you’ll get without a hard credit check.

Cons

- Minimum credit score requirement of 650

- No co-signer option for refinancing student loans

Should You Refinance with Earnest?

If you're considering refinancing your student loans, you may be wondering if Earnest is the right lender for you. Here are a few things to keep in mind as you compare your options:

- Earnest offers competitive rates and terms. When it comes to refinancing your student loans, you'll want to find a lender that offers competitive rates and terms. Earnest definitely fits this bill – in fact, their rates are some of the most competitive in the industry. In addition, they offer flexible repayment terms so you can choose a plan that fits your budget.

- They have a great reputation. Another important factor to consider when choosing a lender is their reputation. You'll want to make sure you're working with a reputable company that has a history of satisfied customers. Earnest definitely fits this bill – they have an excellent reputation and their customer reviews are overwhelmingly positive.

- They're easy to work with. Last but not least, you'll want to make sure you're working with a lender that is easy to work with. The last thing you want is to get bogged down in paperwork and bureaucracy. Fortunately, Earnest is known for being quick and easy to work with – so you can get the process of refinancing your student loans started as soon as possible.

So, should you refinance your student loans with Earnest? If you're looking for a competitive rate, flexible repayment terms, and an easy application process, then the answer is definitely yes!

Earnest offers student loan refinancing and private student loans for undergraduate and graduate students. It stands out for its flexible repayment options.

- Customizable payments and loan terms.

- Option to skip one payment every 12 months.

- You can see if you’ll qualify and what rate you’ll get without a hard credit check.

- Minimum credit score requirement of 650.

- No co-signer option for refinancing student loans.

When Should You Refinance Student Loans?

There are a number of reasons why you might want to refinance your student loans. Perhaps you’re looking for a lower interest rate, or you want to switch from a variable-rate loan to a fixed-rate loan. Maybe you’re hoping to shorten your loan repayment term or consolidate multiple loans into one.

No matter what your reasons for wanting to refinance are, it’s important to make sure that refinancing is the right move for you. Below, we explore when it might make sense to refinance your student loans and offer some tips on how to get started.

- When interest rates are low. One of the most common reasons to refinance student loans is to secure a lower interest rate. This can save you money over the life of your loan, and it can also make your monthly payments more manageable. If you have a variable-rate loan, refinancing to a fixed-rate loan can also provide some much-needed stability and predictability when it comes to your monthly payments.

- When you want to consolidate multiple loans into one. Another reason to consider refinancing your student loans is if you have multiple loans that you’d like to consolidate into one. This can simplify the repayment process and may even help you qualify for a lower interest rate.

- When you want to extend or shorten your repayment term. If you’re looking to save on interest costs, shorten your repayment term, or both, refinancing can be a good option. Keep in mind, though, that extending your repayment term will likely result in higher overall interest costs.

- When you want to release a cosigner from your loan. If you have a cosigner on your student loan and you want to release them from the loan, you may be able to do so by refinancing. This can be especially beneficial if you’ve improved your credit score since taking out the loan or if you now have a steady income.

When Not to Refinance Student Loans

You shouldn't always refinance your student loans. Sometimes it can make sense to do so, but there are also times when it can end up costing you more money in the long run. Here are a few things to consider before you decide whether or not to refinance your student loans.

- When you’re not eligible for a better interest rate. If you don’t think you’ll qualify for a lower interest rate by refinancing, it probably doesn’t make sense to do so. Keep in mind that your interest rate is just one factor to consider when refinancing – there are others that are important as well (more on that below).

- When you can’t afford the monthly payments. Before refinancing, be sure to consider what your new monthly payments will be. If you can’t afford them, it’s probably not worth refinancing. You don’t want to end up in a situation where you’re struggling to make your loan payments each month.

- When you might need to access forbearance or deferment. If you think there’s a possibility that you might need to access forbearance or deferment at some point during the life of your loan, it might not be wise to refinance. That’s because most private lenders don’t offer these options (federal loans do).

- When you have federal loans with unique benefits. If you have federal student loans, there are some benefits that you might lose if you refinance them with a private lender. These include things like access to income-driven repayment plans and student loan forgiveness programs.

- When you’re close to paying off your loans. If you only have a few years left on your loan repayment term, it might not make sense to refinance. That’s because you won’t recoup the costs of refinancing (closing costs, origination fees, etc.) before you pay off your loan.

Earnest offers student loan refinancing and private student loans for undergraduate and graduate students. It stands out for its flexible repayment options.

- Customizable payments and loan terms.

- Option to skip one payment every 12 months.

- You can see if you’ll qualify and what rate you’ll get without a hard credit check.

- Minimum credit score requirement of 650.

- No co-signer option for refinancing student loans.

Tips for Refinancing Student Loans

Shopping around for student loan refinancing lenders? You’re not alone. In fact, according to a new study from LendEDU, nearly 1 in 4 student loan borrowers are considering refinancing their loans. The top reason is? To save money, of course.

The study found that the average borrower could save $18,668 by refinancing their student loans. And, more than half of the respondents said they would be “very likely” to refinance if they could save just $10 per month on their payments.

If you’re thinking about refinancing your student loans, here are a few things to keep in mind:

- Shop around. When you’re ready to refinance your student loans, shop around and compare rates from multiple lenders. This will help you ensure that you’re getting the best deal possible.

- Consider all the costs involved. In addition to interest rates, be sure to consider all of the costs involved in refinancing before making a decision. This includes things like origination fees, closing costs, and prepayment penalties (if any).

- Read the fine print. Before signing on the dotted line, be sure to read the fine print of your loan agreement carefully. This will help you avoid any unpleasant surprises down the road.

- Compare apples to apples. When you’re comparing rates from different lenders, be sure to compare apples to apples. In other words, make sure you’re comparing loans with the same repayment terms, interest rates, etc.

- Keep your old loan in place. If you’re not sure whether or not refinancing is the right move for you, consider keeping your old loan in place and taking out a new one to refinance just a portion of your debt. This will help you minimize risk if things don’t work out as planned.

Compare Lenders

Compare the best lenders to refinance student loans like SoFi, Laurel Road, Commonbond, or LendKey:

- Easy online application

- 0.25% APR discount with autopay

- No hard credit pull required

- Customized loan terms

- Instant interest rate estimate

- Incomplete degrees are accepted*

- No hidden fees

- 0.25% rate discount with AutoPay

- Graduate, Parent PLUS, private loans

Earnest Review Summary

Earnest student loan refinancing can be a great way to save money on interest costs, lower your monthly payments, or both. However, it’s important to understand the pros and cons of refinancing before making a decision. Be sure to shop around and compare rates from multiple lenders before moving forward. And, as always, be sure to read the fine print carefully before signing on the dotted line.

What to know about student loans?

Sure you can learn how to budget in college, but the major thing that'll help out most borrowers is how to tack student loans after graduation or even before.

If you want to learn more about student loans before refinancing student loans with Earnest, here are some good student loan resources to consider:

- Want to pay off your student loans and need an actual repayment plan? Here’s everything you need to know to get started.

- Looking for the top rated student loan refinancing companies? Find out the top rated student loan refinancing companies.

- In a position where you actually NEED more student loans? If so, do it the right way. Here’s how to find the best private student loans.

Earnest offers student loan refinancing and private student loans for undergraduate and graduate students. It stands out for its flexible repayment options.

- Customizable payments and loan terms.

- Option to skip one payment every 12 months.

- You can see if you’ll qualify and what rate you’ll get without a hard credit check.

- Minimum credit score requirement of 650.

- No co-signer option for refinancing student loans.

Do you have any tips for refinancing student loans? We’d love to hear from you!

- Up to $250 Instant overdraft coverage

- With Instant, you can overdraw your Albert Cash account up to your Instant limit

- Costs $14.99 per month after a 30 day free-trial