Do you have a college student budget? If not, there is no better time to start saving than today. College students can benefit from having a college budget, actively saving money into a savings account, and accounting for fixed and variable expenses in a monthly budget. If you don't have a college student budget, now is the time to start one. A college budget can help you manage your money so that you have enough to cover your expenses and still have money left over for fun.

Learning how to budget in college shouldn't be hard. Follow along, step-by-step, as we walk budgeting beginners through the process of budgeting. Do you ever look at your paycheck stub and wonder where all that money went?

Making and maintaining a budget is an important step in managing your finances. Keeping careful track of your income and expenses can curb impulse spending and help you attain your financial goals.

Best part? It's not that hard. Continue reading to learn how to start your college student budget.

Why You Need a College Student Budget

My friend, when I was in college the last thing I was thinking about was budgeting. I was more concerned about making new friends, attending social mixers, studying for exams, or ways to make money as a student.

I soon realized that budgeting allows you to create a spending plan for your money (the little that college students have). This ensures that you have enough money for things that you need and that are important (rent, books, fun, partying, beers). Following a budget can also help you stay out of debt or work your way out of debt *cough* student loans *cough*.

Got it?

Next, Define Your Financial Goals

Whether you are an adult going back to college, currently in high school, or currently a college student it's important to define your financial goals.

Smart financial goals include ways to save money and live cheap — especially while in college. This can help you build savvy financial skills that will stick with you in your later years.

Some typical financial goals that college students should strive for are:

- Make a budget and living by it

- Pay off credit card debt

- Save an emergency fund

- Strive for early retirement

- Live below your means

- Develop skills to improve your income

- Save for your children's education

- Become a homeowner

Next, once you have your goals in mind you can build your budget in easy steps.

Budgeting Tips That Improve Financial Decisions

When it comes to budgeting, there are a lot of helpful tips and tricks that can help you make the best financial decisions for your unique situation. However, with so much information out there, it can be hard to know where to start. If you're feeling overwhelmed by your finances and aren't sure where to begin when it comes to creating a budget, consider these tips to help get you on the right track.

Developing Financial Literacy

Many young students have to make the tough decision right out of high school whether or not to take out student loans to attend college or university. While trade schools remain a popular, more affordable option for getting into the workforce sooner, many students believe that a degree is essential to success. Because of this, a large portion of people entering college is forced to take out student loans, whether they truly understand the student loan crisis or what they’re getting into or not.

Millennials have continued to exhibit an astonishingly low level of financial literacy, taking on long-term debt while regularly overdrawing their checking accounts at the same time. Many young people consciously go further into debt by racking up spending on credit cards while they still have massive student loans hanging above their heads. This is often done to simply support a basic lifestyle or to quickly obtain big-ticket items like computers and televisions in the hopes that they will generate enough income down the road to pay them off without too many consequences.

This consistent failing of financial literacy litmus tests doesn't bode well for millennials, as these negative spending habits tend to stick with people no matter how much money they end up making in the long run. Millennials are by and large not a lazy sect of American society by any means, either. The rise of the “grind culture” among millennials is evidence of a clear desire to become successful. However, large, long-term debts often keep many from their goals, despite all their hard work.

Create a Financial Plan and Stick to It

The best way to avoid having to work endless side hustles well into old age is to develop a solid financial plan. Paying off existing long-term debt like student loans should take priority when it comes to financial planning, as the interest on long-term debt puts the biggest damper on the ability to actually save money. Seeking employment through public service is a good idea, as it often offers up loan forgiveness, and it is always wise to avoid extending the grace period in which loans aren’t being paid off.

If somebody doesn’t pay back their student loans, it can have lasting, harmful impacts on their financial health. While student loan delinquency can wreak havoc on someone’s credit score, it's when people default on their student loans that things really start to get bad. Loans and all accrued interest may become immediately due; the debt may be referred to collections companies; and perhaps worst of all, a school might withhold academic records until the debt has been paid.

Because of all of this, adopting an aggressive loan repayment plan as possible is recommended. A good exercise for people learning the ropes of financial literacy is to try doing a trial balance of their finances. A term often used in the accounting world, a trial balance involves tabulating all of your expenses, financial statements, and sources of income for a month. This will let you know if your income can support your lifestyle.

Once an individual has developed how to budget (even on low income) that specifically addresses long-term debt, people can begin to build savings goals. A budget helps people to stop living from paycheck to paycheck, allowing them to save as much as possible for their retirement and, barring that, have enough money to start an emergency fund.

Make Healthy Spending Habitual

It’s no wonder that the U.S. has a financial literacy and savings problem, a few states require any sort of financial education in high school. This results in unhealthy spending habits like living outside of one’s means in order to have experiences that are seemingly worth their investment.

However, living outside of one’s means is not a tenable plan for financial success, and though the people attending music festivals throughout the year will certainly have memories that will last a lifetime, their bank accounts will be less prosperous.

This unhealthy spending can lead to unnecessary financial stress, leaving people feeling overwhelmed. People who engage in unhealthy spending habits regularly might find themselves struggling to keep up with credit card and student loan payments, and they often have virtually no money set aside in case of an emergency. Healthy spending habits are developed by learning how to actually have money and making sure that it can be held on to.

Writing down financial goals both short and long term is a fantastic way to add some structure to financial planning. Saving up for retirement can seem a bit nebulous, but attaching expectations and experiences to the idea of retirement can spur improved financial health. Asking for help from professionals or taking financial planning courses through a college or even the local library can give people the leg up they need to become healthy spenders.

How to Budget in College in 7 Easy Steps

Budgeting may seem like a daunting task, but it doesn't have to be! By following these seven easy steps, you'll be on your way to creating a budget even when your income varies.

1. Getting started

The first step to making a budget is figuring out how much money you currently have as well as how much money you typically spend in a month (on food delivery, Netflix, etc). Obtain a copy of your last month’s bank statements, checking accounts, savings accounts, and credit card statements. Make sure the statement you are looking at has at least an entire month’s span for a typical month. Using a budgeting app at this stage makes the process much easier.

Here are a couple more rules to follow before choosing:

- The budgeting app should be simple to use. No need to get fancy — you should be able to download and start using your budgeting app without any major complications. Creating a monthly budget should be easy but if you need a tutorial to get started — use another one.

- It should be cheap or free. When you are looking to create a monthly budget — don’t spend any money and start saving money. There are a lot of apps out there that are free and allow you to budget without cutting into your budget. Start with something simple and cheap and stick to it!

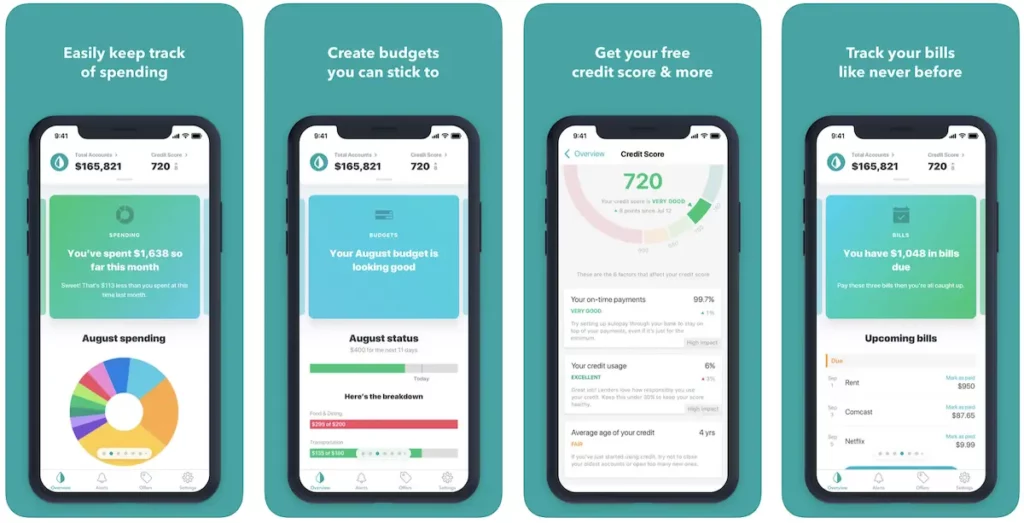

A great budgeting app to start budgeting is Mint.

Mint is one of the most popular financial management applications among money-savvy individuals looking to handle their money better. Mint offers its users the opportunity to link in their investment accounts along with the budgeting tools that they offer. However, they are primarily known for the great work that they have done with making it easy to keep track of spending, create budgets you can stick to, and you can track your bills with ease. It is also 100% free to use.

2. Categorizing expenses

Once you have a budgeting spreedsheet in place or are using a budgeting app like Mint, you can start to categorize your expenses. Starting with your checking account, go through your statement and categorize the expenses withdrawn from your account. Do the same with all of your credit card statements as well as all other accounts that you normally deposit income or withdraw expenses from. Track your cash as well. If you don’t know exactly what your cash went to, track your cash withdrawals instead. After you’ve categorized your expenses, total each category. You can do this manually or within a budgeting app based on its features.

3. Making categories

The next step is to divide your expenses into sections. These are the four recommended sections, and you may need to adjust the sections as appropriate.

- Fixed essentials. These are expenses that are necessary and have the same monthly payment. Examples of fixed essentials are mortgages or rent, car loan payments, personal loan payments, and insurance payments.

- Variable essentials. This category is for expenses that are necessary but that don’t always have the same amount monthly. Some examples include payments for gas, water, electricity, and groceries.

- Fixed non-essentials. Items in this category are not necessary, but they have a fixed monthly expense. Examples are cable, subscription fees, and other membership fees.

- Variable non-essentials. In this last category, items are not necessary with varying payments every month. These expenses tend to be most difficult to predict and include dining out, entertainment, and the incidentals.

4. Totaling expenses and income

Once you’ve added up all the expenses in your categories, you’ll know approximately how much you spend every month barring any financial emergencies. This number is your total expenses. You should also add up your sources of income to find your total income. This includes your paycheck and any other forms of support such as government support, alimony, and child support.

5. Income vs. expenses

Now it’s time to see how your income matches up with your expenses. Subtract your total expenses from your total income. If the difference is a positive number, you're doing a good job!

This means that you’re generally spending less than you make every month. If you have any debts, this may be a good time to start paying them back. Putting money into savings apps like Acorns or Qapital is also a great way to help plan for your future.

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

If, however, the difference between your total expenses and your total income is a negative number, that means you’re typically spending more than you make in a typical month, and changes in your expenses may need to be made.

Take a look at your expense categories, with the non-essential categories first. You may need to trim some expenses that are not necessary. In fact, you may even find that some expenses you thought were essential may be in fact non-essential. For example, expenses such as gas for your car may be cut down or made non-essential if you take up public transport.

6. Creating an allowance

Knowing what your income and expenses are will help determine what you can spend on the non-essentials. After determining how much is going to go into savings, create an allowance. Know what part of your income can go towards your non-essentials, and don’t spend more than you have budgeted.

7. Maintaining your budget

Now that you have a working budget, stick to it. Review your budget every month for the next three months to ensure that you haven’t forgotten to add expenses. Once your budget is on track, continue to review it every few months.

Ensuring that you are spending only what you can afford will help avoid late fees, keep you out of debt, and make saving money and making beer money a reality. Creating and keeping a budget is an essential part of planning for your future.

Tips for Budgeting in College

When you're in college, money is often tight. You may have to live on a shoestring budget, which can be tough. But don't despair – there are ways to make college life more affordable. Here are eight tips for budgeting in college:

- Make a budget. As detailed above, the first step to successful budgeting is creating a budget. Determine how much money you have coming in (from scholarships, grants, loans, part-time jobs, etc.) and how much your regular expenses are (tuition, books, rent, food, etc.). Then, see what's left over and decide how to best use that money. Budgeting apps can make this process a lot easier.

- Track your spending. Once you have a budget, it's important to stick to it. Track your spending by keeping receipts or logging purchases in a notebook. This will help you stay on track and make better financial decisions.

- Cut costs where you can. There are plenty of ways to cut expenses and costs in college. For example, you can cook your own meals instead of eating out, buy used textbooks instead of new ones, and live in a less expensive apartment or dorm.

- Find scholarships and grants. One great way to save money in college is to take advantage of scholarships and grants. There are many sources of financial aid for college students, so be sure to do your research.

- Work part-time. If you can swing it, working part-time while in college can help you cover some of your costs. Just be sure to factor in the time commitment when creating your budget and course schedule. Consider online jobs that provide better flexibile terms.

- Live at home. Living at home with your parents or guardians can save you a lot of money on rent and other living expenses. If this is an option for you, it's worth considering.

- Use student discounts. Many businesses offer discounts to college students. When making a purchase, always ask if a student discount is available. You may be surprised at how much money you can save.

- Be mindful of your credit. Use credit cards wisely and avoid accruing too much debt. Pay your bills on time and keep track of your spending. College is a great time to start building good credit habits. You can use credit building apps to help you as well.

College Student Budget Summary

Both millennials and Generation Z are the most highly educated generations that the United States has ever produced. Unfortunately, this pursuit of higher learning comes with a much higher price tag than previous generations had to contend with. The high cost of attending college and university leaves many students stretching to make ends meet.

Even with assistance from family or hard-earned scholarships, many people don’t make it out of college debt-free. While some may be lucky enough to land a high-paying job directly out of college, many still struggle to keep up with loan payments, keeping their dreams of success out of reach. However, with proper planning and financial education, budgeting for college and beyond can be made less painful.

Start your own budget today now that you know how to make a budget with these 7 easy steps!