Budgeting is often viewed as a scary thing for many American families who see it as a way to spend less and not have any fun. No more eating out, shopping, or spending money on entertainment.

It can be even worse when you are budgeting on a fluctuating income or budgeting on a low income. Whether you have a fluctuating income, learning how to budget with a variable income is possible.

Budgeting doesn't have to mean that you no longer have a life. Instead, it allows you to track your money coming in and out. You can still budget to go out to eat, go shopping or spend on anything else. Learning how to budget your paycheck allows you to build a plan for your money.

Choosing a Budgeting System

Choosing how you want to budget is up to you. The 4 main ways are tracking by pen and paper, spreadsheet, free online software, and financial software.

- Pen and paper: Call it old school, but this method is a proven way to track your expenses. Simply jot down all your income and expenses and if they're in sync — you're in good shape.

- Spreadsheet: Another way to track your budgeting is by using spreadsheets like Google Sheets (Free) or Microsoft Office Excel. There are many free budgeting templates you can choose from available online to get you started.

- Free Online Software: I use Empower to manage my budget because of the vast array of free tools it offers. Not only can you manage your budget, but you can track your net worth, set money goals, and track every penny that's spent daily. You can see a bunch of free online budgeting apps here and choose one that fits your needs.

- Financial Software: This would include software that you purchase and download onto your desktop computer such as Quicken.

Creating a Budget

Budgets will vary across the different generations, as a Millennial will primarily focus on paying off debt and a baby boomer is likely to be inching towards retirement. Spending and income levels also greatly vary. However, the one thing that is constant is the method one uses to create a budget.

Step 1: Set Goals

Setting realistic savings goals is an important first step. Take a minute to sit and reflect on what your short-term financial goals are and long-term. Both are important and go hand in hand with each other on a daily basis. The money that you are saving today will be how much you have later in life.

Here are some common examples of financial goals:

- Start an emergency fund

- Get out of debt

- Save for retirement

- Become a homeowner

- Pay off your car

- Pay off student loans

- Plan for fun

If you're in debt then your primary goal should be to pay off your debt. If you're already debt-free, you would try and max out your retirement accounts.

For example, this year the IRS has increased the maximum employee 401(k) contribution limit to $20,500 per year. Try and hit that goal so later on in life, you'll be better suited for retirement.

Step 2: Calculate Your Income and Expenses

Once your financial goals are in order and you have a target you are reaching for it makes sense to make adjustments so you can reach them. Your next step would be to calculate how much income you are bringing in and how much you spending each month.

Your income would consist of your salary, any side gigs that bring income, freelancing jobs, or random beer money that comes in.

Your expenses would be fixed expenses (rent, mortgage, car payment, utility bills), variable expenses (groceries, gas), and discretionary expenses (entertainment, movies, dinners).

The overall goal is to keep track of your finances and know what money is coming in and what money is coming out.

Step 3: Analyze Your Spending and Balance Your Checkbook

Ultimately you want to analyze your finances and ensure that your expenses don't surpass your income. If so, you're living beyond your means and that's not a wise financial move.

If you're overspending, usually you would trim the discretionary spending and then the variable expenses. There are a lot of ways to trim your spending, you can use money-saving apps that do all the work for you.

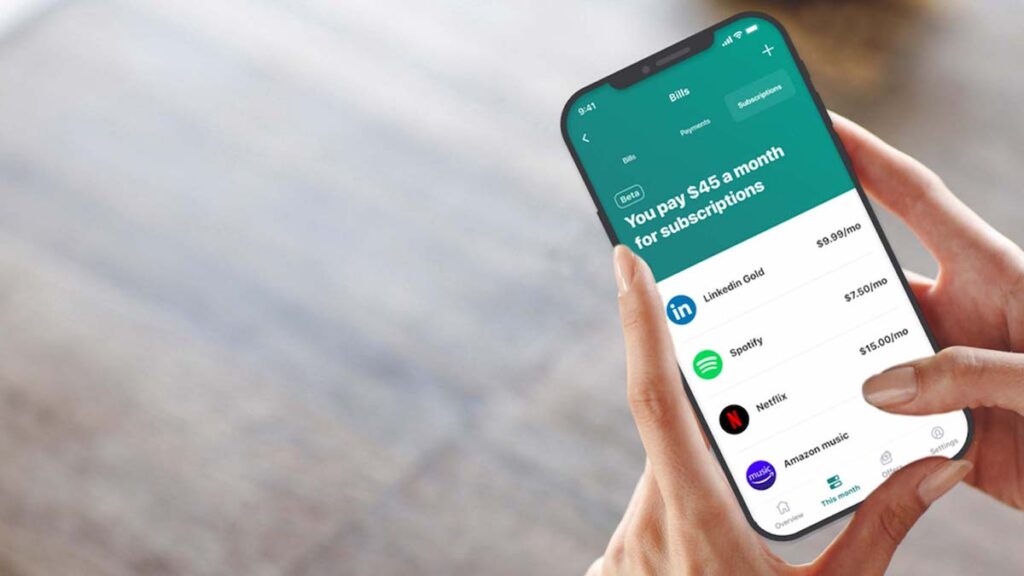

Services like Rocket Money make canceling subscriptions effortless, eliminating the need to negotiate the process on your own.

For Rocket Money to lower your bill, you'll upload a copy of your most recent bill with one of the service providers or connect directly to your online account. Then, you'll provide information about the service you're already receiving. After that, Rocket Money will negotiate a lower rate for you.

Step 4: Revisit Your Original Budget

Once your budget is set, revisit it after a month to see if you are closer to your goals. Many financial experts recommend saving 20% of your income every month.

For example, if you were to follow the popular 50/30/20 rule, you should reserve 50% of your budget for essentials like rent and food, 30 percent for discretionary spending, and at least 20 percent for savings.

Revisit your budget and make adjustments as needed.

Step 5: Commitment

Once you're on track with your budget, don't stop there! Stay committed to it and if that means changing who you hang out with or not visiting your favorite store — make it happen.

How to Manage Your Budget Effectively

Once your budget is set and you are committed to it — learn how to optimize and manage it. To reflect, a budget is how much of your earnings are flowing into your costs in addition to where your funds are used (rent, food, and other expenses).

Budget management also helps you to live as well as possible with your earnings. So, in order to value your money, it is very important to manage your budget wisely and live cheap. If you could use a few pointers to manage your budget effectively then this article is for you!

Step 1: Have a monthly budget

A great way to manage your money is to create a monthly budget and follow it which is what we've gone over. Remember that it is essential that you set a budget for yourself to understand exactly how much you can spend according to your needs.

This process will help you to know your expenditure and also assist you to handle overspending. You can also benefit from the best budgeting apps to help you save without even thinking about.

Step 2: Record your expenses

In spite of having a monthly budget, it is essential to record all your expenses. It is a human tendency to spend on luxury rather than necessity.

So make sure to record all the money transactions to identify your overspending areas. Though I am not asking you to stop spending on things you enjoy but by keeping a record you can at least know the areas where you spend unnecessarily.

You can benefit from using sites that help you track and cut your expenses like Mint or Empower.

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

Step 3: Reduce debt

It usually is a good idea to relieve your debt as rapidly as you can. Substantial debt impacts a lot on your spending budget. Avoid using your credit card as much as possible or cut your credit cards up if you need to. Use it for emergency purposes only.

With the high rates of interest on credit cards, you might get stuck in a debt cycle. Make all the essential monthly payments at the earliest and if possible then pay more than the minimum- your debt will certainly decrease faster in this way.

Step 4: Saving

This is one of the most important aspects in which we all should consider to manage our budget. Once your monthly budget is ready then you should think of savings and contribute a part of your amount in it.

Based on your monthly income, open an online savings account and add an appropriate percentage of your income towards your savings account. These types of accounts give you the monetary strength to face any kind of emergency. Start visiting saving blogs to help you reach your financial goals.

Start small. Basic investment methods can bring a massive result.

Step 5: Investment

Investment is another great option to manage your budget. Investing is often a wise strategy to get just a little extra cash. You can benefit from opening an account at investing brokerages like Fidelity or Vanguard and invest in mutual funds and index funds. You can use helpful investing guides to get you started. There is no chance of losing the amount once you invest in a reputed organization.

Ready to Budget on When Your Income Varies?

The above-mentioned budgeting tips will surely help you to value your hard-earned dollars as well as to handle your budget adequately.

If you are in need of some quick budgeting assistance then go for budgeting software or apps that are easy to use. Once you are committed to saving money, it becomes fun to watch your bank account grow as you manage your budget effectively.

I hoped you enjoyed this money management for beginners guide. Good luck!