As kids grow up, they start to develop a sense of financial independence and responsibility. As a parent, you may be wondering if it's appropriate for your 12-year-old to have their own debit card.

After all, they may need to make purchases on their own or manage their allowance more independently. But is it really safe for them to have access to their own funds?

In this article, we'll explore the pros and cons of giving your child a debit card at such a young age, and provide recommendations for some of the best debit cards for kids in the market today.

By the end of this article, you'll have a better understanding of whether a debit card is right for your child, and which option is the best fit for your family.

Should a 12 Year Old Have a Debit Card?

Giving a debit card to a 12-year-old can have both advantages and disadvantages. On one hand, it can help teach them about financial responsibility and budgeting. On the other hand, it can expose them to the risks of fraud and overspending.

Some factors to consider before giving a 12-year-old a debit card include their level of maturity, their ability to manage their own finances, and your own comfort level with giving them access to their own funds.

If you do decide to give your child a debit card, there are several options designed specifically for kids that come with features such as parental controls and spending limits. It's important to research and compare these options to find the best fit for your family.

Ultimately, the decision to give a 12-year-old a debit card should be based on individual circumstances and considerations.

Can a 12 Year Old Have a Debit Card?

Yes, it is possible for a 12-year-old to have a debit card. However, whether or not they should have one depends on various factors such as their level of financial responsibility, maturity, and your own comfort level with giving them access to their own funds.

It's important to weigh the pros and cons before making a decision and consider options designed specifically for kids that come with parental controls and spending limits.

There are several options for the best debit cards for kids in the market. Some popular choices include GoHenry, Greenlight, and Till Financial which we showcase below:

|

Primary Rating:

5.0

|

Primary Rating:

5.0

|

|

$4.99 monthly

|

$4.99 monthly

|

What Are the Best Debit Card for Kids?

Getting a debit card for your kids entails opening an account on their behalf that’s linked to your bank account. You can then send money to their account and have parental controls that help you monitor and maintain a certain level of supervision over the account.

Knowing the importance of opening a debit card for your kids is one thing, but figuring out which card is ideal is another. There are a lot of financial companies offering debit cards for kids, and the last thing you’d want is to go with one that doesn't tick all the right boxes.

A few things to look out for include:

Ability to lock the account: If the card is lost, most issuers will have a feature that allows you to lock your child's account to prevent the cash from being withdrawn.

Security: The account should be password-protected, requiring a PIN, fingerprint, or facial recognition to access the account.

FDIC Insured: The bank should be insured by the Federal Deposit Insurance Corporation to ensure your money is protected if the bank fails. The FDIC covers up to $250,000.

Privacy of personal data: Card issuers should be transparent in what data they’ll collect on your child and seek your approval first. Go over documents regarding their data policies, and if you notice that they plan to sell your child's data to third parties, it’s a red flag.

That said, here’s a list of some of the best debit cards available for kids.

- Best Overall: Greenlight

- Best for Customer Service: GoHenry

- Best for Savings Round-Ups: Current

- Best for Joint Accounts: Axos First Checking

- Best for Investing: M1 Finance

- Best for Traveling Aboard: FamZoo

- Best for Earning Interest: Nationwide

Greenlight

Greenlight is a debit card and app that teaches kids how to manage their finances and helps parents instill healthy financial habits. It has no minimum age requirement, which makes it ideal for kids and teens.

Greenlight has three plans (Greenlight, Greenlight + Invest, Greenlight Max) and debit cards for up to five kids. Their basic plan starts at $4.99 per month, while their mid-tier plan stands at $7.98 per month, and their highest plan is priced at $9.98 per month.

Transfers are instant and can be done from anywhere at any time. You’re able to create in-app chore lists and attach rewards. Furthermore, you can automate deposits to your kids’ accounts, which makes it easier to send allowances without missing a payment. Parents can also receive notifications when the card is used, allowing you to track your kids’ spending.

Another feature Greenlight offers is the ability to select stores where your kids are allowed to spend. If they try to spend elsewhere, you get an instant notification. Parents can also decide whether kids can use their cards at ATMs and how much they can withdraw. In case of misplacement or theft, you can switch the card off.

Kids can earn 1% cashback on their purchases, and they’re able to earn up to 2% on savings via Greenlight Savings Reward program. Kids can set savings goals and track their progress in their savings account.

Greenlight + Invest and Greenlight Max users have access to an investing platform that enables kids to identify investments while parents give the go-ahead. Finally, Greenlight has an in-app feature that enables kids to create a custom debit card, personalizing it with a picture of their choice to express their personality which costs $9.99. You can see the pricing page here.

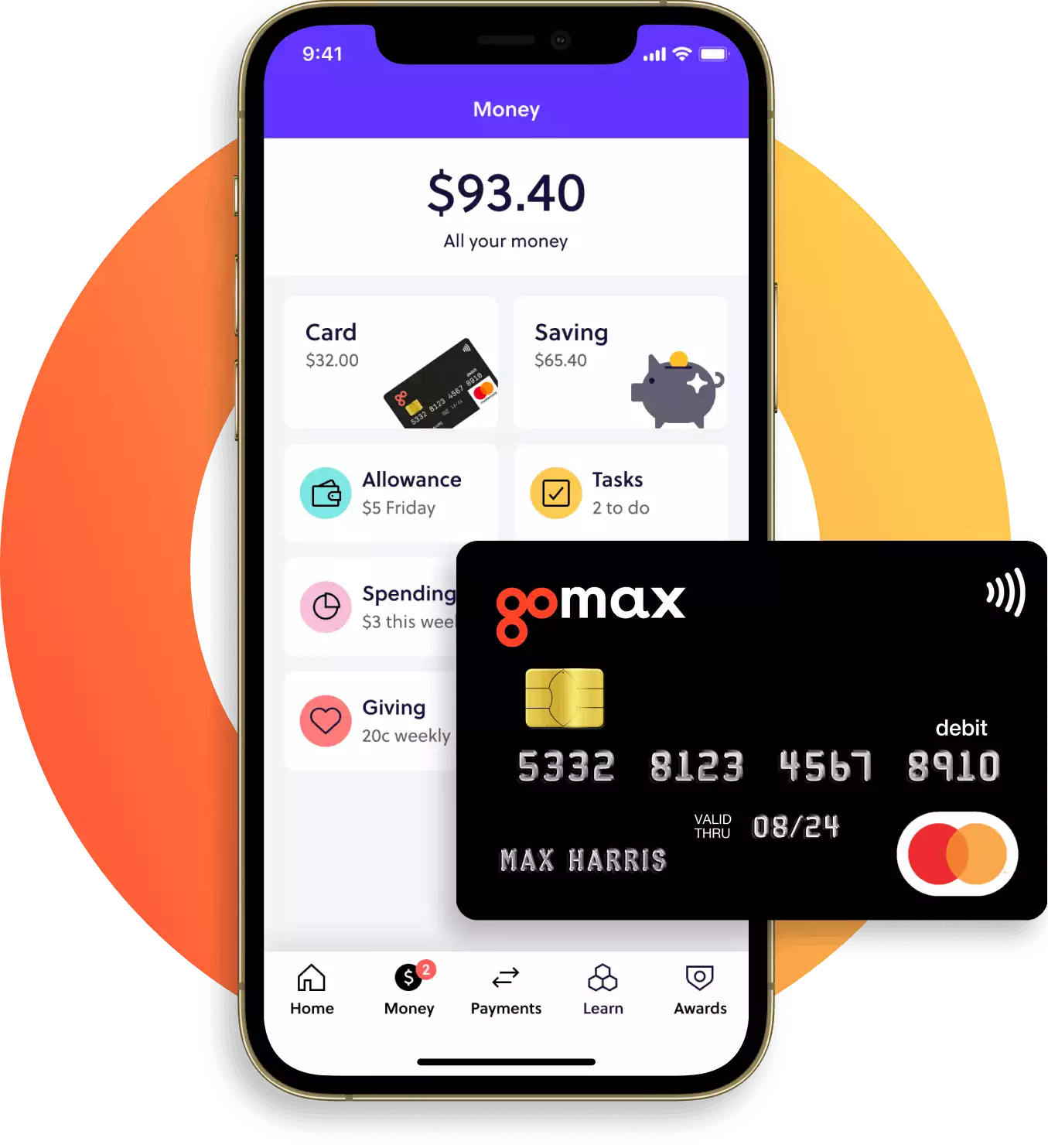

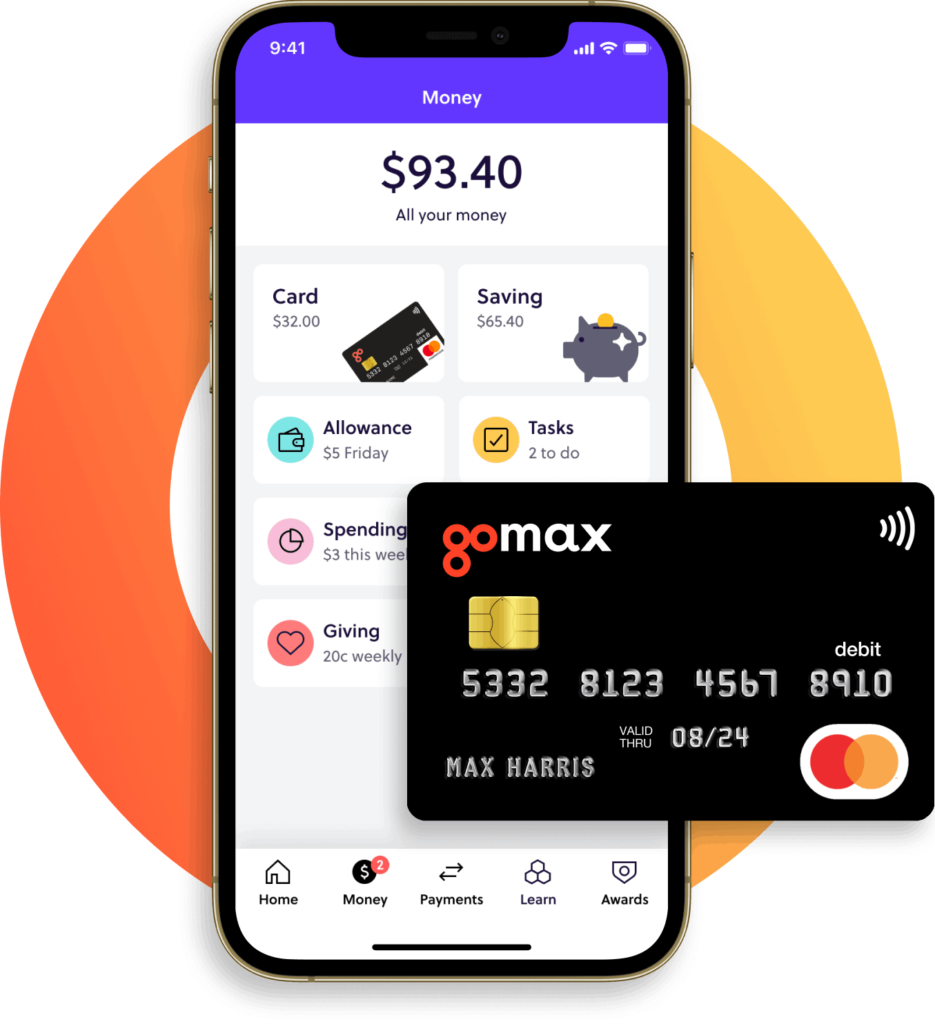

GoHenry

GoHenry is a pre-paid debit card for kids aged 6-18. It was founded in 2012 by parents who wanted to teach their kids how to budget with digital money. However, it’s more than just a budgeting app. It includes videos, games, and quizzes (called ‘Money Missions’) that teach kids about things like compound interest, saving, and borrowing.

It isn’t just for kids – GoHenry has great benefits for parents too. As a parent, you can automate a weekly allowance transfer so you won’t have to remember to send money ever again. It also sends real-time notifications of how and where your kid is spending their allowance.

It has a one-month free trial, after which it will cost $4.99 per month for each child registered. The family plan is $9.98 per month, for up to 4 children. However, it’s only available for UK and US residents. Overall, GoHenry is a slightly cheaper alternative to Greenlight that also has in-depth parental controls.

- Rating: ★★★★★

- Maintenance fee: $4.99 monthly

- Age Requirement: 6 to 18 years old

Current

Another great checking account for teens is Current. Like most debit cards for kids, the account is linked to a parent’s bank account. The app lets you manage your kid’s account with features like the ability to set spending limits, block specific merchants, automate allowances and receive notifications on purchases they make. You’re also able to assign chores and reward them through the app.

With Current, teens can use their debit card online or make in-store purchases. They’re able to learn the ins and outs of money management through the app by sending and receiving money, setting budgets, and having a savings plan. They can also learn about giving with the ability to donate to charity.

A Current account costs $36 per year for one teen. There are no minimum balance requirements, overdraft fees, or transfer fees. Current also has no ATM fees at all their in-network Allpoint ATMs in the U.S.

- Rating: ★★★★★

- Maintenance fee: $4.99 monthly

- Age Requirement: Any age

Axos Bank First Checking Account + Debit Card

The Axos First Checking account is specifically designed for teens between 13 and 17 years old. Parents are required to facilitate account opening, making it a joint account. The account earns an annual percentage yield of 0.10% and has no minimum balance requirements or monthly maintenance fee.

It has a daily transaction limit of $100 cash and $500 debit with no overdraft fees included. Additionally, account owners can get up to $12 domestic ATM fee reimbursements per month.

Your child can make payments, get account alerts, automate bill payments and manage their debit card. The account is held secure by 2-step authentication, regular account monitoring, anti-virus, and malware protection, and it automatically logs out users during inactive sessions.

- Rating: ★★★★★

- Maintenance fee: $0.00

- Age Requirement: 13 to 17 years old

M1 Finance

Instead of opening a traditional checking account for your kids, you can opt for an investment account with M1 Finance. First, you’ll need an M1 Plus account before you can open a custodial account for your child. You will then be able to manage their portfolio and build wealth for them.

Your child is listed as the owner and beneficiary of the account, and when they’re of age, they’ll have complete control of the assets and can withdraw funds.

Start investing by signing up for the M1 Plus account that costs $125 per year. The first year is free so you have enough time to use the account before making a long-term commitment. Through the account, you’ll be able to invest, borrow and spend cash through the M1 Spend Visa Debit Card.

FamZoo

FamZoo is a prepaid debit card suitable for the whole family. It’s paired with a mobile app that’s primarily focused on teaching financial literacy to kids and teens. It includes parents by giving them access to a wide range of features that helps them positively enhance the experience for their kids. Families can opt for a monthly fee of $5.99 or a six to 24-month advance fee, leading to savings of up to 58%.

Some parental controls include: the ability to lock or unlock the card, automate allowance payments, pay interest on child savings and set interest on loans. Parents can also automate debits to charge kids for shared family bills and assign chores with rewards or penalties attached to them.

Kids can open accounts on spending, saving, investing, and giving. They’re able to use the FamZoo card to make online payments and in-store purchases. They can track their expenses through the app, monitor their savings goals, and anticipate earnings through assigned chores.

Further Reading:

Nationwide First Checking

The Nationwide First Checking account is primarily geared towards teenagers and helping them with money management. Parents are required to open an account on their behalf, but the kids will have full access to the account through a mobile banking app. Additionally, your child can learn the power of compound interest by earning 0.10% APY on their balance.

You’ll need a minimum balance of $50 to open an account, and there are no overdraft or maintenance fees. The account has a daily transaction limit of $100 cash and $500 debit. Finally, your child can get up to $12 ATM fee reimbursements per month.

- Rating: ★★★★★

- Maintenance fee: $0.00

- Age Requirement: 13 to 17 years old

Debit Cards for Kids Alternatives

Although you may find these popular cards for kids on other websites, they didn't make the cut because they don't provide comprehensive features or unique educational tools for children.

BusyKid

BusyKid is intended to help kids learn about financial literacy with the help of their parents. The app has features that facilitate earning, investing, sharing, and spending money. What’s unique about BusyKid is that your child can invest in stocks directly from the app. What’s more, you’re able to review stock trades beforehand and block or approve them.

Parental controls allow you to monitor your kid’s account and view account or debit card transactions as they happen. You’re able to allocate chores and include a payout for successful completion. Furthermore, you can automate allowances to be deposited on a set schedule.

To encourage savings, parents are capable of matching their kids’ weekly savings. In addition, each child has their own account and PIN, making it easier to learn financial management on an individual basis. They can also have individual debit cards to make online or in-store purchases. This card can be used at ATMs and with Google Pay and Apple Pay.

BusyKid is priced at $3.99 per month, which includes one prepaid visa spend card and no fees on stock purchases. This includes up to 5 BusyKid Prepaid Visa Spend Cards and no fees on stock transactions.

Till

Till is a free app and debit card combo that lets kids and parents collaborate on smarter spending decisions. With Till, it’s easier than ever for parents to find teachable moments to help their kids learn financial literacy. Till is intuitive and by using the fee-free app and debit card, kids can develop money habits that prepare them for the real world.

Till provides a free, physical debit card for your child to use online and in stores. It was named “Best App for Teaching Teens to Budget” by US News & World Report.

Overall, Till is a fee-free debit card and banking app for kids with some parental controls. There are no monthly costs or maintenance charges. You may also establish numerous kid accounts in your family without incurring any additional expenses. There are no overdraft costs since you can't overdraft the account.

Copper Banking

Mobile banking is easier for kids thanks to Copper Banking. It’s a prepaid debit card and app made for teens and managed by parents. You can instantly transfer money to your child’s account and set up automated payments for allowance as well.

The app gives teens the knowledge and power to save, invest and manage their finances. They can also spend online, in-store, and use Apple Pay using the Copper debit card. There are no overdraft or minimum balance fees, and they can enjoy free withdrawals at Allpoint ATMs.

Once you’ve signed up, you can have up to five child accounts linked to your copper account. The good thing about Copper is that it doesn’t run a credit check when you sign up, so your credit score remains unaffected no matter what.

RoosterMoney

To be clear, RoosterMoney is primarily an allowance tracking app. This means that the free version isn’t meant for transferring funds — you’ll need to do that another way. Instead, it helps you manage your kids’ allowances: how often they receive it, how much they spend or give, and how much they save.

Rooster PLUS, which is $18.99 per year, goes a step further by including a chore management system that encourages kids to earn money by doing their chores. Another interesting feature it offers is the ability to add interest to your kids’ savings.

Lastly, the Rooster Card is a prepaid card with parental controls. It’s meant for kids ages six and up. The plan is $2.99 per month, and it includes all the features of Rooster PLUS.

Can I get a debit card for my child?

The short answer? Yes!

While in most states, kids need to be 18 to open their own checking accounts, you can still open a sub-account under your name. However, opening an account for your child through a bank comes with a few drawbacks. For one, your kid won’t be able to get their own debit card until they’re 13 years old.

Next, banks don’t provide parents with some of the features these apps do. With a bank, you won’t be able to track spending habits as easily or incorporate chores into the mix, for example. Keep this in mind when deciding which debit card to get your kids.

What's a good age to give your kids their first debit card?

Is it ever too early to start teaching your children about personal finance? Researchers from Cambridge University say “no.” A 2013 study conducted by Dr. David Whitebread and Dr. Sue Bingham encourages parents to start teaching their kids financial literacy as early as three years old.

While your toddler won’t have the attention span, or capacity, to understand the stock market, there are age-appropriate ways you can introduce them to money. One of those ways is by giving them a prepaid debit card like the ones discussed earlier.

The best time to give your kids their first debit card is between the ages of 6-12. According to the report by Dr. Whitebread and Dr. Bingham, children in this age group are learning how to set long-term goals, be consistent, and trust their own decision-making processes. This makes it a good time to introduce lessons in budgeting, saving, and borrowing.

Why do kids need debit cards?

There's no doubt that kids can still learn about money without getting debit cards. In fact, it’s recommended that kids aged 3-5 be taught with physical money. It helps them understand the concept easier and faster.

For older kids, debit cards are recommended because it helps them learn about the world of digital money. In essence, it prepares them for the real world by teaching them how to build good money management habits and how to use a debit card safely. They can learn lessons on how to guard their banking information properly.

What is the best debit card for kids?

Identifying the right debit card for your kids is essentially dependent on the lessons you’d like to impart to your kids. Each debit card has its benefits, and what may be ideal for one family may be less than ideal for another. It’s important to make a decision based on your child’s needs and your family’s capability.

To sum it up, most debit cards provide an all-rounded approach by operating like a checking account, but some emphasize saving or investing, for example. These can be good if you’re trying to teach your kids the importance of one particular financial aspect, especially if they have a good grasp of the rest. Alternatively, you can go for an all-rounded debit card to teach your kids about every aspect of money management.