Millennials’ interest, and their perceived lack of interest in homebuying, has drawn many headlines over the last few years.

Most of that attention is rightly focused on student loan payments weighing down this generation in debt. Today's average student debt has ballooned to $37,000.

These sky high monthly payments coupled with rising apartment rents and cost of living in metro areas — hello, avocado toast scandals — has made it nearly impossible for many millennials to afford a monthly mortgage payment, let alone a down payment on a home for first time homeowners.

So, Millennial Home Ownership?

To put it bluntly: millennials are interested in buying homes — it's just too expensive to do so.

The National Association of Homebuilders has previously found that more than 90 percent of millennials say they eventually want to buy a house.

But, median down payments on homes have risen to a three year high of $18,850 across the country.

For those planning to buy in a city like Los Angeles, that number is more like $120,000 if you’re putting 20% down.

Millennials are juggling a bunch of fairly new expenses that previous generations didn't have take into account, whether it's those dreaded student loan payments or on-demand and subscription services like Uber and Netflix that have become a part of everyday life.

With December being a traditional month to start considering and saving up for home ownership goals, we decided to take a detailed look at where millennials currently stand with their homebuying plans and get insight into which expenses are the toughest to cut.

Millennial Home Buying Trends

Open Listings surveyed 500 U.S. millennials between 18-34 years old to dig into how they plan to save up for a home and additional financial measures they're taking to afford their downpayment or earnest money.

Millennials are Buying Homes, Especially in the Midwest

Our representative sample of U.S. millennials found that 44% of the much buzzed about generation has bought a home to date. This falls somewhat in the middle of previous real estate industry analysis and past studies on millennial homebuying.

Overall, millennial men were more likely to have bought a home (47%) than women (40%).

Furthermore, 30% of those under 24 are currently homeowners, and 53% of millennials older than 24 have a bought a home.

48% of the respondents, which have yet to buy a house, plan to buy a home within five years. The other 52% of non-homeowners plan to buy in more than five years.

Millennials’ purchases of homes and plans to, also continue to be regional in nature.

For instance, 51% of millennials in the Midwest note they have already bought a home, versus 41% of millennials on the east and west coasts.

Home Buying Tips For Millennials

It seems like millennials really do love their avocado toast — or at least, dining out.

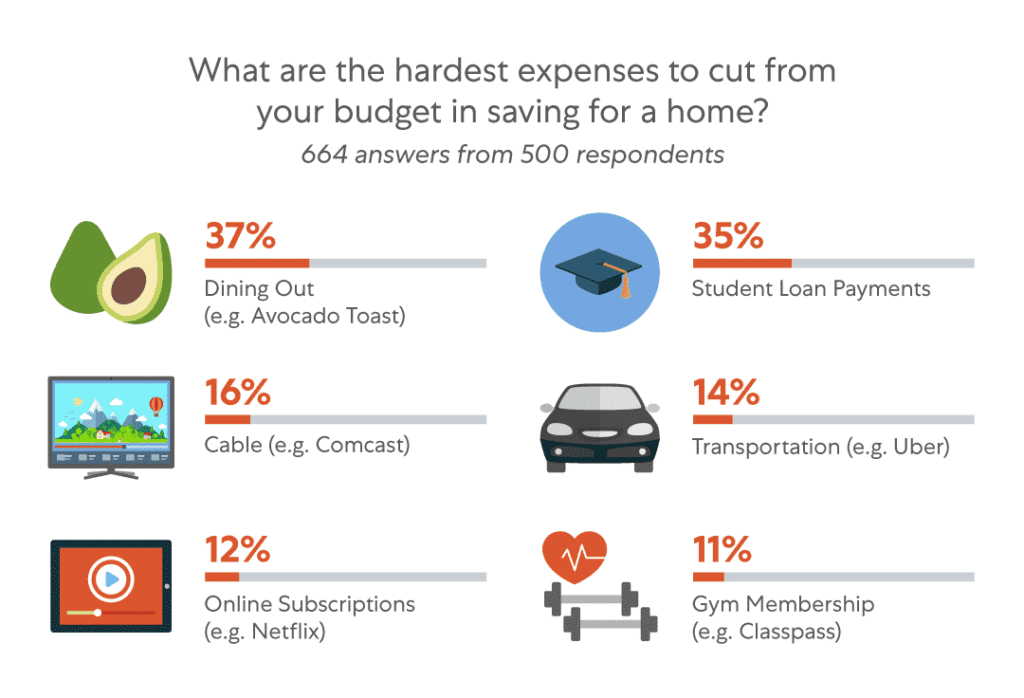

When we asked respondents to choose the hardest expenses to cut from their budgets when figuring out top savings to buy from a home, dining out (e.g. avocado toast) was the most frequent answer (37%).

Surprisingly, it even beat out those who are trying to beat student loans with Student Loan Payments (35%), which is often a large fixed cost that cannot be easily mitigated within a personal budget.

In some sense, it’s not a huge surprise.

Previous studies have noted that the average millennial eats out 5 times per week, which is more than 14% more than baby boomers.

Even if it's is the healthy, quick service choice that many millennials are opting for (think: Sweetgreen, Cava), we’re likely talking about $60-$100 per person, per week.

Over the course of the year, that amounts to almost $5,000, or around 25% of the current national down payment average for a home!

For existing millennial homeowners, dining out was an even tougher expense to cut, with 44% of them saying it was the hardest expense, compared to 27% choosing student loan payments.

It’s likely that current millennial homebuyers may have been able to buy a home earlier because they weren’t suffering the same student debt crunch. Therefore, cutting student loan payments from their budgets while saving for a home was easier than their cohorts.

Comparatively, millennials that noted they wouldn’t be buying a home for at least another five years were the most likely to note how hard it was to cut student loan payments from their expenses (43%).

This group of respondents was also more likely than their peers to note that Cable (e.g. Comcast), Transportation (e.g. Uber) and Online Subscriptions (e.g. Netflix) were hard expenses to cut from their personal budgets.

When it came down to other variable expenses, women found it easier to cut the gym from their expenses (8% noting it was hard to cut out) than men (13% noting it was hard to cut).

Millennials Guide To Buying A Home

While the number of millennials moving back in at home draws media headlines, there are a variety of financial measures today's millennial homebuyers are taking to save for a home.

Moving back in with mom and dad isn't at the top of the list.

Millennials would rather consider getting a side job to accompany their 9-5 (40%).

They're also likely to be foregoing yearly vacations (34%) and are more likely to consider moving in with a roommate to save for a home (19%) before going back to their old room at their parents (15%).

Those that said they won’t be buying a home for at least 5 years were the most likely to note they would consider moving back in with their parents (18%) to save money for a home (likely trying to become a saving junkie).

Women were also slightly more likely (16%) to note they would consider moving back in with their parents versus millennial men (14%).

Somewhat surprisingly, millennials that noted they were within 2 years of buying were the most likely to note that they would consider selling their car to save for a home (18%).

This could be a result of eyeing locations that are more urban or near public transit.

9% noted they’d consider renting their apartment on Airbnb to save for a home.

Millennial Home Buyers 2024

With the impending impact of tax plan reorganizations and the continuation of a volatile market, the next two-five years will provide further insights into millennials and homebuying behavior.

It remains to be seen if these financial measures and priorities give the next generation of buyers the possibility to grab their own slice of the home-owning pie.

Should I take “buy a house” off my to-do list?

You don’t have to. Just because you can’t buy a house right now, doesn’t mean you can’t eventually. You may just have to wait a little longer or come up with an alternate plan.

There are a few things to consider before taking the plunge into homeownership. First, do you actually want to own a home?

Any tips for buying a house right now?

- Stack your savings. Start with a small down payment. Look for a fixer-upper. Think outside the traditional mortgage. Rent to own. Look for government assistance programs. Partner with someone else. Be patient and keep your eye on the market.

- Phone a pro. Looking for a house is a big deal. So is buying one. If you have any questions or concerns, be sure to speak with a real estate professional who can help guide you through the process.

- Keep an open mind. It’s a good idea to have a list of must-haves, but try not to be too inflexible. You may end up missing out on the perfect home because you’re holding out for something that may not even exist.

The bottom line is this: there is no right or wrong answer when it comes to buying a house. It’s a personal decision that you need to make based on your own circumstances.

If you’re not ready to buy a house right now, that’s okay. Just remember, there are other options besides buying a house. You can always rent, or look into other types of housing such as condos or townhomes. Whatever you do, don’t give up on your dream of owning a home. It may just take a little longer than you originally thought.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.