Is the Motley Fool Stock Advisor suitable for you? That's a question only you can answer, but in this review, we'll provide you with all the information you need to make an informed decision.

We'll look at what services the Stock Advisor provides, how it rates against other investment advisory services, and what kind of investor it is likely to be most helpful for. By the end of this post, you should have a good idea whether or not this service is right for you.

Who is Motley Fool?

Looking for stocks that can take you to the moon? Then you need to check out Motley Fool's Stock Advisor service. With over ten years of outperforming the market, this service can help increase your portfolio's value while minimizing risk. But before signing up, you need to know what Motley Fool is.

Motley Fool is not a person but a private financial and investing media company. It was founded by the Gardner brothers, David and Tom, in 1993. Their drive to make the world happier, smarter, and wealthier through sound business and investing guidance prompted them to put up the company.

According to one write-up, the Gardners don't want to wax rhapsodies on investing but instead wanted to speak the truth and never be afraid to question conventional wisdom.

Today, the Motley Fool is one of the biggest names in stock market investing. It is classified as a stock recommendation and investing education service that picks high-growth stocks and occasionally blue chips. If you are questioning its credibility, Motley Fools has beaten the market more than once since its launch in 2002.

- Averaged Stock Pick Return over 318% (vs 114% for the S&P)

- 2 New Stock Picks Every Month

- 700,000+ Loyal Members

- Smarts' Reader Deal: Special $79 Stock Advisor Introductory Offer

Motley Fools also offer different packages. Here are its prices.

- Rule Breakers – $99/year (for new members)

- Everlasting Stocks – $299/year

- Rule Your Retirement – $149/year

- Motley Fool Options – $899/year

- Everlasting Portfolio – $1,599/year

- Epic Bundle – Stock Advisor, Rule Breakers, and Everlasting Stocks – (Check Price)

- Everlasting X10 – $1,999/ year

My Experience with Motley Fool

When I initially came upon the Motley Fool, I wondered if it would benefit financially from adhering to their stock picks.

An expert will answer your question with ease; it depends. I, therefore, put my query to the test. I started by investigating the Motley Fool's whole performance history and looking at the figures that are unavailable elsewhere.

The first thing I looked into was the high-level analysis of Motley Fool Stock Advisor's performance since its inception.

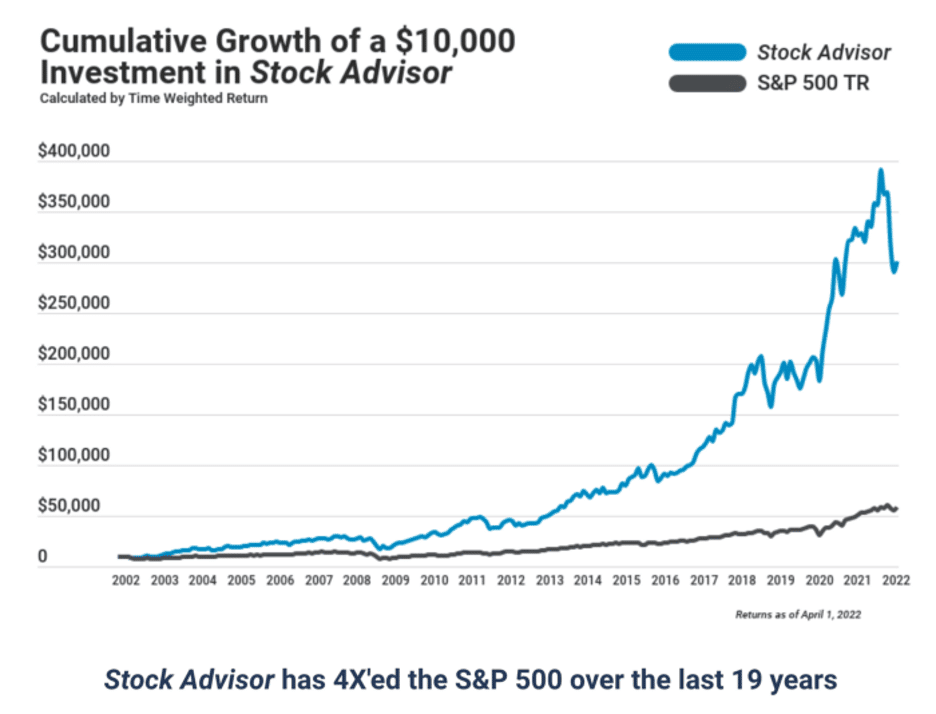

It was a fantastic performance, as you can see in the graph. Moreover, it demonstrates that over the past 19 years, the Motley Fool has outperformed the market four times.

How is the Motley Fool organized? Let me simplify things for you.

Every stock recommended by The Motley Fool has an official recommendation date, and if they decide to sell, they also record a sale date. From the date of the recommendation up until the present, or the date they advised selling the stock, it contrasts the performance of their stock with that of the S&P 500.

Here is how it works to give a clearer picture.

On December 17, 2010, the Motley Fool advised picking Amazon; the pick is still in effect today (meaning, no sale date). It has returned 1,278% versus 315% for the S&P 500 (these figures can change daily since the position is still open).

Another recommendation Motley Fool has was Stamps.com on May 20, 2016, and then its subscribers to sell the stock on September 3, 2021. During this period, Stamps.com gained 303% versus 144% for the S&P 500 (these figures don't change because the position is closed).

These two examples showed how Motley Fool's stock recommendation measured against the S&P 500 for as long as it remains an honest recommendation on their list. However, the final performance is on record when the recommendation is closed.

When I reviewed the history of 476 stock picks by Motley Fool from 2002 to 2021 (I divided them into 5-year batches), here is what I discovered about its performance:

The Motley Fool choices have significantly outperformed the market since their introduction (hundreds of percent).

The older batches outperform the fresher batches, and each of the 5-year batches chosen is exceeding the market. According to my theory, older stock picks have had more time to scale than fresh ones.

I said that I had separated the stocks into batches of five years. I wish to share several intriguing observations:

- Most of Motley's stock predictions were profitable, with 60–70% of their forecasts yielding gains.

- The fact that their stock picks fall short of the S&P 500 is an additional intriguing observation (I will tell you more about this later).

- Their best wins have increased by 11,000 to 16,000 percent, significantly outpacing the market.

- Additionally, their top losers have experienced a sharp decline, with some losing nearly all of their worth.

- By a considerably more significant margin than the massive losers underperforming the market, the big winners on Motley Fool stock pick beat the market. The most considerable loser may lose, at worst, -100 percent, while the biggest winner could earn 12,000 percent or more.

- The truth is that even though most of their stocks do not outperform the S&P 500, the enormous profits of their big winners have more than offset this, and the portfolio as a whole is outperforming the market.

- The longer-held stock picks from 2002 to 2011 have produced significant winners, with gains of up to 500 percent.

- Their best wins have increased by 11,000 to 16,000 percent, significantly outpacing the market.

- Additionally, their top losers have experienced a sharp decline, with some losing nearly all of their worth.

I could see suggestions starting to realize their full potential here in 2022 as I examined the stock picks from 2016. I discovered that the majority of their stock predictions were profitable. However, just around half of their picks outperform the S&P 500, and the performance of any individual stock pick is inconsistent.

Additionally, the stocks that outperform the market do so by a wider margin than the underperforming stocks that outperform the market. In other words, Motley Fool recommendations outperform the market and generate larger gains.

Stock Advisor makes suggestions for stocks that could produce returns of 100% or more. The platform is intended for investors who want to profit from the stock market but lack the time or knowledge to do their research.

You get access to Stock Advisor's library of suggestions as a member, and new stock ideas are added each month. Stock Advisor's specialists also provide insights, in-depth research, and investing guidance.

The platform gives you all the information you need to make wise investment decisions, even though it does not let you purchase or trade equities. Therefore, Stock Advisor is worth checking out if you're seeking a technique to make money on the stock market.

Now, let me put this research to the test.

I have access to the library of suggestions as a member. Additionally, each month I receive new stock recommendations, hints, in-depth research, and investment guidance. I took advantage of the introductory deal. This is how I did.

Pinterest was one of the recommendations made by Motley Fool in 2020, and I bought it in November of that year for $18.16. It rose in April and July before peaking at $85.90 in February 2021. As of June 2, 2022, it is now at $19.7.

In 2022, it might consistently fail, though. But the great thing about Stock Advisor is that you'll get a notification when it's time to sell, so I won't have to keep an eye on your stocks.

The Motley Fool advised holding onto their recommendations for at least five years for significant gains. I paid $92.65 for the shares in 2020. When it reached its height, I owned 100 shares, bringing in $14,570 in less than a year and a half. After then, the price increased to the point that I was unable to purchase any more stocks. The benefit of Motley Fool is that they alert you when it's time to repurchase.

We can conclude that finding huge winners is a crucial component of Motley Fool's success.

As an example, here are the five best stock picks by the company for the last five years:

- Shopify (SHOP): Gain 994% compared to 112% of the S&P 500

- Tesla (TSLA): Gain 718% compared to 31% of the S&P 500

- The Trade Desk (TTD): Gain 704% compared to 73% of the S&P 500

- Fortinet (FTNT): Gain 650% compared to 92% of the S&P 500

- Nvidia (NVDA): Gain 630% compared to 100% of the S&P 500

These are just the best five. If I go through the whole list, dozens more have doubled, tripled, or quadrupled the overall stock market since the recommendation.

What Do They Offer?

The most extensive offer from Motley Fool is their Stock Advisor.

The Stock Advisor

You may find a list of stocks, including a starter portfolio and stocks to buy each month, in The Motley Fool's flagship offering. Research has been done on each of these stocks. Here is what you get with the Motley Fool Stock Advisor recommendation:

- Two new stock picks each month – the latest stock recommendation delivered monthly.

- Best Buys Now – ten timely buys chosen from over 300 stocks.

- Starter Stocks – foundational stock recommendations for new and experienced investors.

- Community and investing resources – access to additional materials and a strong community of investors to help you improve.

This stock advisor service offers a variety of options. Each month, a member is entitled to two picks and a thorough report on those picks. Reading the analysis that is included with each option is a good place to start if you're a beginner who wants to learn more about investing.

You'll learn the real reason behind those selections. You can therefore avoid speculating on probable options. Instead, when choosing to invest in stocks that are not highlighted in the newsletter, you must put what you learned from the Stock Advisor research into practice.

They will demonstrate their performance over time, and you can receive an alert if the Motley Fool believes it is time to sell the stock.

The most typical idea is to have at least 25 individual stocks and hold them for at least 5 years; these stocks are not intended for day trades.

Motley Fool Wealth Management Review

Get a stock alert so you are aware of any changes.

It is most frequently advised to keep at least 25 different equities for at least five years; these are not day transactions.

Review of Motley Fool's Wealth Management

Investors work hard to increase and safeguard their capital. Of course, there are obstacles they must overcome, but with the assistance of a wealth management company like Motley Fool Wealth Management, they can do so.A group of financial managers who work for Motley Fool Wealth Management provide services for managing your wealth. It is a Virginia-based financial and investment advising firm with clients in more than 50 states.

It offers various services designed to help investors achieve their financial goals. The following are the services provided by Motley Fool Wealth Management:

Investment portfolio management

In Motley Fool, investors can set up personal portfolios and allow their portfolio managers to make investments via a separately managed account. This separately managed account is essentially a private portfolio with individual securities. It might be similar to a brokerage account, but a knowledgeable expert is doing the heavy lifting here.

Financial planning

With its financial planning services, Motley Fool Wealth Management can assist in reaching a certain financial objective. To establish an appropriate financial plan, the firm's advisor will meet with the client and listen to their needs and long-term objectives. Anyone who wants guidance from a professional investor can benefit from this service.

Retirement planning

Any investor must find time and seek guidance while planning for their eventual retirement. With Motley Fool Wealth Management's retirement planning services, a qualified advisor can help you select a retirement plan that meets your goals. They can also assist you in estimating your income requirements and retirement expenses, including health insurance policies to keep you protected until you become eligible for Medicare.

Estate planning

Every investor needs to make a plan for how their assets will be distributed in the event of their passing or disability. This is crucial because you never want the incorrect people in charge of your assets or your medical care.

A will that specifies how property will be distributed should be part of an estate strategy. Trusts should be a part of it as well so you can safeguard your wealth till the appropriate time. A financial advisor from Motley Fool Wealth Management can assist you in developing an extensive estate plan that meets your goals.

Tax planning

Significant net worth investors pay high taxes to comply with the law. The taxes you owe based on your income can be estimated with the use of tax preparation services. However, they can also aid in your tax efficiency by employing a number of techniques. This entails having the legal ability to legitimately minimize the taxes you owe in light of changes to your portfolio or your state of residence.

If you're a new investor wondering whether it makes sense to use wealth management services, the answer is yes. Motley Fool Wealth Management, for example, offers wealth management services that can help you manage portfolio risks, save time, and reach your portfolio goals.

Motley Fool Stock Advisor Review

Since 2002, the Motley Fool Stock Advisor picks have dramatically outperformed broader market indexes. In 2021 alone, it returned 598% in comparison with the 133% on the S&P 500 index.

What is a Motley Fool Stock Advisor? This program is developed by stock market gurus at Fool.com that comes with additional features and recommendations, including:

- Best Stocks to Buy (Best Buys Now) is a rotating selection of top monthly stock picks from more than 300 candidates.

- Starter Stocks, a group of blue-chip and growth stocks for new investors.

- Premium reports and articles are available only to paying members.

- Premium Community Boards where the members can exchange tips and strategies with other investment community members.

- Email subscription – when you sign up for Stock Advisor, you are automatically enrolled with their email newsletter. Expect four to eight monthly emails containing these subjects: New recommendations, trade alerts, expert analysis and commentary on stocks, industries, and economic recommendations, Best Buys recommendations and multimedia content.

- Stock Watchlist is the same as what is available on Yahoo! Finance or any back end of an online platform.

- Favorites – the favorites feature contains stocks you are already watching or have already taken positions in.

- Scoreboard – it is the visual representation of the stocks you are holding. You can link your brokerage account to trade Scoreboard stocks seamlessly.

- Performance Tables and Charts – this is the data-rich portion of the Stock Advisor. It has a long table with the company, recommendation date, market capitalization, returns, and risk score.

- Premium Articles and Research Reports – members can access premium research reports and articles produced by Motley Fool staffers.

- Discussion Boards – it contains two dozen members-only discussion boards covering the topics of investing basics, strategies, and personal finance.

- Stock Screener – this tool is not revolutionary but practical to market watchers.

The Motley Fool Stock Advisor is not for everyone. The company has made no claims that its Stock Advisor is a key to getting rich quickly, and it does not guarantee returns to any of its recommendations. Moreover, it is not designed for long-term investors looking to match, not beat, the stock market indexes.

However, this is not saying that Stock Advisor is a waste of money. Instead, it is for subscribers at the crossroads of picking individual stocks. The Stock Advisor's recommendations are a good fit for formulating investing strategy, risk tolerance, and objectives.

Pros

- Weekly stock recommendations with expert analysis

- Relatively affordable annual cost compared to some investment newsletters

- Text and email alerts give you quick information

Cons

- Upsales

- No guarantee on stock recommendations

- Recommendations can move the market

Access To Previous Picks

On Motley Fool, you may view your previous suggestions. The company's goal to be transparent about its track record, which shows its past stock selections, is the reason for this. Therefore, this feature is yet another wonderful opportunity to judge whether or not those choices are good.

You can immediately access the following options after creating an account with Motley Fool. Instead, you'll be able to access the most recent selections right away.

Long-Term Investment Horizon

Day trading is not allowed with the Stock Advisor. Investors with a long-term investment strategy—at least a few years—are the major audience for stock choices. Furthermore, it is not only for retirement portfolios. Other investment purposes can work as well.

Community Support

Members of The Motley Fool can access the investing community created exclusively for them, which is another fantastic feature. Like-minded investors, both new and experienced, can be found in this neighborhood. This is excellent for those who are hesitant to take the plunge, seek input on potential stock ideas, or just need a place to have stock questions answered.

Additionally, they have a CAP community where stockholders can rate equities and follow other investors who are performing well.

Bonus Reports

Additional information beyond what is provided in your subscription. One of the added in the Stock Advisor service are reports that serve as a bonus. Investors benefit from this. It now includes papers that provide extra analysis and knowledge.

Millionacres

The Real Estate Winners by Millionacres is another service offered by Motley Fool to those who are interested in investing in real estate. It targets investors who are more into real estate than stock picks.

Motley Fool offers another service if you are into real estate investing. This service targets those interested in real estate more than stock picks.

Are There Any Fees?

New members must spend $79 for the subscription during the first year to Stock Advisor in order to take advantage of its features. There is a 30-day membership-fee-back guarantee on the membership charge after that. You may cancel your membership at any time before the conclusion of the 30-day trial period if you don't like the newsletter, and you will receive a full refund of your membership price.

Here are the other options to take advantage of the Motley Fool features:

- Rule Your Retirement: $149/yr

- Rule Breakers: $299/yr

- Discovery: Cloud Disruptors: $1,999/yr

How Does Motley Fool Compares

Motley Fool vs Morningstar

| The Motley Fool | Morningstar | |

| Membership Fee | $79/for the first year | $199/for the first year |

| Stock Picks | Yes | Yes |

| Research Tools | Yes | Yes |

| Promotions | $100 off | 14-Day Free Trial |

- Find new investment ideas

- Evaluate investment Ideas

- Monitor investments

- Offers a 14-day free trial then $34.95/monthly

- Use code Partner1 for $50 off

Motley Fool vs Seeking Alpha

| The Motley Fool | Seeking Alpha | |

| Membership Fee | $79/for the First year | $239/year |

| Stock Picks | Yes | Yes |

| Research Tools | Yes | Yes |

| Promotions | $100 off | Basic Plan is Free |

- World's largest investing community

- Find profitable investing ideas, improve your portfolio, research stocks better and faster as well as track the news to find investing opportunities

- Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations

- Find stocks likely to outperform and make you money

- Proprietary quant records have an impressive track record leading to massive market outperformance

Motley Fool vs Zacks

| The Motley Fool | Zachs | |

| Membership Fee | $79/for the First year | $249 / Year |

| Stock Picks | Yes | Yes |

| Research Tools | Yes | Yes |

| Promotions | $100 off | 30-day Free Trial |

How Do I Open An Account?

To open an account at The Motley Fool, you only need to go to their website and sign up. Make sure to have your credit card number ready as it is required during the sign-up process.

Is My Money Safe?

Your money is safe with The Motley Fool, mainly when using a credit card to pay for your membership. This is because the website uses encryption to protect your information. Also, no money will be deposited or invested in the come.

Is It Worth It?

The Motley Fool can save you from spending a lot of time researching stocks. When you subscribe to The Motley Fool's stock-picking service, you don't have to do them. For only $79 for the first year of subscription (new members), the Stock Advisor service offers value for money. If you want to invest in index funds and ETF investing, you can further save money by subscribing to the Rule Your Retirement newsletter for only $149/year.

Even with the wealth of information you get from The Motley Fool, you still have to make actual investment decisions either with yourself or with a discount stock broker. You don't have to look far, as The Motley Fool offers Wealth Management services with advisory fees. For accounts less than a million dollars, the fees could range from 0.40% (for index fund and ETF portfolios) to 0.95% (for stock portfolios).

FAQs About Motley Fool

Here are some of the frequently asked questions about the Motley Fool.

What is a Stock Advisor?

The Stock Advisor, the company's flagship product, offers a listing of stocks you can buy every month, ranging from those for a beginner portfolio. Each of these stocks has been thoroughly investigated, and their performance history is also provided.

This aids investors in their independent or joint investment selections with stockbrokers. The stock picks in the Stock Advisor usually have a holding period of at least five years and are long-term investments. Day trading is not also covered by this.

How long has The Motley Fool been around?

The Motley Fool was established in 1993 and has amassed outstanding results since then.

Is The Motley Fool legit?

The Motley Fool is a stock selection and analysis service with a proven track record. Past performance does not, however, ensure future performance, just like with any investment products.

How much does Stock Advisor cost?

For the first year of subscription, Stock Advisor costs $79 per user.

How can I cancel Motley Fool subscriptions?

You can go to the “My Account” area and choose “Turn Off Automatic Renewal,” or you can call The Motley Fool's customer care to cancel your subscription.

What can you say about The Motley Fool's email service?

Many people are complaining about the Motley Fool's frequent mailings trying to upsell them on other goods and services. That being said, Stock Advisor is still worthwhile (or any of their products for that matter).

What other products does The Motley Fool offer?

Motley Fool now provides the Millionacres real estate successes in addition to Stock Advisor. A high-growth newsletter called Rule Breakers is also available, among other things.

Motley Fool Contact Number

Here is the contact information for those interested at The Motley Fool:

Customer Service Phone Number (877) 629-2589

Customer Service Hours Mon-Fri, 9 AM to 5 PM (ET)

Customer Service Email [email protected]

How to Sign Up with Motley Fool

If you are not a Stock Advisor member yet, sign up to open an account. Go to The Motley Fool website and complete the information. Don't forget to have your credit card number ready.

What is Motley Fool all in stock buy alert for 2022?

The Motley Fool issue these three tech stocks on hyper growth and definite must-buy in 2022 and beyond:

- Z scale (ZS 3.92%)

- Datadog (DDOG 6.10%)

- JFrog (FROG 4.13%)

Motley Fool Review Summary

If you're trying to find a dependable place to get investing ideas, Motley Fool is a great option. The reputation of the Motley Fool hinges on its capacity to provide stock recommendations that outperform the market going forward.

The results speak for themselves; this is not a stock picking service that relies on a few fortuitous stock selections, but rather one with a successful track record. In both good and bad economic times, their investing ideas have been crucial in assisting some investors in expanding their holdings. The Motley Fool is a company to consider if you're serious about making money in the stock market.

- Averaged Stock Pick Return over 318% (vs 114% for the S&P)

- 2 New Stock Picks Every Month

- 700,000+ Loyal Members

- Smarts' Reader Deal: Special $79 Stock Advisor Introductory Offer

More Investing Resources:

- Appreciating Assets to Buy When You Want to Build Wealth

- 16 Best Stock News Apps for Unbiased News Sources

- 8 Best Options Trading Platforms

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.