Need an Earnin review in your life so you can find ways to get paid today? Did you know that in 2022, half of all Americans made less than $51,480 per year?

The U.S. Bureau of the Census’s compiled income data shows that was the median individual income just three years ago. Your short-term money borrowing apps know this and it’s why you see them competing side-by-side in every working-class neighborhood.

Even with two adults working full time, the timing of paychecks can cause cash flow problems. High-interest rates on short-term loans and payday advances cause hard-working people with good cash management skills to lose thousands of dollars every year to these unexpected fees when cash flow gets tight.

That's where Earnin can help, right?

We'll go over this paycheck advance app and you can see if it's for you in this Earnin app review for 2024.

- Access to your hard-earned cash right when you need it

- No hidden fees, no penalties, no waiting

- Get up to $500 of your paycheck per pay period

What is Earnin?

Earnin is the app that lets you get a cash advance any day you work, up to $500. There are peer-paycheck limits, of course, and you can’t get more than you earn that day.

However, you can withdraw whenever you want without questions asked if you can upload the right information verifying your wage and work hours:

- Build a cash reserve

- Never pay more than $15 per transaction

- Update your limits as your finances improve to get more per pay period

- Your withdrawals are deducted from your paycheck

Earnin is very similar to other cash advance apps on the market:

|

30-day free trial

|

|

|

Primary Rating:

5.0

|

Primary Rating:

4.8

|

|

Pros:

|

Pros:

|

|

Fees: 30-day free trial

|

Fees: $1/mo

|

- App Store: 4.8 – 146k reviews

- App Store: 4.8 – 652k reviews

What You Should Know about Earnin

- Withdraw up to $100 per day as needed

- Make withdrawals any day you work

- Weekly or per-pay-period limits vary between $100 and $500

- Fees in the form of “tips” between $0 and $15 are applied to each transaction

- Not every transaction requires a tip fee

- Build a cash reserve by making withdrawals up to your limit even when you don’t need them

- Next-day deposits to your regular bank account

It’s clear this option is cheaper than other ways of accessing your salary early. You might be wondering how it all works, though.

How Does Earnin Work?

When you sign up to Earnin, you provide them with your timesheets, location-tracking information, and other data they need to verify your salary and your work schedule daily.

Then, you are authorized to make a withdrawal if you need one. Some banks even support instant fulfillment. Add your tip, and then you just wait for processing.

On payday, Earnin deducts those withdrawals from your paycheck. This does mean it has to access your bank account, which is why it comes with hefty encryption. It’s also why it doesn’t work for freelancers and many other multiply-employed people.

You can start with Earnin whenever you want, but to get money as fast as possible, you need to be on the service and verified. Signing up takes a day or two as your work is verified and you confirm your account.

After that, you can get your money the next day by requesting it as you leave work. Some banks even offer same-day fulfillment of Earnin transaction requests.

All sounds good so far? Don’t wait to get access to your money as you earn it. Download Earnin for your mobile device today and save money every time you need an advance.

Is the Earnin App Right for Me?

For most people, the financial obligations that cause issues leading to a cycle of debt are relatively small, it’s just their timing that creates an issue.

Large expenses have financing support, and they tend to be invoiced in ways that don’t expect an immediate payment, but a car repair, unexpected home repair, or injury can cause a $200-500 hiccup that costs twice as much or more by the time all the financing fees are handled.

Financial freedom for many would be as simple as getting paid on the day they worked. Having a two-week pay period followed by a week of paycheck processing means getting paid as much as three weeks late, and your daily expenses don’t wait. If you want cash advances without cash advance fees, there is an option.

How Does Earnin Make Money?

There are a few ways that Earnin makes money. First, Earnin makes money through tips. When you use the app and get paid back quickly, you have the option to leave a tip. This is completely voluntary, but it is a great way to support the company. Finally, Earnin partners with companies that offer financial products and services that may be of interest to you. When you use these products and services, Earnin may receive a referral fee.

Join Earnin and Save

If you’re wishing you had a financial management app that included the ability to withdraw your pay the same day you work, you are in luck. Earnin provides just that service, to anyone who is employed salaried, hourly, or on-demand.

Freelancers and other self-employed individuals like professionals in practice will need to find a different service, but they also have the option of accessing business financing not open to the traditionally employed. That’s what this app brings you.

- Access to your hard-earned cash right when you need it

- No hidden fees, no penalties, no waiting

- Get up to $500 of your paycheck per pay period

Apps Like Earnin

So what are other payday loan apps like Earnin? Here are the best instant money loans apps like Earnin:

|

30-day free trial

|

|

|

Primary Rating:

5.0

|

Primary Rating:

4.8

|

|

Pros:

|

Pros:

|

|

Fees: 30-day free trial

|

Fees: $1/mo

|

- App Store: 4.8 – 146k reviews

- App Store: 4.8 – 652k reviews

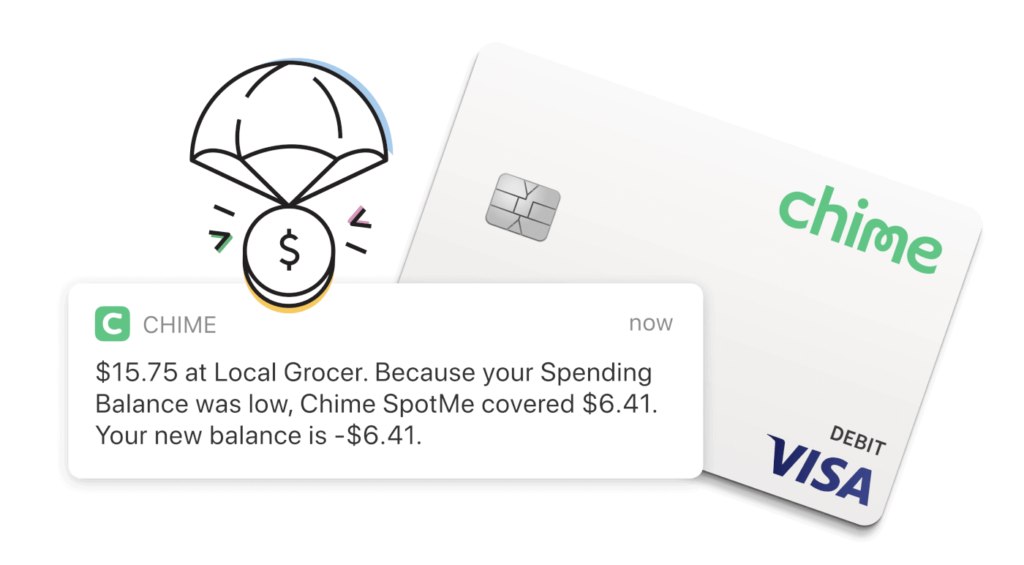

Chime

Traditional banks took $11 Billion in overdraft fees in 2019. At Chime, they do things differently. Instead of charging you an overdraft fee, they allow you to overdraft up to $200* with no fees. So if you need to pay for something but don't have any money, you can still buy it with Chime SpotMe covering you. There are a ton of apps that work with Chime so it's a flexible option for any consumer.

- Qualify for up to $200 overdraft without paying any fees with SpotMe*

- No monthly fees and no minimum opening balance

- Get paid up to 2 days early with direct deposit*

Empower

Empower is an app like Earnin designed for today’s generation. No matter what lies ahead, they’ll help you thrive by letting you borrow money. By downloading the app you can get a cash advance of up to $250 when you need it most, and save for your future.

You can count on them to have your back and get a cash advance up to $250 directly to your account. No applications, no interest or late fees, no credit checks or credit risk. You just pay them back automatically when you receive your next direct deposit. There's no catch. It's that simple.

- Get a no-fee and interest-free cash advance of up to $250

- Use AutoSave to automatically set money aside every week

- Costs $8 per month after a 14-day free trial

Brigit

Brigit is another instant loan app like Earnin that can help anyone get paid today. By downloading the free app on iOS or Android — you can join 3 million members who get paid up to $250, budget, and save smarter with Brigit. Only takes 2-minutes. No credit check. No interest.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

MoneyLion

MoneyLion is banking that gives you more, a lot more so you can get paid today. You can get spotted $250 at any time with no interest with Instacash. This gets you 0% APR cash advances up to $250 to help you cover essentials and surprises, just apply here and link your checking account (no monthly fee). Plus, you can get your paycheck up to two days early with RoarMoney – plus easy ways to borrow, save, invest, and earn. All in one app.

- The maximum advance is $250

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

Branch

Apps like Branch offer a mobile digital wallet for working Americans. An on-demand hub that helps them meet their everyday financial needs, this get paid today app allows any employee to receive a payroll advance (up to $500 in earned wages per paycheck), manage their cash flow, and spend anywhere – all from their smartphone.

Dave

Apps like Dave pride themselves on being banking for humans. Meet the banking app that puts your financial mind at ease. Get paid up to two days early, build your credit history and get up to $500 advances without paying a fee. 7 million members and counting consider Dave one of the top reliable cash advance apps.

- Dave is an app that provides an advance of up to $500 on your next paycheck

- Only required fee is a monthly $1 subscription fee

- An optional express fee from $1.99 to $13.99 to receive funds within an hour (instead of the standard two to three days)

DailyPay

With apps like DailyPay, you can work and get paid today. Employees have access to their pay when they need it and in between paydays even. However, these types of daily pay apps are different than cash advance apps as your employer must sign up and offer DailyPay as a benefit.

PayActiv

Apps like PayActiv give workers a complete solution to access cash, pay bills, get around and prepare for the future. Avoid late fees, overdraft fees, and high-interest loans with on-demand access to the money you've already earned. You can get paid today and withdraw the greater of $500 or up to 50% of your earned wages. However, this is another app where your employer must offer PayActiv as a benefit.

FlexWage

FlexWage is another employee-sponsored platform where you can get paid today if your employer offers it. If they offer it you can get access to your paycheck via a reloadable card tied to your earned wages. There are a few apps like FlexWage and if your employer offers it, the fees will be determined by the employer.

More Financial Assistance During Pandemic

There are payday apps like Empower that can help you get your paycheck early so you get paid today. When you need cash to make it to payday, these apps can be a huge help. All these payday apps are listed in this article.

There are websites where you can get paid instantly by completing online activities. You essentially get paid to do something on sites like Swagbucks or InboxDollars.

There are a few apps that will you free money, which we've listed in this article.

Yes, you may borrow money for a short time using one of these cash advance applications. They're available to download and use from your smartphone, so the cash can be distributed quickly and from anywhere.

You should submit your application for a cash advance using the chosen app. To receive the cash you want, provide your personal and banking details.

A checking account must be linked to the app of your choice for every borrower. Otherwise, the borrow money app won't be able to deposit money for you to meet your demands.

You may pick the applications that allow you to borrow money from your future salary. This way, before the next payday, you will get the funds you have already earned and return them automatically once your wages are paid into your account.

External resources, so you don’t have to do the research:

1) Have you lost your job? You can file for unemployment. Apps like Brigit also have automatic advance extensions for any user who has filed for unemployment. No questions asked.

2) Need some government help? Smarts is tracking everything to do with the government's two trillion dollar stimulus package. Are you eligible? How much will you get and do you need to file? It’s all here.

3) Looking to earn money? We have two articles about this, one for people looking for full-time online jobs and another for people looking for part time income (the gig economy).

4) Worried about bills? Here is an article from our team on ways to save money on groceries. Credit card companies and some banks are also delaying payments, waiving fees, and removing interest charges. You can get out ahead of these problems.

5) Trying to stretch your budget? Check out our guide on living cheap. Maybe you already know it all, but maybe there are some tidbits in there to help.

Borrow Responsibly

If you're like most people, any new financial need or demand makes you irritated and tense. The best money borrowing app can help you meet your immediate demands without delay. Since you're likely unready for financial emergencies and each additional financial can put you on edge.

There are several advantages of borrowing money via an app rather than going to a local bank or pawnshop to try and get quick cash. Even though there are many lending institutions in each city today, you may not be aware of all the nuances, interest rates and fees among them.

Every potential borrower must understand that he or she is fully responsible for any loan or cash advance obtained. This money should not be taken for granted, since it will only be used for a brief period of time.

Finally, such small amounts of loaned money can't accommodate long-term financial objectives. Consider alternative ways to finance your long-term goals and needs, or try to increase your income potential with side hustles.

With that said, good luck with borrowing money with these apps like Earnin.

Need Quick Cash Now?

If you need quick cash before payday, you probably already know the traditional options. You also know they’re expensive, and they can pose a risk to your financial freedom. When you need cash advanced to cover expenses, there is an option that is just as fast as traditional short-term loan services, but with fees that are a fraction the cost.

Find out how much you can save. Sign up with Earnin today.

With Earnin, you get paid today and can access up to $100 per day from the pay you've already earned, without hidden fees or interest. With Earnin there are no mandatory fees or interest. You choose what you want to pay to support the service. This is a radical change from the way the American financial system typically functions.

*Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

- Up to $250 Instant overdraft coverage

- With Instant, you can overdraw your Albert Cash account up to your Instant limit

- Costs $14.99 per month after a 30 day free-trial