Saving money is always an important thing to consider for those looking to manage a budget. But what if I told you that you could actually get paid to save?

Today, we have a wide variety of websites and applications that allow people to not only to find out about discounts but have cash back from their purchases as well.

Earning cash back on your purchases is a great way to make some extra money. It might not seem like too much at first, but it’s something that takes no effort and it adds up – simply link your credit card to a website or app and start earning cash back.

Let's get into it.

How to Get Paid for Saving Money

If you want to save $500 in 30 days, it's possible. Or even save $1,000 fast, here are some ways to get paid for saving money.

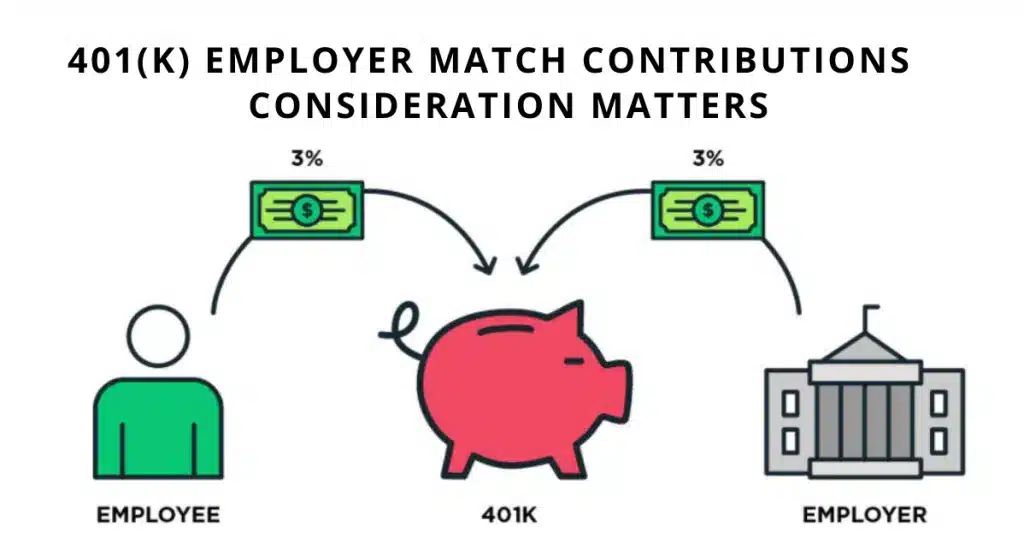

1. Use all your company’s matching funds

Employers will often match the amount of money that you contribute to your retirement plan. This means that every dollar you contribute results in two dollars being invested into your account.

Therefore, if you get paid to save, contributing as much as possible will get the biggest match. That's free money in your pocket. Make it a priority to check what your company does when it comes to giving money for retirement. You don't want to miss out on free money.

2. Get the biggest tax refund this year

Tax refund season will be here soon enough, which means that many taxpayers are thinking about filing their taxes to get their refunds. The average direct deposit tax refund last year was nearly $3,000 according to the IRS.

However, there may be new tax benefits to help with the impacts of coronavirus.

Here are six tips to help maximize your tax refund this year:

- Take advantage of the tax benefits provided by coronavirus relief measures.

- Don't take the standard deduction if you can itemize.

- Claim your friend or relative you've been supporting.

- Take above-the-line deductions if eligible.

- Don't forget about refundable tax credits.

- Contribute to your retirement to get multiple benefits.

Check out the IRS website for Coronavirus tax relief assistance.

3. Open an investment account with a sign up bonus

If you sign up for an investment account like an investing app or online broker, you can usually find some solid sign up bonuses.

Many brokerages offer a sign on bonus for new customers who set up an investment account.

And this isn't just about getting a free calculator, they will deposit more capital into your account if you meet their minimum investment standards.

Believe it or not, most online stock trading brokerages offer sign up incentives these days. From free stocks to free cash, brokerages and investment platforms are willing to give you an incentive for doing business with them.

There are dozens of ways to get free shares of stock through these investing apps. My favorite part of personal finance and the investing experience is making sure my brokerage is doing its job.

The investment apps below are some of the best, so you can build a solid portfolio of mutual funds, stocks and ETFs while scoring free shares of stock.

|

Primary Rating:

4.5

|

Primary Rating:

5.0

|

|

Get 16 free stocks valued up $2,000

|

Get $20 bonus investment after joining

|

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

- No fees to open or maintain an account

- No fees to transfer funds to an account

- Free Level II data

- No account minimum

- Advanced trading platform

- Free research tools

- No fractional shares

- No minimum deposit

- Low-cost, diversified funds

- Beginner-friendly

- Offers online checking account

- Easy-to-navigate interface

- $3 per month

For a list of some of the best bonuses offered by brokerage firms, check out this post on how to get free stocks.

4. Open a savings account with 5% APY

As an eco-friendly financial company, Aspiration puts your savings to work as more than just rainy day money. In fact, you can choose to “plant a climate change-fighting tree with every purchase you make” if you open an Aspiration account.

There are two different types of savings accounts at Aspiration: Basic and Plus. The basic savings account allows you to pay what is fair, which can be $0 per month if you choose. You will earn 3% APY on the first $10,000 you save, but the real savings begin with the Plus account which offers a 5% interest savings account.

With the Aspiration Plus account, you unlock a 5% interest rate that puts this financial institution at the top of our list of the best 5% interest savings accounts.

Now you can get some beer money at any time — for free! You didn’t have to do anything, other than originally sign up for Aspiration. It’s as simple as that.

There's a good chance your bank is using your money to fund oil projects that destroy the climate. Put your money where your values are. Join Aspiration today.

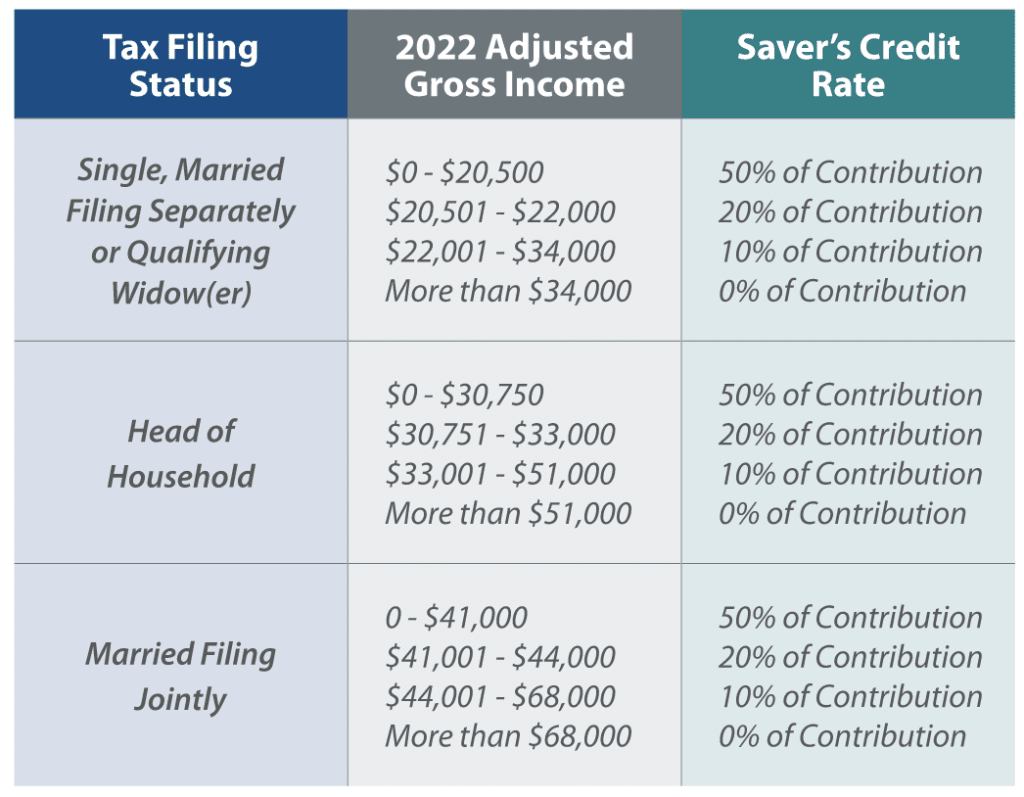

5. Take advantage of the Saver’s Credit

Another way to get paid for saving money – the Retirement Savings Contributions Credit.

Contribute money to a qualified retirement account and the IRS will send you an additional $1000 or $2000 if you are married.

There are income limits in 2022. For instance, single individuals can have up to $34,000 in adjusted gross income per year while married couples filing jointly may earn a combined total of up to $68,000 annually.

The Saver’s Credit will make it worthwhile to make saving for retirement a priority.

For more information, check out the IRS website for details.

Get Paid To Save with Cash Back Apps

What is a cash back, you might ask?

It is a financial refund that you receive after making a certain purchase. So right now, we will present you with the best grocery rebate apps to get your cash back.

6. Ibotta

Ibotta works with all kinds of products, but the majority of items to receive your cashback for are still groceries. However, you have to remember that you can only receive your money back if you buy specific products. That is not something to worry about though, the variety of goods is quite extensive. There are also welcome bonuses for those who register for the first time.

Ibotta will pay you for going shopping, it's that easy and you can get a $10 bonus after uploading your first receipt.

7. Dosh

For Dosh to work properly you have to connect your credit or debit card to it first. Then, you can go shopping and receive up to 10% cashback on selected goods. The most convenient thing about this particular cash back app is that you can choose where to transfer the money you receive, be it your bank account or via PayPal.

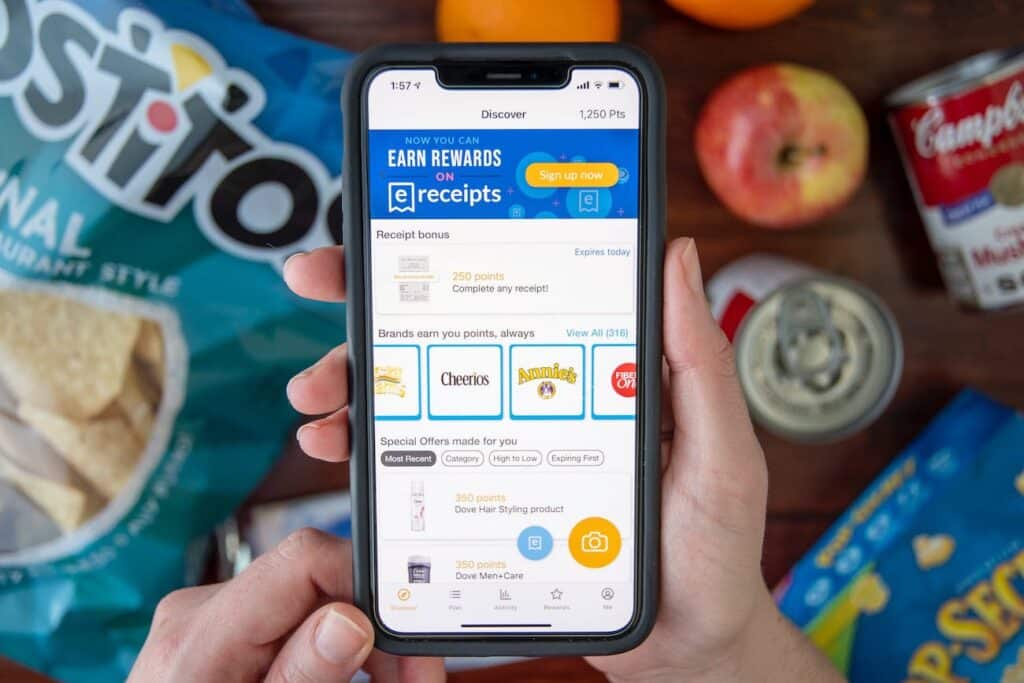

8. Fetch Rewards

Great news from the very start – Fetch Rewards gives you a bonus of $1 as a registration gift. You might want to check it out because it gives you a wide amount of grocery items to choose from if you want to receive a cashback for your purchases. It might not be as big as previous ones, but it is definitely growing.

With Fetch, you get rewarded for anything you buy. Snap a receipt to get started. Shop all your favorites & get rewarded on Fetch. Try the free app now. Earn points and redeem.

9. Acorns

Acorns is a bit unusual as it allows you to make a direct deposit with your cashback money. This way, when you go grocery shopping, the app takes your cashback and invests it in more than 250 top brands, therefore creating a source of passive income for you. Well, isn’t that cool?

With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

You can read our Acorns review for more details.

10. Capital One Shopping

Capital One Shopping is a browser extension that is completely free of cost and assists you in saving money while shopping online. It offers an array of features that includes an automated coupon code lookup, price drop alerts, and “Shopping Credits.” Shopping Credits can be earned by making purchases at designated merchants and can be later redeemed for gift cards. The extension's “Exclusive Deals” feature is worth exploring, as it enables users to earn up to 30% in Shopping Credits at major retailers, making it a must-have tool for frequent online shoppers.

11. Checkout 51

In many ways, this cashback service from Checkout 51 is similar to the one that we have already discussed here – Ibotta. However, this particular app is not as big. Nevertheless, you can often find sweet discounts and cash back for vegetables and fruits. You have to check out new offers that are updated every week on Wednesday.

12. Receipt Hog

Unlike other cashback services previously discussed in this article, Receipt Hog does not have a strict restriction on the type of items that you have to buy in order to receive your money back. This way, you can easily use it for a wide range of items and not only for grocery shopping. The money that returns to you can later be transferred to your bank account or presented to you in a form of free gift cards – the choice is yours.

13. NCPMobile

NCPMobile (iOS only) lets you easily turn your shopping receipts into fantastic rewards with just a quick pic. Unlike most similar grocery apps, you can use NCPMobile to take pictures of all your receipts, from grocery stores to hardware stores (and everything in between).

Send the pictures of your receipts using the app, and you’ll earn reward points to redeem towards a pretty solid selection of gift cards. Or just cash out for a free Amazon Gift Card, which is my favorite option. Users can earn up to 500 reward points for their weekly receipt pictures. Plus, every receipt captured earns you sweepstakes entries for even more rewards. You’ll also be invited to take online surveys – giving you additional reward options.

Grocery store, department store, pet store, convenience store, home improvement – you name it, you can scan in your receipt to earn rewards. Forgot to scan in a receipt? Don’t worry – you have up to 14 days after your purchase to capture your receipt picture and send it in for your rewards. Signing up is easy and you can start earning rewards right away.

Other Ways to Save Money

There isn’t a person on this planet who hasn’t thought, “I need to get better at saving money.”

While getting paid to save money by using money-saving apps can help — there are still countless other ways to save money that you probably haven't even considered.

I'm a huge frugal person and came up with a list of creative ways to save money. Because let's face it, many times we unknowingly spend our money frivolously without knowing how much we can easily save.

Here is a list of unconventional ways to save your hard-earned money.

Ask your employer to divide your paycheck

It means you request the human resource department of your company to divide your monthly paycheck between your savings and checking account. Doing so, a portion of your salary will automatically get deposited into your online savings account. Moreover, the rate of interest is also more for savings accounts as some banks now offer 5% interest savings accounts.

Plan a budget to save more

Yes, this is the basic step in every financial planning. You need to plan a budget to track your spending and set savings goals. Without a budget, you’ll never know where you need to cut down. It will take some time to plan a suitable one. But start planning one and soon you’ll master the art of planning the most suitable one even if you're on a low income.

Opt for a rewards credit card

Using a credit card is not bad altogether. If managed properly, it can help you increase your credit score. However, you should swipe your card for an amount that you can repay comfortably within the billing cycle. Opting for one of the best rewards credit cards helps to earn rewards on your purchase. For example, a rewards card can give you cash back of a certain percentage when you use it to pay at a grocery store.

|

Primary Rating:

5.0

|

Primary Rating:

5.0

|

Primary Rating:

4.4

|

|

Pros:

|

Pros:

|

Pros:

|

- Intro APR: 0% intro APR for 15 months on purchases and balance transfers

- Promotion: Earn 100,000 Membership Rewards®points

- Pros: The only premium card for building credit.

Buy in bulk to save more

You can buy certain items in bulk to get lucrative discounts is a great way to learn how to live cheap. However, before doing so, make sure you’ll be able to consume those stuff before the expiry date. You can also take a friend with you and split the things amongst yourselves.

Take advantage of corporate discounts

Check out whether or not your company offers corporate discounts on hotel fares, gym membership, etc. It is a great way to save a substantial amount. However, restrict yourself to spend extra due to such privilege.

Use your body weight to exercise

Figure out ways to cut out expenses like the gym. You can easily cut out the expensive gym membership and enjoy nature while working outside. You can do cardio workouts along with yoga and freehand exercises to stay healthy. It will be more enjoyable if you work out with your partner or family. Also, check how much you’re able to save by exercising this way. However, if you stay at a place where the weather is not suitable to work out throughout the year, then choose a cheaper gym membership for those months.

Plan your weekly meals ahead during the weekend

Sit down with your family and plan the meals for the entire week. Along with saving time, it will help to save money and have healthy food too. Doing so, you can also restrict your visit to the grocery store because you know exactly what you want instead of speculating what to get. You can just follow the list.

Try to stay closer to your workplace

This might not be possible every time but try to stay closer to your office. It will help you save a lot on fuel. It is best if you can walk to your job. By doing so, you can exercise and save fuel costs at the same time. You can save time too!

Ask for discounts and promo offers at the stores

There is no harm in asking for a discount when you visit a store. Believe me, you won’t hear a ‘no’ every time. You shouldn’t be ashamed of asking that; after all, it’s your hard-earned money. Also, ask the store to price match if the price of a thing has got reduced after you bought it. Usually, the stores offer price match within a week of purchase.

Unplug all electrical gadgets when not in use

You can stop draining power from your electrical gadgets at least during the night, when you sleep, by unplugging them. Also, when you go out, there’s no use of keeping your television, computer, etc. plugged.

Keep your condiments in a jar

Always keep the extra condiments from the restaurants in a beautiful jar. You can use them when you cook food at home. By using condiments, you can enjoy the taste of restaurant food at home. Moreover, the jar of condiments will add to the decor of your dining room.

Give a portion of your house on rent

You may not need the entire house to live comfortably, do you? For example, if you have a garage space to keep 3 cars, rent one of them and earn a few dollars every month. Likewise, you can also rent another portion of your house if it can be accessed from outside.

Get carpet samples to cover your floor

Usually, you get these samples at free of cost when you visit the carpet stores. Accumulate them, place them, and glue them. You will get a beautiful unusual floor design. You can apply this technique in your basement, playroom, or to create a unique design in your living room. The same technique you can use with wallpapers.

Use less water to flush tank

Use this mechanism to reduce the amount of water in your flush tank. It is really simple. Just take a jug, fill it with sand, and keep it in the back of your toilet tank. Every time you flush, you’ll save a significant amount of water. Over the year, it will help you save about $100.

Do not waste water when you’re waiting for hot water

This is a very unique and creative way to save money on your water bill. When you run the faucet and wait for the hot water, store the cold water in a pitcher. Later, you can use cold water to water plants or for other purposes. You can even use this water for cooking if stored properly.

Maintain a constant temperature in your thermostat

Always keep your thermostat temperature constant. Do not make it too cold during the summertime and too hot during the winter season. Instead, wear light woolen garment inside your house during the winters. This will help you save a great amount of energy, and in turn, money.

Shop and compare insurance policies before buying one

Do not buy any insurance policy, without comparing it, even if you think you’re getting the best price. Because you never know another company might offer similar coverage at a much lower price. However, make sure you compare apple with an apple and not orange. For example, compare the exact policy coverage along with the price offered. Also, check out the financial strength rating of the company to be sure that you’ll get the coverage amount if you need it.

Plan a vacation during Christmas

Looking for a creative way to save money when Santa is around besides cheap Christmas gifts? Plan a vacation during Christmas time and save money on gifts. You can spread this news amongst your family and friends and tell them that you’ll exchange gift once you come back. The gifts are usually offered at a much lower price after the holiday season. Moreover, you can also buy decorations for next year just after Christmas and New Year to take advantage of the lowest rate.

Give yourself some occasional treat and splurge a little

This may sound contradictory but occasionally splurging a bit can help you stay on track. However, make sure you don’t spend too much. Plan a budget or use budgeting apps to optimize where you keep a little allowance to enjoy every month with your family. Doing so, your family members will also motivate you to follow the other tips to save more.

Get married to a person who practices frugal living

This is one of the most unconventional ways you’ll ever hear of. If your partner practices frugal living, it’ll be easier for you to save money. Both of you can accomplish your mission if you’re not able to do it on your own. If you’re in debt, your partner can help you to consolidate your debt and repay the amount within a definite time. Both of you can discuss and find out a suitable strategy to solve your debt problems.

Always take care of yourself

It is of utmost necessity to look after your health along with your family members. Get a good amount of sleep, exercise regularly, follow healthy eating habits, avoid bad habits, etc. to stay healthy. It will help you save the cost of expensive medical bills. Even if you have medical insurance, which is a must, you have to make the co-payment and co-insurance before your insurance company pays the bills.

Use Google Voice instead of calling from your mobile

Bet you never heard of this creative way to save money. How can you do that? Get Google Voice and access your phone interface from your desktop computer. Then, you can make calls or even send a text to your friends.

Make your own creams and lotions

Apart from saving quite a hefty amount, your DIY creams and lotions are skin-friendly too. You can control the number of chemicals you use on your skin. So, it will reduce your trips to the parlors as well. In addition to this, do your own manicure at home. You will find a number of videos on Youtube that can help you prepare your DIY stuff. Along with it, also pamper yourself at home by preparing a home-made spa instead of paying a lot for a spa session.

Getting Paid to Save

We hope you enjoy this list of the best ways you can get paid to save. If you use these apps, you will be surprised, how much money you can actually save at the end of the day. So do not waste any more of your time and go buy some healthy foods and receive your cash back later.

You may wonder how much you’ll save by following these creative ways to save money. But, think once again and calculate how much you can save per month if you follow all these tips. Wait! Now multiply that number by 12; it is a substantial amount, isn’t it?

So, start following these tips one by one and save a considerable amount which you can spend on things you like. Enjoy saving!