Looking for ways to make passive income? I'm sharing my secret stash of an untapped list of the best passive income ideas to make money online.

Passive income seems like an elusive fantasy for most people. I want to spread the word and set the record straight that passive income is for anyone to enjoy.

Depending on how much disposable cash a person has, they can put their money to work in areas ranging from high yield savings accounts, real estate, and more unique ways such as peer-to-peer lending.

Getting passive income is simple but many people don't realize it. Realty Shares did a study and found that only about 15% of Americans invest in real estate beyond their primary residence. I believe this is due to a lack of awareness that investments in real estate can be made with just $100 with companies like Arrived Homes, no really.

Clearing up misconceptions such as these can be a significant difference-maker for individuals looking to learn how to make money online fast. But what are the best approaches to generating passive income?

The Two Approaches to Generating Passive Income

I'm now going to reveal the untapped list of the best passive income ideas to make money online.

Before I pull back the curtain and share some of the most creative and best ideas for active income you must know that are two ways to create an income stream:

- Create passive income (if you have money)

- Create passive income (if you have time)

Create Passive Income (if you have money)

We all heard the old saying “Make your money work for you” right? Generating passive income can sound tough if you don't have a lot of money lying around. Building a passive income strategy can be for everyone — even if you only have $50. Here are some ideas you can start with:

- Open a high-yield savings account

- Invest in real estate

- Rent out your room

- Start investing commission-free

- Get cash back for shopping you already do

- Refinance your student loans

- Refinance your home

Create Passive Income (if you have time)

What's better than money? Time. Whether it's after work, on the weekends, or even in the mornings — you stand a chance to generate passive income streams… all you need is time and effort. Don't believe me? Here are some legit passive income streams to start with:

- Start a money making blog

- Take online surveys

- Get paid to search the web

- Earn money with Gmail

- Make beer money

- Get paid to lose weight

- Make money by walking into stores

- Pick up riders on your route to work

- Share your car

- Start dropshipping

- Play trivia apps for real money

- Watch YouTube videos

- Make money by reading emails

#1: Open a high-yield savings account

You may not consider a high-yield savings account as one of the most lucrative passive income ideas but it is a must. If you have cash sitting in a checking account or a traditional savings account, no matter what amount, it's likely earning only 0.09% (the national average). It now pays off to have high-yield savings accounts that now offers attractive interest rates up to 4.00%. Basically, the higher your interest rate, the more money you make off your cash.

Current is a great example of this. Current is a neobank that works differently than traditional savings accounts, far from it actually since it offers a hybrid checking/savings account.

What separates Current from other banks is that it offers 4% interest on its savings “pods” for balances up to $6,000.

Savings Pods are a way to save for whatever you want, whether that’s a rainy day fund, a vacation, or even monthly expenses like groceries.

Current has different savings pods where you can deposit $2,000 in each earn to earn up to $240 in interest over the year.

This is a significant increase from the traditional 0.07% offered by most traditional banks. In addition, there are no fees associated with Current’s savings account. This makes it an ideal option for those looking to save money.

Current also has a slew of other features, such as a debit card that offers cash back, overdraft protection, a debit card for kids, getting paid 2 days early, and a cash advance feature.

- Get Paid Up to 2 Days Faster

- Fee-Free Overdraft up to $200 with Overdrive

- 40,000 fee-free Allpoint ATMs in the U.S.

- No minimum balance or hidden fees

#2: Invest in real estate and earn rental income

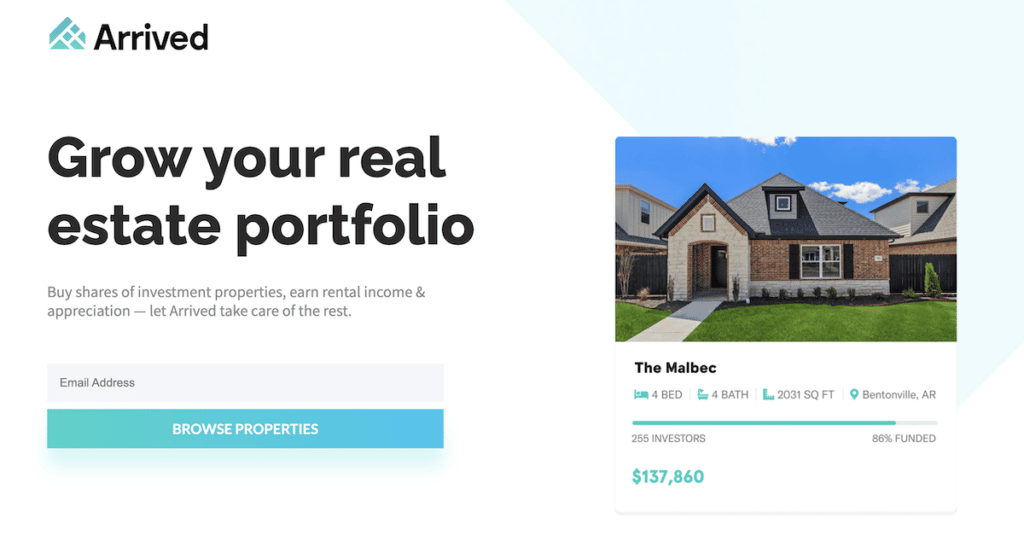

Arrived is a great real estate investing platform to use if you want a low minimum investment threshold for real estate investing. You can get started with as little as $100.

It’s an especially useful tool to use if you want to diversify your portfolio and have someone else handle all the work that comes with being a landlord. All you really need to do is sign up, and collect your rental income each quarter.

The management fee is a modest 1% asset management fee, but it's worth it considering how easy it is to get started. You can sign up for free and view the different properties available to invest in. Buy shares of properties, earn rental income and appreciation — let Arrived take care of the rest.

Then you can literally beat the stock market year after year and start making money in your sleep. If you want to earn the big bucks then you can learn how to get started by getting more information from Arrived here.

Arrived lets you invest in residential real estate and vacation rentals with only $100. It's an excellent option for anyone looking to earn passive income with rental units. And the platform is available to non-accredited investors.

#3: Earn passive income by renting out a room in your home

One of the best passive income streams for those with a spare room is becoming an Airbnb host. No matter what kind of home or room you have to share, Airbnb makes it simple and secure to host travelers. You’re in full control of your availability, prices, house rules, and how you interact with guests.

Like Uber did for Taxis before it, Airbnb is fast revolutionizing the holiday and travel accommodation industry, and you’re set to profit from it!

Airbnb is an online marketplace for people with space, rooms, or even entire houses to spare as they let you list your place for rent just like a hotel or motel.

Maybe you’re traveling overseas yourself and want to make the most of your empty place while you’re away? Perhaps you have a spare room that currently houses nothing more than empty boxes? With Airbnb, you fill that empty space in your home and fill that empty spot in your wallet with more than a little spare change.

#4: Start investing with free commissions

We all heard the old saying “make your money work for you” right? Investing can sound tough if you don't have a lot of money lying around. But investing can be for everyone — as some companies even give you free stocks just for joining.

My favorite part of personal finance and the investing experience is making sure my brokerage is doing its job and I reap the cash flow. The investment apps below are some of the best, so you can build a solid portfolio of mutual funds, stocks and ETFs while scoring free shares of stock.

|

Primary Rating:

4.5

|

Primary Rating:

5.0

|

|

Get 16 free stocks valued up $2,000

|

Get $20 bonus investment after joining

|

|

Pros:

|

Pros:

|

|

Cons:

|

Cons:

|

- No fees to open or maintain an account

- No fees to transfer funds to an account

- Free Level II data

- No account minimum

- Advanced trading platform

- Free research tools

- No fractional shares

- No minimum deposit

- Low-cost, diversified funds

- Beginner-friendly

- Offers online checking account

- Easy-to-navigate interface

- $3 per month

#5: Get cash back for shopping you already do

Another passive income idea is getting paid cash back for the shopping you do daily. You can start doing this by using two simple strategies:

Step 1: Cash back credit cards

The best credit cards can help you generate passive income with every swipe. If you’re serious about saving money to make extra money, then you should know about cash back credit cards.

There’s a credit card for everyone, whether you prefer cash-back incentives, eco-friendly cards, the thrill of travel rewards, or the need to establish credit.

But with so many credit cards on the market, it can be hard to find the one that’s right for you.

To help you narrow down your choices, we’ve compiled a list of the best credit cards in several different categories. So whether you’re looking for a card with no annual fee, a 0% intro APR period, or the best rewards program, we’ve got you covered.

No matter what your financial goals are, there’s a credit card out there that can help you achieve them. So take a look at our list of the best credit cards and find the one that’s right for you.

|

Primary Rating:

5.0

|

Primary Rating:

5.0

|

Primary Rating:

4.4

|

|

Pros:

|

Pros:

|

Pros:

|

- Intro APR: 0% intro APR for 15 months on purchases and balance transfers

- Promotion: Earn 100,000 Membership Rewards®points

- Pros: The only premium card for building credit.

Strategy #2: Cash back shopping portals

Another passive income idea? Of course. You can also utilize your cash back credit cards with these shopping portals for ultimate saving hacks:

MyPoints

Have you heard of MyPoints? It’s a cash-back site that pays you to shop online. I love it because it lets you earn cash for the shopping you would do anyway.

And right now, you can earn a $10 Amazon gift card with your first purchase at any retailer through MyPoints!

Here’s how it works…

- Sign up for MyPoints here (you just need to give them a name and email address).

- MyPoints will instantly send you an email to confirm your email address. You’ll need to click that to get the free gift card.

- You’ll also need to purchase $20 worth of products at any of the more than 1,500+ top retailers like Walmart, eBay, & Amazon. MyPoints will reward you with 1,750 bonus points that you can redeem for a $10 Amazon gift card.

That’s all! It’s basically $10 off anything you buy.

Click here to get your free Amazon gift card!

Upside

Another monthly income idea? Have you ever dreamed of paying less for costly gas each week? Well, that time has come, with Upside you can earn money by sharing your purchase receipts and shopping at local stores. I heard about this app on the radio and decided to try it out for myself.

The system is simple: you take a photo of your gas receipt and upload it. Then the app will digitize the receipt information and you'll get up to 25 cents off each gallon. I'm surprised I don't hear about this app more often though, I make a killing with it:

You can likely rack up $60 fast or make $70 fast this year by using it. And you can also save up to 35% at restaurants and 15% at grocery stores near you and make $45 depending on how much you shop. The money you earn can be transferred to your Paypal account or redeemed for gift cards to buy at Amazon and other stores.

#6: Save on your student loans

Refinance your student loans, like now. Sometimes you can make extra money just by finding new ways to save.

A big one that many people fail to remember is that you can save around $300/month just by refinancing your student loan debt.

Are you wondering did I get the best deal on my loan? Should I refinance? How do you go about refinancing?

With online student refinancing portals, you can now see how much you can save literally in minutes — and it doesn't affect your credit score.

If you are interested in refinancing student loans, it's simple to check. Compare the best lenders to refinance student loans like SoFi, Earnest, Laurel Road, Commonbond, or LendKey below:

- Easy online application

- 0.25% APR discount with autopay

- No hard credit pull required

- Customized loan terms

- Instant interest rate estimate

- Incomplete degrees are accepted*

- No hidden fees

- 0.25% rate discount with AutoPay

- Graduate, Parent PLUS, private loans

#7: Save $1,000’s by refinancing your home

If you are a homeowner, then this is one of the smartest things you can look into.

I have worked as a Business Analyst at Freddie Mac, so I know a thing or two about the mortgage market.

If you own a home and have not yet taken advantage of historically low refinance rates, you probably are spending way more than you should be on your mortgage.

LendingTree could help you refinance your mortgage at a significantly lower interest rate – Let’s say you can lower your rate by around 1%, on a $200K mortgage, can save you over $100/month and over $40,000 in total over the course of your 30-year loan!

You can also look into learning how to leverage home equity in your home to take advantage of sky-high home prices.

Passive income ideas that require time & effort investment

These passive income ideas require some time and effort on your part. No money is required, but time is.

#8: Start a money making blog

If you are looking for ways to make extra money online then you probably already know about blogging. But do you have one yet? And do you really know how much potential there is to make money with blogging?

The best part? Starting a blog is easy with Bluehost. You can get the initial set up done in under 20 minutes and it's just a Google search away.

Bluehost is one of the largest website hosting providers and powers millions of websites and you can start a blog in less than 10 total clicks. If you set up your site on a platform like Bluehost, it automatically walks you through every step of the process, from buying the domain to setting up your own blog.

#9: Get paid to take surveys online

Websites like Survey Junkie can make you quick money for passively sharing your opinion and trying new products.

It is 100% legit and simple: companies pay you in cash via PayPal so they can understand consumers better and survey takers can benefit.

The number one survey site is Survey Junkie, which has an 8.9/10 on Trustpilot, the highest of any survey site.

Expect to make between $1 and $50 per survey, it varies but most surveys take under 5 minutes to complete. If you're already a fan of Survey Junkie, be sure to check out our list of recommended paid survey sites.

Knowing that companies are using your opinions to make decisions about restaurants, consumer products, movies and a lot more is oddly satisfying. They also have plenty of high paying surveys to choose from, so you don't have much to lose. You can get started with a registration bonus here.

Survey Junkie has a well-designed platform, straightforward rewards system where you can get paid to surveys, listen to music, try out new products and participate in focus groups at home.

#10: Score a $10 bonus from this rewards company

Swagbucks is a rewards site that pays you to do simple tasks like search the web, play games and even watch TV!

It’s similar to Survey Junkie, but there are also a few other ways you can earn money as a member (including a $10 bonus just for signing up).

Other ways you can make money with Swagbucks outside of surveys:

- Cash back program for online shopping (Includes $10 bonus).

- Get paid for searching the web (Includes $10 bonus)

- Watching videos (Includes $10 bonus)

Swagbucks is conveniently offering a $10 bonus just for signing up through this link, so act fast.

There are quite a lot of reward sites out there. These just happen to be the more reputable ones that are legit. As always, be wary of handing out your information to random survey sites. I recommend using an entirely separate email address for online paid survey sites so you don’t clutter your inbox.

Bonus: $10 sign up bonus

Swagbucks is a site that allows you to earn points or "Swagbucks" to redeem for gift cards or cash, yes, cold hard cash, via your PayPal account for doing simple tasks.

#11: Download beer money apps that pay you passively

Beer money apps let you build a new passive income stream from the comfort of your home. For example, by using the internet as you do every day, a company called Nielsen invites you to make a difference – and you can make money too. You don’t even have to do anything other than registering your computer or phone.

That's right — Nielsen will pay you $50 a year to keep their app on your favorite internet browsing device and they also give away $10,000 each month. So you can possibly make more than $50 for no effort at all.

Like beer money apps? Here are some of my favorites:

Swagbucks

Swagbucks is one of the highest-paying beer money apps that actually works and pays via PayPal. Earn money by having videos play (easiest way to earn), play games, use their search engine or participate in focus groups. As a new member, you can conveniently earn up to $35 per survey.

Bonus: $10 sign up bonus

Swagbucks is a site that allows you to earn points or "Swagbucks" to redeem for gift cards or cash, yes, cold hard cash, via your PayPal account for doing simple tasks.

InboxDollars

You can even make money by using the InboxDollars search toolbar (an instant $1 credit) which, according to their website, could potentially net you up to $57 a year (passively). Most of the payouts on activities range from a few cents to a few dollars depending on what you choose. If you sign up before the end of this month they also give you a free bonus so you can make $5 fast just to give it a try.

InboxDollars is a legitimate way to make extra money online. It's been around for 20 years, and the company says it's paid its members more than $59 million since 2000.

Swagbucks LIVE

This is a trivia app that hosts games over the Swagbucks LIVE app. Usually, the prizes are well over $1,000 so if you're privy to trivia, give it a go. What do I like about this beer money app? You'll get beer money just for testing your knowledge and they pay you straight cash without doing any work.

Nielsen Panel

As mentioned earlier, this is the easiest beer money apps to create a new passive income stream for beginners. Nielsen Panel will pay you $50 a year to keep their app on your favorite internet browsing device. By participating in Nielsen research, you can improve the products and services you use online today. Nielsen Computer and Mobile Panel combines your device usage with people like you to build a picture of consumer behavior. By downloading the app, They also give away $10,000 each month if you sign up using a PC — so you can possibly make more than $50.

By participating in Nielsen research, you can improve products and services you use online today. Nielsen Computer and Mobile Panel combines your unique internet usage with people like you to build a picture of internet behavior.

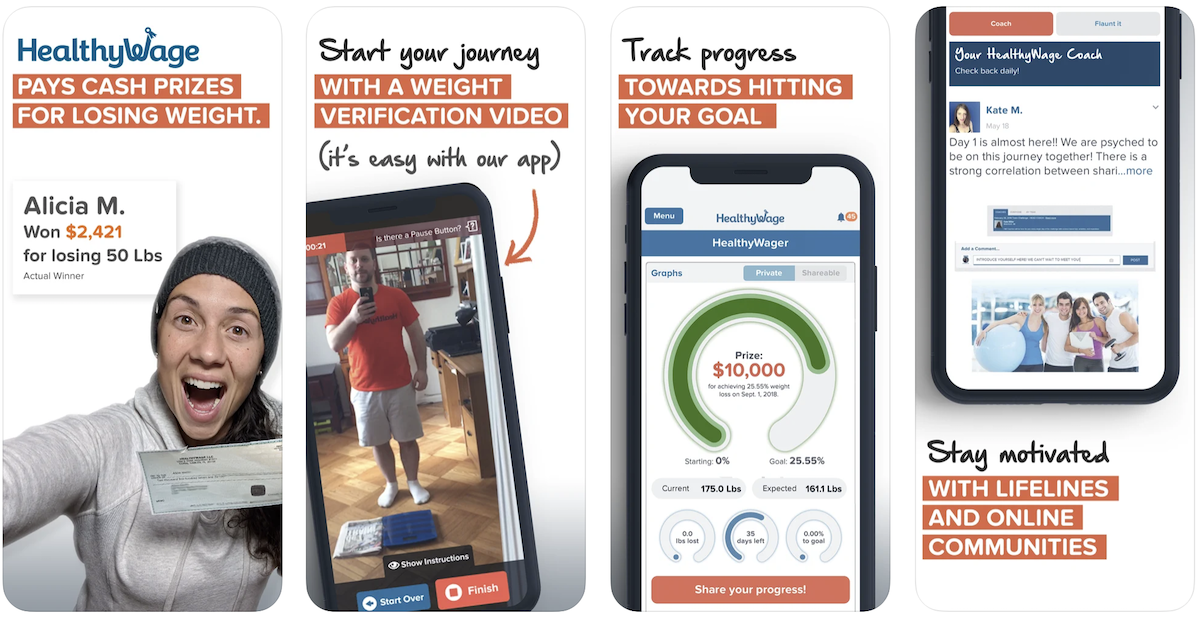

#12: Get paid to lose weight

HealthyWage offers people the opportunity to earn cash for losing weight. Earn cash for losing weight? Sounds too good to be true, but you read it right. The company was founded in 2009, and its HQ is in New York, and part of its mission is to provide ways to have a measurable impact on the growing obesity epidemic in the US.

They do this by legitimately offering cash prizes to make weight loss more fun and effective. Since HealthyWage was founded they have been featured in literally hundreds of newspapers, magazines, TV shows, blogs, and websites:

How can you make money with it?

You essentially bet on yourself and how much weight you can lose. Since they are promoting ways to be healthy, your winnings depend on how much weight you lose and how much you bet. It's a great way to make money and be healthy at the same time.

To participate with HealthyWage, you make a bet on your weight loss and then compete against others – either as an individual or as part of a team – to achieve that goal. If you reach your goal, you will win money. If you don’t, you lose and don’t get to share in the winnings.

#13: Make making passively for walking into stores

Shopkick is the app that rewards you for walking into stores. You don't have to do anything else, just physically walk into a store nearby and you can get paid to save and shop. You can earn reward points (they call them ‘kicks'), then redeem for a wide selection of free gift cards.

So whether you have any stores you can walk by on your lunch break, or go shopping now and then, you can make some quick cash with this app. What's not to love? Create a new passive income stream with Shopkick and start getting paid just for walking into stores.

#14: Pick up a rider on your way to work and earn

If you want to make legitimate money quickly, driving with Lyft is a smart side hustle.

With Lyft, you get to drive people around your city and get paid well (I'm talking an extra $500 to $1000 a month with just a few hours on the weekend).

Of course, your earnings will vary but you can earn even more now since you get tipped directly and even get a $1000 driver sign up bonus in all cities.

The smartest way to earn more is to drive when there is surge pricing. You might have guessed that surge pricing occurs when people are out and about most (weekday & weekend nights).

So instead of partying up this weekend, why not make passive income with Lyft?

Next, you can turn your car into a passive income idea that'll actually pay.

Did you know that you can rent out your car when you're not using it? And that you can bring in a lot of extra cash in your wallet by doing so? Do you plan on heading on a vacation soon while your car sits unused at your home? Do you sometimes not use your car on the weekends?

If so, renting out your car while you're not using it could be an easy way to make passive income. A well-known company, Turo, which has signed up nearly 5 million users to its website, according to Bloomberg, lets you do just that.

It's also really simple to do (and free). Listing your car is quick and easy and takes less than 10 minutes to set up. According to a recent Turo review, somebody listed their car for 5 days every month and made $3,496 in a year.

Sounds pretty good to me. Oh, and they also protect your car against physical damage, so you're fully covered. You can sign up and start making money with your car.

#16: Start a low-risk drop shipping business online

Another one of the top passive income ideas is dropshipping. Drop shipping is a system whereby you sell products without having to carry any inventory yourself. When a customer places an order, the order is then fulfilled by a third-party supplier, who ships the product directly to the customer’s door.

This is an amazing option if you’re looking to start an online business without any overhead costs. Another great thing about dropshipping is that it’s one of the easiest businesses to scale. If you find that your business is growing quickly, you can simply add more products to your store and start selling even more.

If you’re interested in starting a dropshipping business, I recommend using Shopify with Oberlo. Oberlo allows you to easily import products from AliExpress directly into your Shopify store and ship directly to your customers – in only a few clicks. It's very simple to open a shop on Shopify and drop ship items in order to create a business without too much risk.

You can literally start and set up a drop shipping business without any type of product in one afternoon with minimal risk as Shopify has a 14-day free trial and Oberlo is completely free.

Sell online, in person, or both with the marketing tools, social integrations, and sales channels you need to get your products in front of customers—and out the door.

#17: Make passive income with your smarts

What is the most popular drink in the world that does not contain alcohol? What is the official national anthem of the United States of America? What is the Capital of Australia?

If you answered coffee, star-spangled banner, and Canberra, then you may want to look into the new Trivia App called Swagbucks LIVE that pays you huge cash prizes for your smarts.

Today’s prize is worth over $1,000!

I'll be playing, will you?

Click here to download the free trivia app and start winning cash daily!

#18: Earn money for watching YouTube videos

Many of you have come here by searching “how to make $50 fast.” Well, here you go. This has got to be one of the fastest and easiest ways to make quick money.

Did you know you can actually get paid to watch movie previews, celebrity videos, news and all sorts of other videos?

You can sign up for websites like Swagbucks and Survey Junkie that will pay you to watch certain videos. They will tell you how many minutes you need to watch the video for and you might also be asked to like the video.

While you not going to make a career out of it, it’s very easy money for pressing a few buttons on your phone in your free time. There really is no limit when it comes to the question of how to make money online.

You can make around $500 a month by spending 15 minutes a day on surveys. If you wanted to make money by watching videos and other tasks you may be interested in:

- Swagbucks: Watch videos, take surveys, shop and more to earn real money. Join Swagbucks Now to Get $10 Free

- SurveyJunkie: Make up to $50 per survey in your spare time from home to take online surveys, participating in Focus Groups and trying new products. Join SurveyJunkie Now

- InboxDollars: Has so far paid its members over $40 Million. Watch videos, take surveys, shop and more. Join InboxDollars Now and Get Free $5

#19: Earn money passively by reading emails

Earn extra cash by evaluating products and services. Get up to $50 for each completed survey, product and service review. Plus earn up to $.50 for every email you read. Free to join!

InboxDollars compensates its members to test out products, services and give feedback on those tested. It's free to sign up and only requires a small amount of information.

InboxDollars is a legitimate way to make extra money online. It's been around for 20 years, and the company says it's paid its members more than $59 million since 2000.

What is Passive Income Exactly?

Passive income often sounds like some magical thing reserved for the world's wealthiest people. You know, CEOs and oil tycoons. In reality, that mindset couldn’t be more wrong. When it comes to passive income the mentality of “it all starts somewhere” is a better guide.

Separate from your regular earnings, passive income is money you earn with little to no effort usually done by completing a few (or more than a few) actions upfront and then reaping the rewards over time with little maintenance later. In a simple form, that means is your money is making money for you or you are making money while you sleep.

As you read this article, I want you to keep reminding yourself that the amount of money you get from passive vehicles does not matter. What matters is that passive income is passive income, and the goal is to increase the amount you earn from 0% to 0.1 to 0.2%, or $1 to $2 to $3 and so on. Also, this will be a long term effort to increase your wealth, not a get rich quick plan.

So what are these mythical passive income vehicles once thought to be reserved for the rich and famous? Let's take a look at 6 different passive income investments:

1. Savings accounts

It remains true that you shouldn’t toss your money into the first online bank that pops up at the top of a Google search. The advantage in that aspect remains with the local bank you can walk into and have confidence it’s a real and trustworthy bank.

You will have to do a lot more homework in regard to online banks. Although, with a bit of effort you will find a huge financial reward.

And let's be real, financial success is mostly gained by giving up an equally huge amount of hard work. To get you started, check out Marcus by Goldman Sachs Bank, Synchrony, and Ally. All three of those banks are FDIC members.

2. Certificate of deposits (CDs)

The average rates of CDs in 2024 is around 5.00% for a year or 4.80% for two years. CDs are similar to a savings account in the fact that they give you a guaranteed rate of return on your money without risk factors such as a sudden downturn in the economy or a volatile stock market.

Although, CDs do come with more rules and restrictions. The most notable difference being if you want access to your money before its maturity date you will be hit with a penalty fee. With that being said, use a CD as a secondary vehicle for your cash after you have enough in your emergency fund account for a rainy day. Typically, you should keep 6-8 months of reserve cash on hand for emergencies.

Let's take a brief pause.

I believe this is the drop-off point where most people start to say they don’t have “extra cash” and thus think passive income is for the rich.

I understand, and this is where I will remind you about increasing your passive income from 0% to 0.1% and so on.

You should, and I repeat you should have a savings account. If you do nothing else after reading this article other than opening a higher yielding savings account than the one you have now, consider it a success because you improved your passive income.

If you only have $100 in savings at any given time, you need to understand how important it is to earn $2 a year on your money vs. just 10 cents. I refuse to let you believe $2 isn't important when you only have $100 in savings.

Use whatever scenario that will help you to realize that. $2 = one meal for your child or the difference between being able to pay your power bill and not. Whatever it takes, understand more is more. Simple as that. Now, let’s continue.

4. Real estate

We have entered the realm of higher difficulty in passive income vehicles. Remember, financial success takes extra effort. There are multiple ways to earn passive income in real estate and not all of them require a six-figure salary to enter.

Real estate investment trust (REIT):

There exist public and private trust open to investors. A REIT can be thought of as a pool of money that is gathered and used to invest in something that each contributor may not have been able to (or don’t want to) finance alone, and the investments are handled by a company whose main purpose is real estate investing.

Some have high minimums, but a lot have low barriers to entry. Public REITs can be found using most investment services (TD Ameritrade, Robinhood, Merrill Edge, etc.) and investments can be made by purchasing individual shares.

Public shares give you the freedom to invest as little as you like and to retrieve your money whenever you like based on your brokerage account rules. Although, using this method you are also at the mercy of stock market volatility which means your holding could be down significantly at the time you want to retrieve it. My recommendation is to treat public shares the same as a private holding and only use cash that you don’t expect to need for at least the next 3-5 years.

Private REITs take a little more work to find and offer some advantages as well as disadvantages when compared to public REITs. After doing your research, it will help you decide which method is best for your situation.

In the private sector, you will have limited access to your funds as most real estate investments have an expected investment horizon of 3-5 years. The advantage comes from being, mostly, separate from the daily volatility of the stock market.

5. Investment groups and crowd funding:

If executed correctly with due caution, both investment groups and crowdfunding can be excellent ways to pool money together to invest in a real estate property that would have been near impossible for the average investor to invest in alone.

Investment groups can be started by anyone, and the key to success is working with partners you trust and developing robust guidelines that you will adhere to no matter the nature of the working relationships.

Avoiding the horror stories of working with family and friends should be an essential goal when establishing rules and responsibilities. Exit strategies should be clear and agreed on by the collective group because they can be an effective way to end a professional partnership while maintaining a personal one.

It is also possible to work with people who you have no personal relationships, and many online resources exist in facilitating those introductions. As with any other business venture, make sure you should do your due diligence to before making any serious commitments with people you don’t know or trust just yet.

Once a solid group is formed, as well as the supporting team members such as realtors, accountants, and others, finding and investing in a property will be a difficult task.

Although, if your group consist of people who have bought real estate before, such as their own house, sticking to a solid plan should provide good results as the actual process of buying a property is rather common.

Certain complexities will arise in the form of transferring ownership to the company, but with a solid strategy, you will be on your way to earning passive real estate income that can add another step on your stairway to financial success.

| Crowdfunding is relatively new and is rightfully so in the realm of being a skeptical route. Still, the possibility exists for it to be a successful venture toward earning passive income. Websites like Arrived Homes are gaining popularity because they expand to non-accredited investors, which basically means there are lower minimum investment options. Tread carefully, but with optimism. I would suggest as you expand your passive investment portfolio you start with the safer alternatives and then move on to the route with more risk involved. |

Traditional rental income and Airbnb

Rental income can be a great way to generate a passive income source. If you own property, you can rent it out to tenants and collect regular payments. This can provide you with a steady stream of extra income, which can be used to cover your living expenses, pay down debt, or save for retirement. Additionally, if you have the space, you can also rent out storage units or parking spaces to generate even more monthly income.

These options should be more familiar, but a good reminder never hurts. If you inherited property from your family, or have a vacation house you never use, then you should think about renting the space out.

If you think time can’t be spared to do so, then you should look at property management services. They will cost money to use but letting them take a small cut of the profits is better than having no profits at all.

| Airbnb has become a highly regarded and recognized platform for travelers to rent rooms and houses. If you have a spare house or room, consider looking into Airbnb. Protect yourself by establishing ground rules you are comfortable with, such as the deposit, cleaning fee, and pets and this could be a profitable passive income vehicle. |

6. Other investment accounts

Peer-to-peer lending:

Another form of investing that is relatively new, peer-to-peer lending is a significant change in the way that average people get a loan for a various number of needs.

In the old days you only had a few options, borrow money from family and friends or a big financial institution. I’m excluding payday loans and pawn shops because those were always outside the box and inefficient ways to get a loan.

In modern times, the landscape is changing, and different companies have risen in many forms to be able to facilitate loans and lend money. These loans can be rather large and will continue to close the gap between what a traditional bank can offer compared to other companies.

In the case of p2p lending, investors crowdfund lend money to offer it up as a loan to somebody who needs it. Investors earn interest on that loan just as a bank would.

The benefits of p2p lending are that you don’t have to offer up a huge sum of money to a single person or business which would create a high risk for you.

Instead, you can create an account and fund it with $1000 for example, and then loan out $25 to 40 different borrowers. Your return on investment will depend on the number of those loans that default and the average interest rate for all of the loans.

This is another method where you should tread carefully. Upon further research, you will find that p2p is not very tax efficient, so this should not be your go-to passive income source. If you already have a diversified passive income portfolio, peer-to-peer lending can add another layer to further diversify your risk if used correctly.

Standard brokerage/investment account with dividend-paying stocks:

Investing in stocks and bonds is a risky business, there is no way around that fact. Even so, when done correctly by using proper research (or using stock news apps), the rewards can be extremely lucrative. In the case of looking for passive income, dividend-paying stocks can provide a steady income if you are able to ignore the noise of the market.

Buying stocks of good companies that have a proven track record of paying dividends can provide steady passive income if you buy and hold for an extended time, think 10-15 years and beyond. Search for so-called “dividend aristocrats” that have increased their dividend annually over the last 25 years.

Alternatively, safer options include investing in a low fee index fund or a trusted Exchange Traded Fund (ETF) or VUG or QQQ. Both funds will come with a price, but the funds take care of the day to day actions that will allow you to reap the reward of passive income.

Holding onto these assets over a long period of time can add passive income to your wallet but is not for the faint of heart because the price can drop significantly in a short amount of time. It will take a steady hand to avoid selling your positions because of a significant loss in value.

Passive Income Opportinuties FAQs

Passive income streams can provide you with a steady stream of extra income, which can be used to cover your living expenses, pay down debt, or save for retirement. There are many ways to build passive income streams. You can start by creating a blog and monetizing it with advertising, affiliate marketing, or selling digital or physical products. You can also create a YouTube channel and generate revenue through advertising, paid subscriptions, or product sales. Another option is to create an online course and sell it for a one-time fee or on a subscription basis. And finally, you can create a membership site and charge a monthly or annual fee for access to exclusive content or features as one of the best passive income streams.

When it comes to creating passive income streams, there are a few key requirements. First, you need to have a skill or knowledge base that others will find valuable. This could be anything from cooking and gardening tips to financial advice or web development tutorials. Second, you need to be able to create content that is high quality and engaging. This means taking the time to produce well-written articles, videos, or courses that offer real value to your audience. Finally, you need to be patient and consistent in your efforts. Building a successful passive income stream takes time and effort, but it can be a great way to supplement your income or even replace your current job.

If you’re an accredited investor, there are a number of ways you can earn passive income. One option is to invest in real estate. This could involve buying a rental property or investing in a real estate crowdfunding platform. Another option is to invest in a private equity or venture capital fund. And finally, you could also invest in dividend stocks to generate income.

Passive income ideas summary

Passive income can be for anyone regardless if they have money or just time. So if any of these passive income ideas was enticing in the slightest, go for it.

You don't have much to lose, but a lot of passive income to gain year after year.

In fact, if you were to make an extra $100 a day, that's $3,000 extra a month, and an extra $36,000 a year.

While it may take some work to get up to $100 a day, it is certainly possible.

What are you waiting for? Go earn passive income — here's to you scrolling back up and choosing one of the best passive income ideas to boost your income and get paid 24/7.